The proliferation of options-based strategies in the last few years highlights the popularity and value for investors. Many investors now own some version of an options income strategy in their portfolio, the most popular of which is the JPMorgan Equity Premium Income Fund (JEPI). There are many complimentary options-based strategies for JEPI that together provide more holistic benefits to a portfolio.

The JPMorgan Equity Premium Income Fund (JEPI) maintains its position as the largest fund in the category at $33.8 billion in AUM as of 03/28/2024. It seeks monthly income and equity exposure with reduced volatility compared to the S&P 500.

JEPI provides a number of unique benefits to portfolios through its actively managed strategy. The fund screens companies primarily in the S&P 500 for their relative value and reduced volatility. It also employs written calls on the S&P 500 Index to generate income through equity-linked notes.

The fund remains enormously popular with investors for its defensive tilt as well as reliable income. Including other complementary options-based strategies alongside JEPI could enhance portfolio performance and provide additional benefits.

Including SPYI With JEPI Expands Income, Equity Exposures

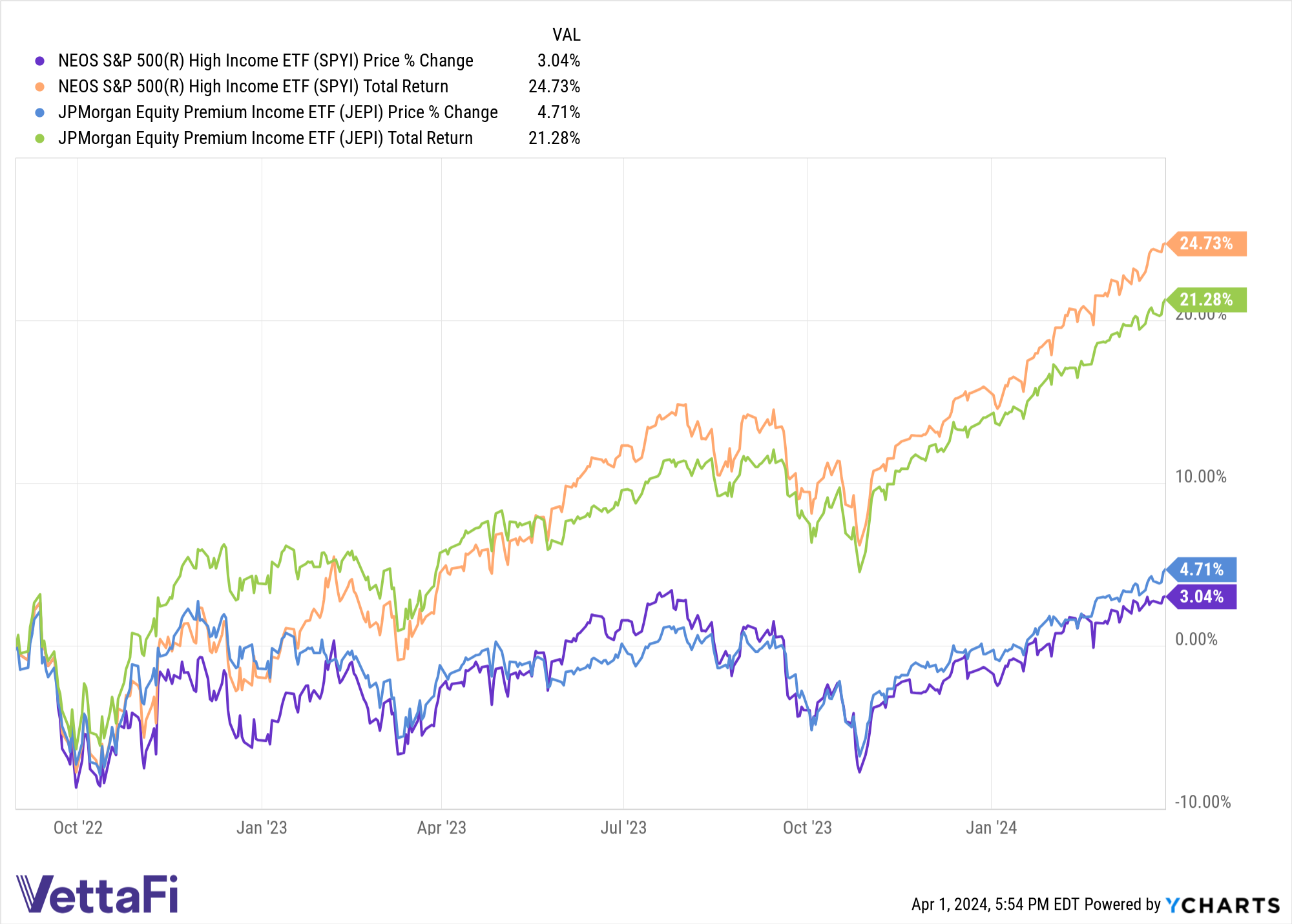

The NEOS S&P 500 High Income ETF (SPYI) recently surpassed $1 billion in AUM. The fund launched in August 2022 and continues to grow in popularity with investors. At first blush, the fund’s objective appears similar to JEPI — seeking high monthly income with exposure to equities — but the two strategies differ in fundamental ways.

SPYI offers broad exposure to the S&P 500, utilizing a replication strategy. This makes it a complement to JEPI’s hand-selected, defensively tilted equity exposure. While both funds utilize a covered call strategy to generate premiums, they do so in significantly different ways.

JEPI uses equity-linked notes (ELNs) that combine the S&P 500’s economic characteristics with a written call option into a singular note. These options are structured in a covered call strategy on the S&P 500.

While SPYI also employs a covered call strategy, it does so by using index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. Options held at year’s end are treated as if sold at fair market value on the last market day. Any capital gains or losses are taxed as 60% long-term and 40% short-term, no matter how long investors hold them.

SPYI offers layers of tax efficiency for investors, including distributions that qualify as return of capital. The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

Understanding the differences between different options income ETFs allows for portfolio optimization. A fund like JEPI, with its expense ratio of 0.35%, makes a strong addition to tax-deferred accounts. Investors often seek it out for its reduced volatility within equities. Meanwhile SPYI, with an expense ratio of 0.68%, is a strong candidate for brokerage accounts. It’s a great complement to JEPI as well as existing broad-equity exposures.

The two funds offer differing equity exposures with different strategies, but both seek to add reliable income streams. The inclusion of both strategies could provide many benefits for investors and portfolios.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.