The aggressive, unprecedented Fed rate hiking regime of the last year has altered the investing landscape that was so dominant in the last decade. In that environment, advisors and investors had to go further out on the risk curve to generate meaningful income. In a market full of income-generating funds, the NEOS lineup is noteworthy for its tax-efficient income within core portfolio allocations.

Currently, there is opportunity and income potential in a number of options that carry less risk, explained Matt Fuller, AIF, WMS, founder and managing director of XO Wealth Management, on the “Income Generation, Inflation, and Interest Rates – Know Your Options” webcast hosted by NEOS Investments on the VettaFi platform.

Given ongoing volatility, the addition of bank sector risk, recession risk, and persistent inflation, advisors face another challenging year for investing and income generation. Advisors that responded to the polling question “Which of the following is currently MOST top of mind for your clients?” reported an almost even division between managing risk (36.7%) and generating reliable income (34.9%). There are a number of income-generating opportunities within the ETF market, but options have become increasingly popular in the last year for a number of reasons.

Options have a multitude of uses in portfolios, including income generation, diversification opportunities through lower correlation to other asset classes, tax efficiency, and hedging for risk or volatility. Historically, options have been used for exposure to one aspect of outcome, such as generating income or hedging against downside, and were index-based and passive. Modern options strategies allow for a multi-dimensional approach, according to Garrett Paolella, co-founder and managing partner of NEOS Investments.

“Today we really focus at NEOS on these multi-dimensional products: how do you deliver multiple outcomes thinking about total return, thinking about tax-efficient income to the underlying investment you’re looking to get exposure to,” Paolella explained.

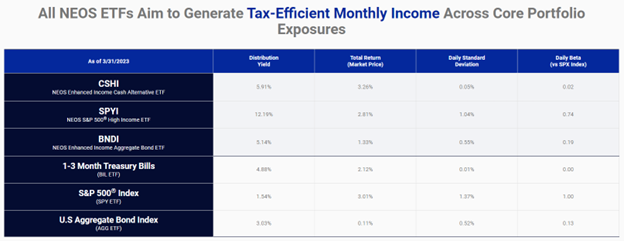

The NEOS ETFs are actively managed and quantitatively based, relying on data in the short, medium, and long term to provide optimal outcomes for clients with products that span equities, bonds, and Treasuries.

Image source: NEOS

Tax-Efficient Income Within Equities With SPYI

The NEOS S&P 500 High Income ETF (SPYI) invests in equities via the S&P 500 and then uses laddered covered call options to generate between 1%–1.5% of income for clients. The options that all three funds utilize are S&P 500 Index options that are classified as Section 1256 contracts that have favorable tax rates: 60% of capital gains from the premiums are taxed as long-term, and 40% are taxed as short-term, regardless of how long the options were held.

The laddered options also allow for more of the fund to participate in the upside as opposed to capping it, capturing more of the total return of the S&P 500’s performance in upwards markets.

“As we think about managing risk in an equity-based portfolio… you’re getting exposure to the S&P, you’re generating an additional tax-efficient income, but you really want to give as much upside potential as possible in the portfolio,” said Paolella.

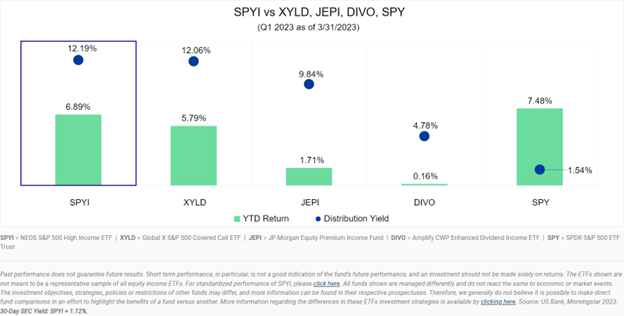

The fund is outperforming in its class as of the end of Q1 and has a distribution yield of 12.19% as of March 31, 2023, and management fees of 0.68%.

Image source: NEOS

The Cash Alternatives Fund Making Waves in 2023

The NEOS Enhanced Income Cash Alternative ETF (CSHI) is a more risk-averse strategy and is less sensitive to duration risk as well credit through its exposure to 90-day Treasuries. These three-month Treasuries offer a different, lower-volatility profile than other short-duration bond portfolios, while also offering inherent tax efficiency. (Treasuries aren’t taxed at the state and local level.)

The fund utilizes a laddered put spread strategy on S&P 500 Index options that refreshes weekly, allowing for better risk and volatility management, while offering negative correlation to the underlying most of the time. It has a distribution yield of 5.91% as of the end of March with a management fee of 0.38%.

“CSHI is looking to distribute to investors one to one-and-a-half percent on an annualized basis above your 90-day Treasury exposure,” Paolella explained.

Income Opportunities in Bonds With BNDI

The NEOS Enhanced Income Aggregate Bond ETF (BNDI) invests in two ETFs, the Vanguard Total Bond Market ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG), for the tax efficiency that ETFs offer as well as the cost savings of gaining exposure to the breadth of the bond market through ETFs instead of full replication.

The fund utilizes a laddered put spread strategy similar to CSHI but is structured to have more exposure to options to match the volatility and risk profile of the bond market that historically has a standard deviation of 5%–6%. The laddered options contribute 2%–2.5% additional income that is tax efficient.

Due to aggressive Fed interest rate hikes and a significantly inverted yield curve, the fund currently has a distribution yield of 5.14% as of the end of March and carries management fees of 0.58%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.