Earnings season is underway, with many companies beating expectations. Despite the wins, market shocks continue to pummel investors as Treasury yields set new 16-year highs and uncertainty spikes. In a challenging market environment, the NEOS S&P 500 High Income ETF (SPYI) is noteworthy for its performance compared to equity income ETF peers.

Treasury yields reached new 16-year highs and the 30-year mortgage rate hit 23-year highs at 8% on Wednesday. Against this backdrop, earnings season picks up speed with more companies reporting.

Approximately 10% of the companies from the S&P 500 have reported earnings this season, with 78% of those beating expectations according to FactSet data. It’s a closely watched earnings season as investors look to forward guidance from companies to gauge the near-term outlook.

Companies engaged in a rash of cost-cutting measures in the last year to boost their bottom lines. Investors are now looking to see revenue growth driven by growing demand according to Kevin Gordon, senior investment strategist at Charles Schwab.

“We’re at a point in the cycle now where companies really need to start showing actual demand coming back online,” Gordon told CNBC. “If that’s not the case, then you’re probably not going to get as much of a lift as people were expecting.”

Optimize Your Equity Income Exposures With SPYI

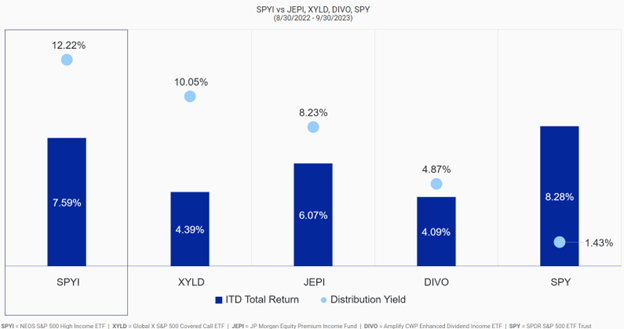

Investors continue searching for ways to make the most out of their equity exposures this year. It’s been a great year for equity income ETFs regarding flows. The NEOS S&P 500 High Income ETF (SPYI) is a strong contender, offering better total returns since inception and better distribution yields than many of its peers.

SPYI capitalizes on core equity allocations while also providing a tax-efficient income stream for portfolios. The fund has YTD net flows of $353 million as of October 17, 2023, according to FactSet data.

SPYI seeks to provide higher income through call options the fund writes and earns premiums on. It then can use the money earned from the written calls to buy long, out-of-the-money call options on the S&P 500 Index.

An out-of-the-money call option has no intrinsic value. That’s because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at year’s end are treated as if sold at fair market value on the last market day. Any capital gains or losses are taxed as 60% long-term and 40% short-term, no matter how long investors hold them. This can offer noteworthy tax advantages.

The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.