Market volatility and strong equity performance alongside noteworthy yields brought strong flows to the NEOS ETF suite in the last year. The ETFs offer high monthly, tax-efficient income within core allocations and celebrate their first anniversary from launch today, August 29.

The co-portfolio managers of the funds, Troy Cates and Garrett Paolella, both co-founders and managing partners of NEOS, have a long history with options strategies. The pair have worked together for 15 years and originally launched the first options-based ETF in 2013 through the firm they founded, Recon Capital. Since then, they have worked to build out options strategies to harness income, mitigate risk, or a blend of both. The NEOS ETFs are their latest endeavor that seeks to enhance tax-efficient income within core allocations.

See also: “A Q&A With NEOS: Income, Tax Efficiency, and More“

Tax-Efficient Opportunities in Equities

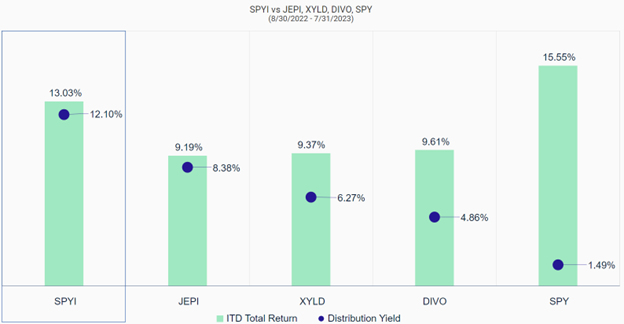

Since its inception, the NEOS S&P 500 High Income ETF (SPYI) brought in $274 million in AUM as of 08/28/2023. The fund seeks to provide higher income within the S&P 500. The fund also offers significant yield above its peers since inception.

Image source: NEOS

SPYI utilizes call options the fund writes that it earns premiums on. The fund can then use the money earned from the written calls to buy long, out-of-the-money call options on the S&P 500 Index. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at the end of the year are treated like they were sold on the last market day of the year at fair value. Any capital gains or losses are taxed as 60% long-term and 40% short-term, no matter how long investors hold them. This can offer noteworthy tax advantages.

SPYI has an expense ratio of 0.68%.

Making the Most of Bond Exposures

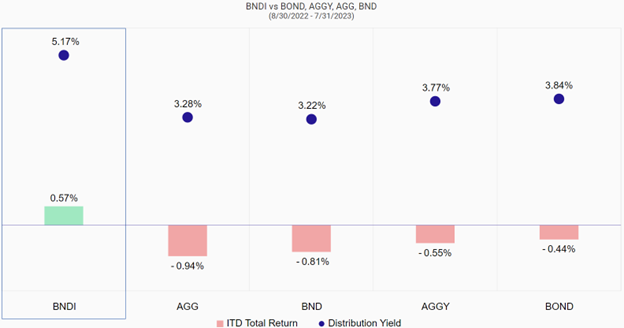

The NEOS Enhanced Income Aggregate Bond ETF (BNDI) currently has $3 million in AUM and is well-positioned for a resurgence in bonds once interest rate risk subsides. Since inception, it has generated significant distribution yields above peers.

Image source: NEOS

BNDI is an actively managed ETF that seeks to offer enhanced monthly income distributions for investors. The fund invests across the broad U.S. Aggregate Bond Market while also implementing a tax-efficient options strategy that generates additional income.

The fund invests in the Vanguard Total Bond Market ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG). The income and capital gains that BNDI receives from its bond allocations are enhanced by the addition of monthly income from the fund’s put-option strategy on the S&P 500. The strategy includes selling short puts and buying long puts to protect against volatility.

BNDI’s put options are S&P 500 index options and are taxed favorably as Section 1256 Contracts under IRS rules.

BNDI currently has an expense ratio of 0.58%.

NEOS Makes Your Money Work in Cash Alternatives

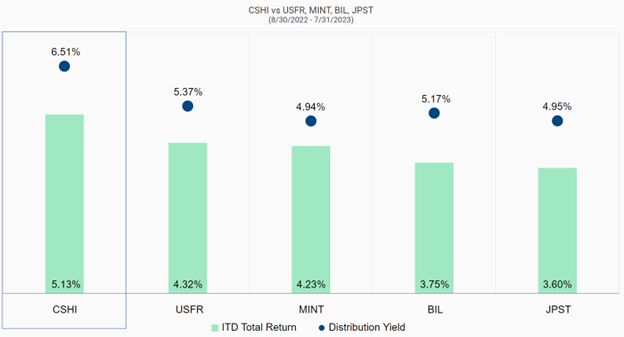

Ongoing market volatility provided investors the chance to put their cash hedges to work while waiting out uncertainty. The NEOS Enhanced Income Cash Alternative ETF (CSHI) garnered $137 million in AUM since its inception. It’s also a strong performer in its class.

Image source: NEOS

The fund is an actively managed ETF and is long on three-month Treasuries and also sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility. It seeks to deliver 100–150 basis points above what 90-day Treasuries are yielding.

CSHI also seeks to take advantage of the tax efficiency of index options by using S&P 500 index put options similar to BNDI. Unlike BNDI, the options are laddered differently to achieve the fund’s target income and strategy.

CSHI has an expense ratio of 0.38%.

Year-to-date SPYI is up 14.30% on a total return basis, CSHI is up 4.12%, and BNDI is up 1.96%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.