Yields remain substantial for Treasuries but increasingly more investors are pulling money out as U.S. default risk looms. For those seeking income opportunities beyond bonds, the NEOS S&P 500 High Income ETF (SPYI) is a fund to consider.

U.S. politicians continue to haggle over raising the debt ceiling, leaving many investors feeling increasingly exposed. Treasury Secretary Janet Yellen warned at the beginning of May that the U.S. could default as early as June 1 without a resolution.

For investors, this could mean late payments on bonds that reach maturity, making Treasuries higher risk. Yields on short-term Treasuries maturing shortly after June 1 continue to spike as investors sell out of these riskier positions.

“Treasurys are supposed to be the part of your portfolio you never really have to think about,” Anthony Saglimbene, chief marketing strategist for Ameriprise Financial, told WSJ.

Sidestep U.S. Default Stress With SPYI

A U.S. default would send shockwaves through markets and have far-reaching effects. One of the most immediate and largest impacts could be the kind of short-term borrowing that many companies and banks do globally. These transactions are dollar denominated and a default would likely throw a wrench into the process, slowing money flow.

Should the U.S. default, “that puts us into a U.S. recession pretty imminently,” according to Adam Turnquist, chief technical strategist at LPL Financial.

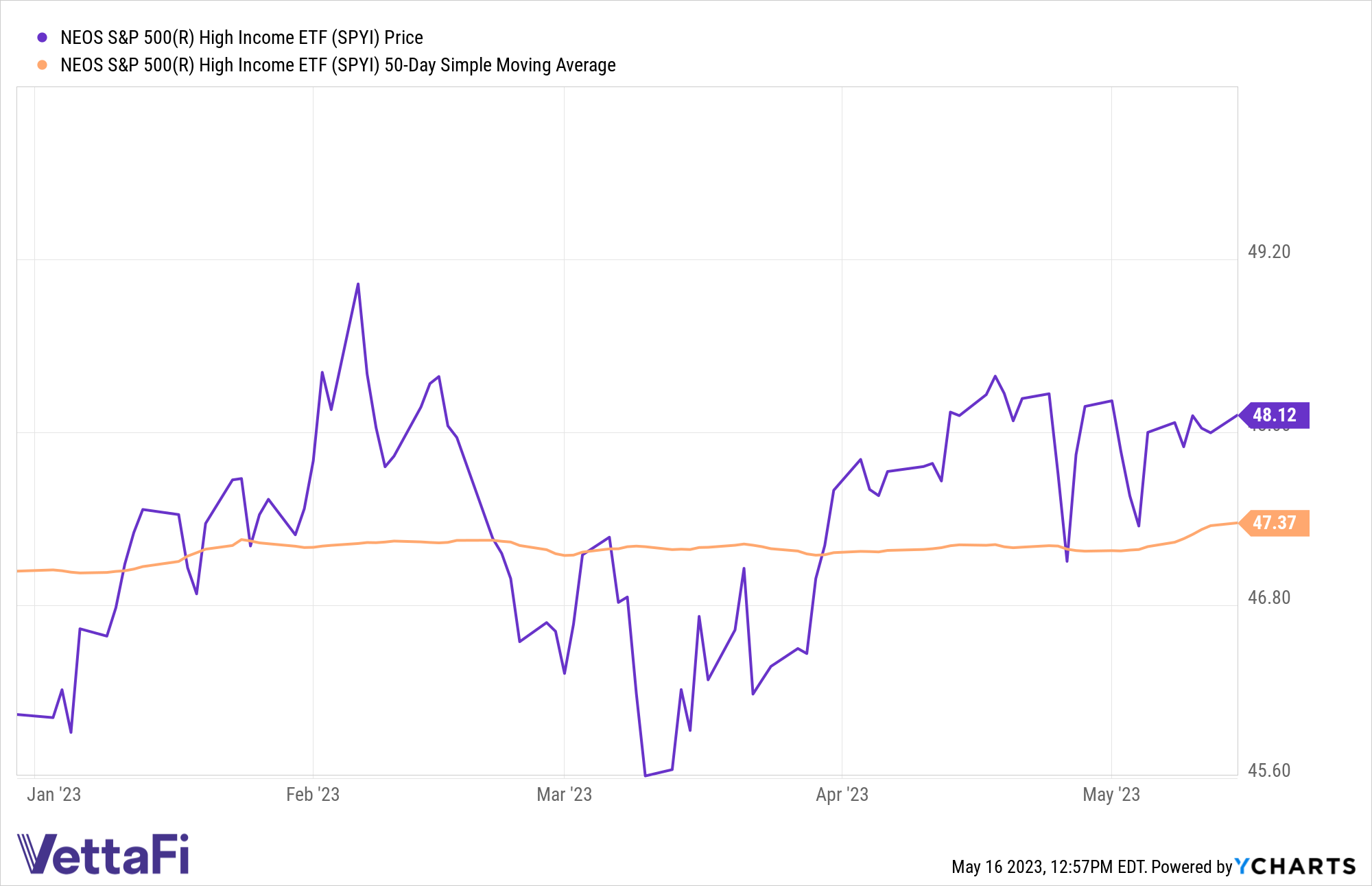

For advisors and investors seeking income opportunities beyond Treasuries, the NEOS S&P 500 High Income ETF (SPYI) is worth consideration. The fund is up 4.51% YTD and is above it’s 50-day Simple Moving Average, a buy signal for trend followers. The fund also has a distribution yield of 12.31% as of 04/30/23.

See also: “An Advisor’s Guide to Understanding ETF Yield“

SPYI is an actively managed fund launched last year and seeks to provide high-income opportunities for portfolios within equities. The fund also works to preserve the income generated through its options overlay in times of market stress.

The ETF seeks to fully replicate the S&P 500 Index and also utilizes a call options strategy layered on top. Call options give buyers the right but not obligation to buy the underlying asset at a specific price (the strike price) within a timeframe.

Tax-Efficient Income Through S&P 500 Call Options

SPYI seeks to provide higher income through call options the fund writes that it earns premiums on. It then can use the money earned from the written calls to buy long, out-of-the-money call options on the S&P 500 Index.

An out-of-the-money call option has no intrinsic value. That’s because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at the end of the year are treated like they were sold on the last market day of the year at fair value. Any capital gains or losses are taxed 60% long-term and 40% short-term, no matter how long investors held them. This can offer noteworthy tax advantages.

The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

See also: “Income-Generating Options as the Risk Curve Changes“

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis visit the Tax-Efficient Income Channel.