The narrative of a soft landing continues to face pressure on numerous fronts heading into 2024. Heightened geopolitical risk, a still aggressively postured Fed, and slowly moderating inflation keep investors and markets on edge in the last month of 2023. Advisors and investors worried about the near term with outsized cash allotments would do well to consider the NEOS Enhanced Income Cash Alternative ETF (CSHI) for its notable yields.

The price of gold reached a new all-time high of $2,100 an ounce briefly over the weekend. Despite hopes of Fed easing, safe haven investments like gold and cash remain popular. It’s not unsurprising, given the number of risk factors currently in play and the uncertainty heading into next year.

J.P. Morgan currently forecasts the U.S. avoiding a recession in 2024, but with marked slowing in the first half. Meanwhile, Vanguard’s Roger Aliaga-Diaz, global head of portfolio construction, recently told Reuters that its anticipating a mild recession next year.

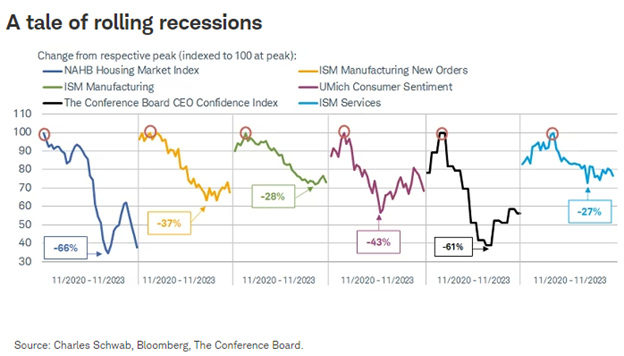

Charles Schwab takes the stance that the U.S. is currently experiencing a rolling recession.

“We have used the term ‘rolling recession’ for some time,” explained Liz Ann Sonders, managing director and chief investment strategist at Charles Schwab, and Kevin Gordon, senior investment strategist at Charles Schwab in a recent U.S. Outlook. Their reasoning holds that “several key segments of the U.S. economy, including housing, manufacturing, and many consumer-oriented segments of the economy have experienced recession-level weakness.”

Image source: Charles Schwab

However you slice it, there remains general agreement that the U.S. is in for slowed, albeit still positive, economic growth next year.

Keep Your Cash Working for You With CSHI

In an environment rife with risk and uncertainty, cash became king for much of 2023. Money market funds experienced a proliferation of inflows this year as investors capitalized on historic yield opportunities while hedging against market risk.

For those advisors with portfolios sitting on a higher percentage of cash, the NEOS Enhanced Income Cash Alternative ETF (CSHI) is a fund worth consideration. CSHI seeks to deliver 100-150 basis points above what 90-day Treasuries are yielding. It’s noteworthy for its tax efficiency and monthly income-oriented strategy.

CSHI is an actively managed ETF that generates high monthly income and is an options-based fund. It is long on three-month Treasuries and sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

The fund also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options. CSHI currently has a distribution yield of 6.15% and a 30-day SEC yield of 5.04% as of 11/30/2023.

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means the options held at the end of the year are treated as if sold on the last market day of the year at fair market value.

Any capital gains or losses are taxed as 60% long-term and 40% short-term. Notably, this tax treatment applies regardless of how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

CSHI has an expense ratio of 0.38%.

For more news, information, and analysis visit the Tax-Efficient Income Channel.