Market volatility rose in the wake of March’s hot CPI print. Investors looking to benefit from volatility within the tech-heavy Nasdaq-100 should consider the NEOS Nasdaq 100 High Income ETF (QQQI).

The consumer price index rose 3.5% in March on a year-over-year basis and 0.4% month-over-month. Core inflation that excludes food and energy also rose in March, up 3.8% YoY. Both readings came in higher than expectations and cast doubt on the potential for rate cuts beginning in June.

“As we continue to see multiple reports in a row that are higher-than-expected, it becomes more difficult for the Fed to advocate cutting rates any time soon,” Chris Zaccarelli, CIO of Independent Advisor Alliance told CNBC.

Volatility surged with the S&P 500 falling 0.95% in trading on Wednesday and the Nasdaq Composite closed 0.84% lower.

Harness Tech Volatility for Tax-Efficient Income

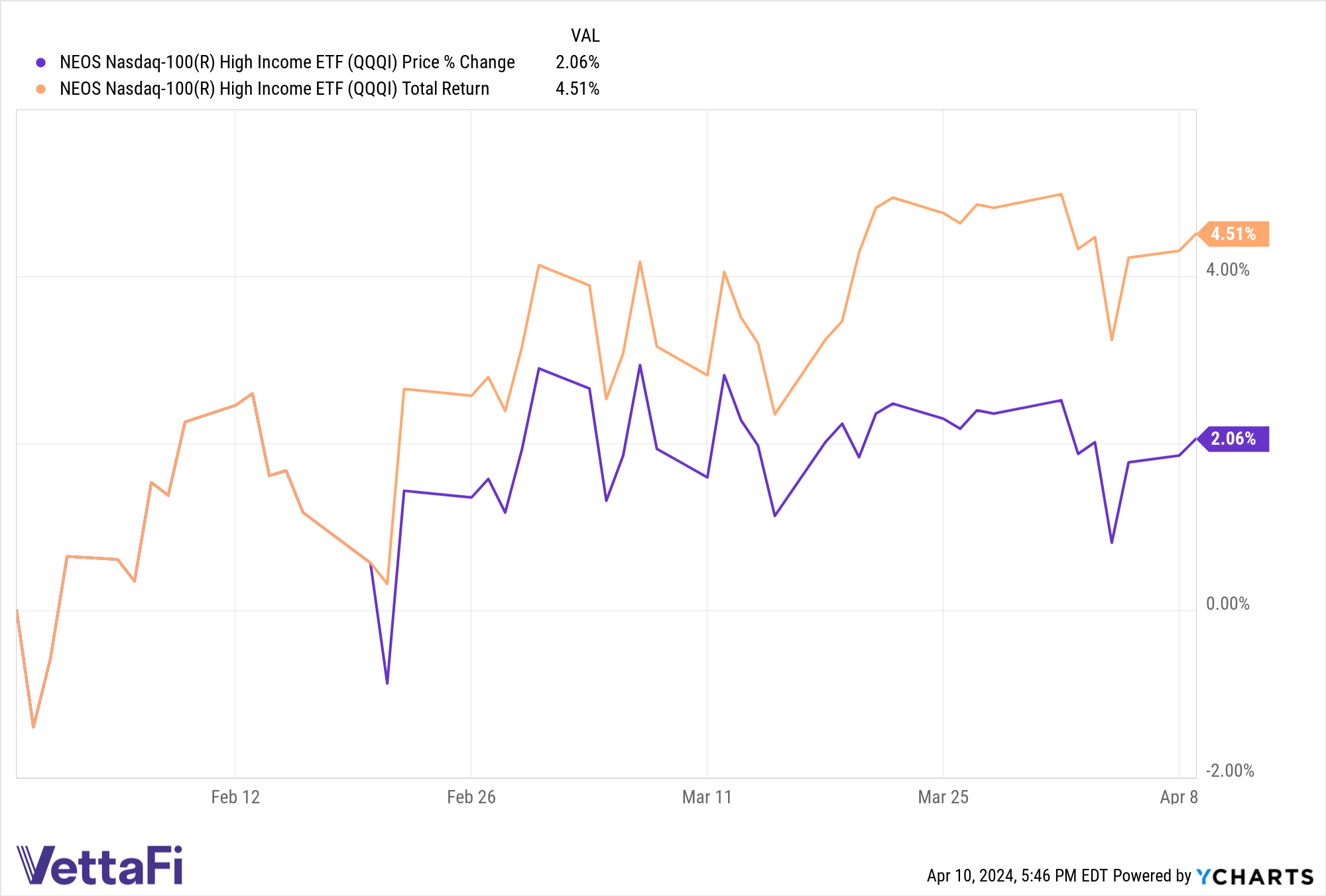

For those looking to maintain tech exposure through market volatility, the NEOS Nasdaq 100 High Income ETF (QQQI) provides an opportunity. The fund seeks high monthly, tax-efficient income by investing in the Nasdaq-100.

QQQI also employs an options strategy using covered calls to generate a premium. It is up over $80 million in net flows since its launch on January 30. The premiums earned by the fund help provide a potential buffer should stocks decline. Premiums also benefit from increased volatility.

The fund offers layers of tax efficiency for investors seeking income. The options that QQQI uses are call options on the NDX and qualify as section 1256 contracts. These receive favorable tax treatment under IRS rules. The options held at year’s end are treated as if sold at fair market value on the last market day. Any capital gains or losses are taxed at 60% long-term and 40% short-term, no matter how long they were held.

Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses. In addition, the fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

QQQI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.