Tech stocks continue their reign of markets in 2024, carrying U.S. equity indexes like the Nasdaq-100 ever higher. For investors seeking to harness tech gains through tax-efficient monthly income, the NEOS Nasdaq 100 High Income ETF (QQQI) is worth consideration.

The Nasdaq-100 remains a core beneficiary of the explosion of AI in the last year. Nvidia’s most recent earnings beat carried the stock ever higher. The company’s stock is currently up 60% YTD as of 01/26/24, according to FactSet data. Nvidia is the third-largest holding by weight in the Nasdaq-100 at 5.62% as of 02/23/24.

The index is home to the 100 largest securities trading on the Nasdaq Exchange and is market cap weighted. It excludes the finance sector. While it skews toward the information technology sector, rules cap the maximum individual and sector weights allowed within the index.

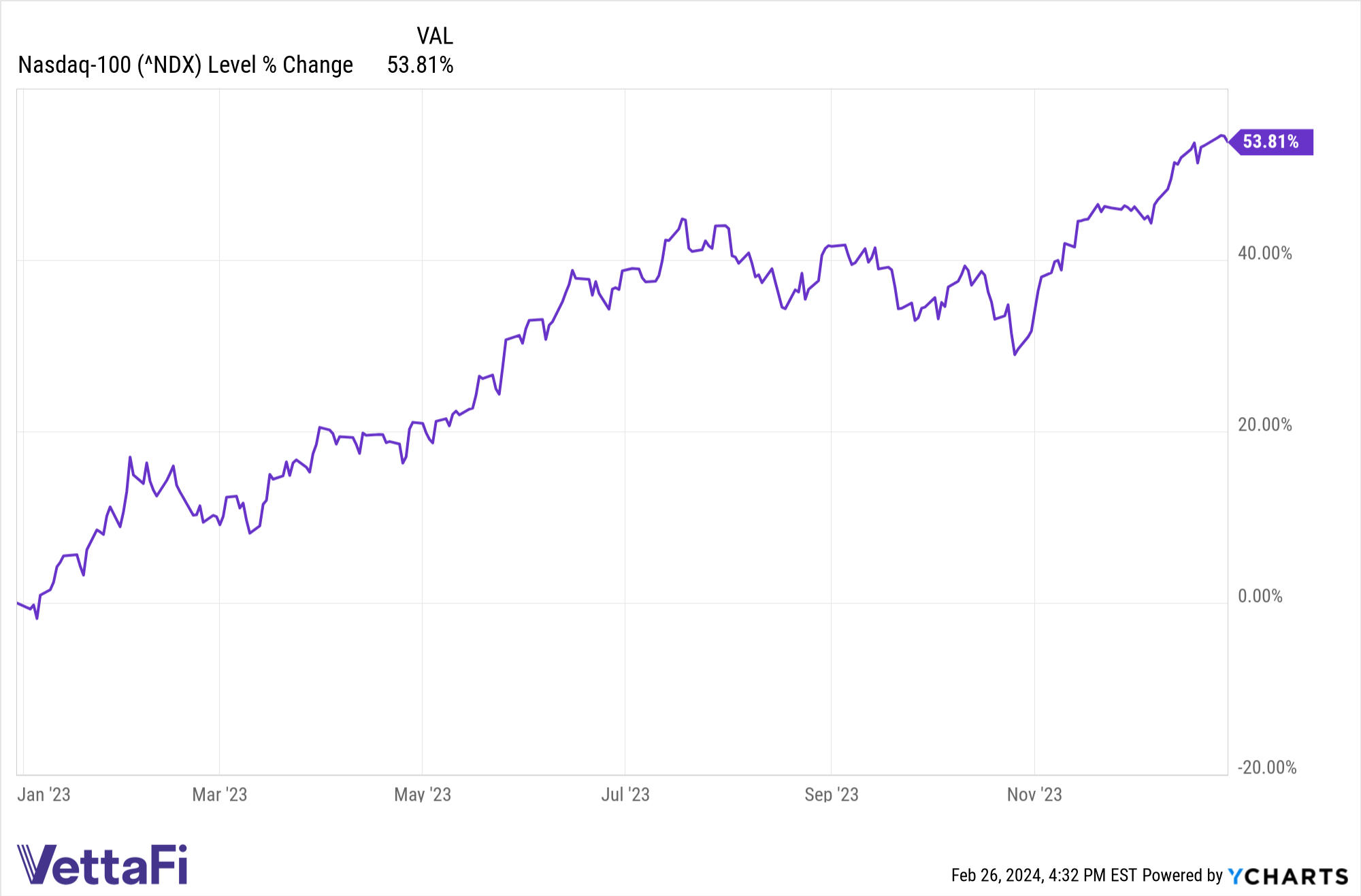

The Nasdaq-100 rose an astonishing 53.81% in 2023 on a price returns basis. Year to date, the index is up 6.83% as of 01/26/24.

Concerns of over-valuation and an AI bubble plague many of the high-flying tech companies. However, where some see a bubble, others see the foundations of the next technological evolution.

“When we had the internet bubble the first time around … that was hype,” Jamie Dimon, CEO of J.P. Morgan Chase, told CNBC. “This is not hype. It’s real. People are deploying it at different speeds, but it will handle a tremendous amount of stuff.”

QQQI Generates Monthly Income Within Nasdaq-100

Investors looking to increase or augment their Nasdaq-100 exposures would do well to consider the NEOS Nasdaq 100 High Income ETF (QQQI). The fund seeks high monthly income by investing in the Nasdaq-100. QQQI also employs an options strategy using covered calls to generate a premium.

The fund offers layers of tax efficiency for investors. The options that QQQI uses are call options on the NDX and qualify as section 1256 contracts. These receive favorable tax treatment under IRS rules. The options held at year’s end are treated as if sold on at fair market value on the last market day. Any capital gains or losses are taxed at 60% long-term and 40% short-term, no matter how long they were held.

Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses. In addition, the fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

QQQI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.