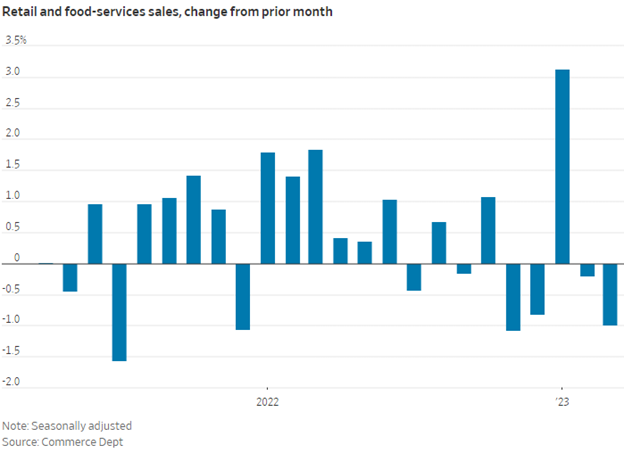

Retail sales fell 1% in March as consumers reigned in spending, a further sign of economic slowing but it may not be enough to curb Fed interest rate hikes. As recession nears, the challenge to equities will continue to grow, and for those advisors looking to make the most of their broad equity allocations, consider the income seeking NEOS S&P 500 High Income ETF (SPYI).

Consumers cut back on big purchases such as electronics, vehicle purchases, furniture, and more in March, with retail spending falling a seasonally adjusted 1%, down from February’s revised drop of 0.2%, reported the Wall Street Journal.

Image source: WSJ

Cutbacks came at the same time that broad inflation fell, though core inflation, which excludes energy and food prices, continued to rise. Core inflation is one of the key data points the Fed tracks, and rising underlying price pressures could sustain inflation over a longer period and keep the Fed on track to raise rates again at the May meeting.

“Growth has started to slow down,” Jitender Miglani, senior forecast analyst at Forrester Research Inc., told WSJ. “Consumers may be tempted to save more in 2023 because of all the talk of recession.”

Optimize Your Equity Exposures for High Income with SPYI

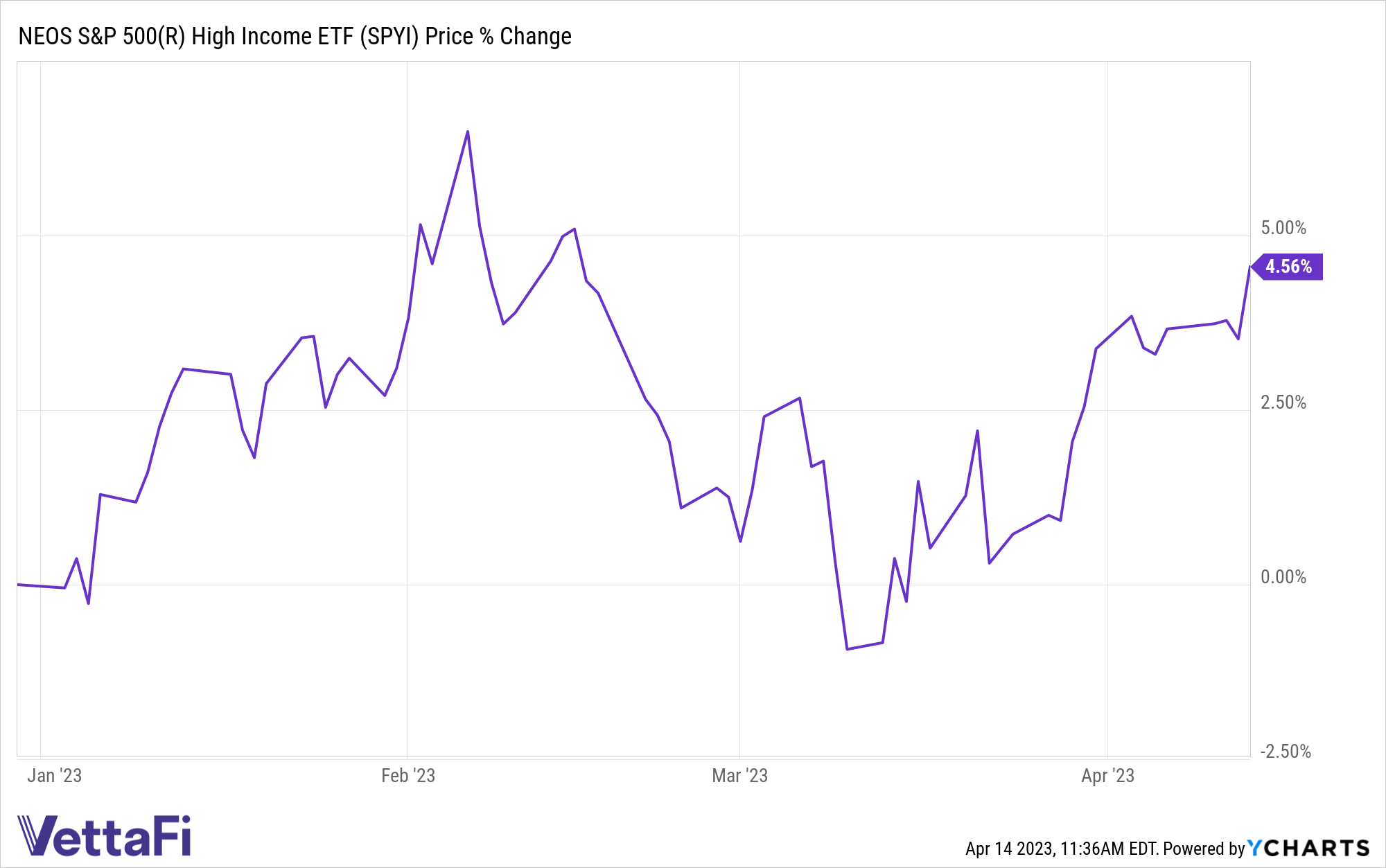

Recession looms large on the horizon and on the minds of consumers and investors alike. For those advisors looking to optimize their broad equity exposures and seek income within equities, the NEOS S&P 500 High Income ETF (SPYI) is worth consideration. SPYI is an actively managed fund launched last year and seeks to provide high-income opportunities for portfolios within equities, while also working to preserve the income generated through its options overlay in times of market stress.

The fund seeks to fully replicate the S&P 500 Index and also utilizes a call options strategy layered on top — call options give buyers the right to buy the underlying asset at a specific price (the strike price) within the timeframe of the contract, but they are not obligated to do so.

SPYI is up 4.56% YTD and has a distribution yield of 12.19% as of 03/31/23, and seeks to provide higher income through call options the fund writes that it earns premiums on, and then can use the money earned from the written calls to buy long, out-of-the-money call options on the S&P 500 Index. An out-of-the-money call option has no intrinsic value because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are not ETF options, but instead are index options that are taxed favorably as Section 1256 Contracts under IRS rules. This means that the options held at the end of the year are treated as if they had been sold on the last market day of the year at fair market value, and, most importantly, any capital gains or losses are taxed as 60% long-term and 40% short-term no matter how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the call options or equity holdings, or both.

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis visit the Tax-Efficient Income Channel.