The ongoing uncertainty of the last two years resulted in a boom for options-based strategy flows as investors sought to maximize income potential. As these strategies continue to prove popular through the first quarter of 2024, advisors don’t want to miss the NEOS S&P 500 High Income ETF (SPYI).

Options-based strategies offer exposure to familiar asset classes while seeking to enhance income potential. They do this generally through premiums earned from selling options, creating an additional income stream. In a time of persistent volatility, enhancing existing, trusted equity and bond allocations made sense for advisors and investors.

“Advisors are increasingly comfortable with options-based ETF strategies that offer enhanced income and equity market exposure,” explained Todd Rosenbluth, head of research for VettaFi. “These products are professionally managed by experienced teams offering an advantage of using options directly.“

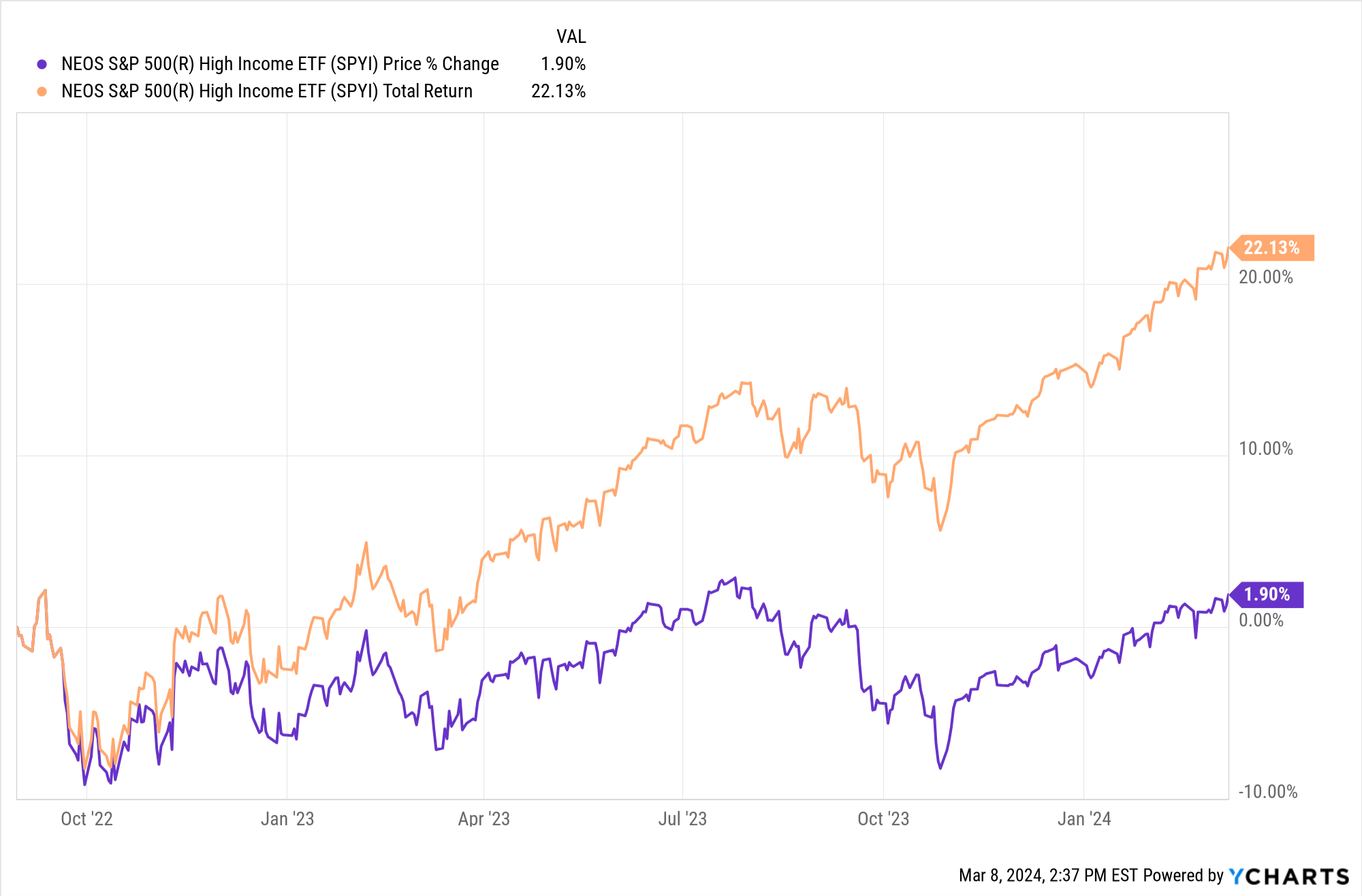

Investors looking to enhance their equity allocations would do well to consider the NEOS S&P 500 High Income ETF (SPYI). The fund seeks to provide exposure to the S&P 500 and generate high monthly income through its covered call strategy. It also uses multiple layers of tax efficiency, a boon in any kind of market.

Flows Continue Into Options Category in 2024

As a category, options-based strategies continue to bring in significant money this quarter. The largest fund in the category, the JPMorgan Equity Premium Income ETF (JEPI), is up $1.2 billion YTD, as of 03/07/24, according to FactSet data. Ongoing economic, rate, and market uncertainty continues to drive advisors and investors to optimize existing allocations instead of taking on new risk.

SPYI is up $317.6 million in net flows YTD, as of 03/07/24, according to FactSet data. Meanwhile, SPYI’s current distribution yield was 12.14%, with a 30-day SEC yield 0.85%, as of 02/29/24.

The fund uses money earned from written calls to buy long, out-of-the-money call options on the S&P 500 Index. An out-of-the-money call option has no intrinsic value. That’s because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at year’s end are treated as if sold at fair market value on the last market day. Any capital gains or losses are taxed as 60% long term and 40% short term, no matter how long investors hold them. This can offer noteworthy tax advantages.

The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.