Analysts and economists currently forecast for increased economic slowing heading into next year. Optimizing income from core exposures through enhanced tax efficiency allows for the potential of greater returns capture in risky markets. For advisors and investors seeking high monthly income optimized for tax efficiency, the NEOS suite of ETFs is worth consideration.

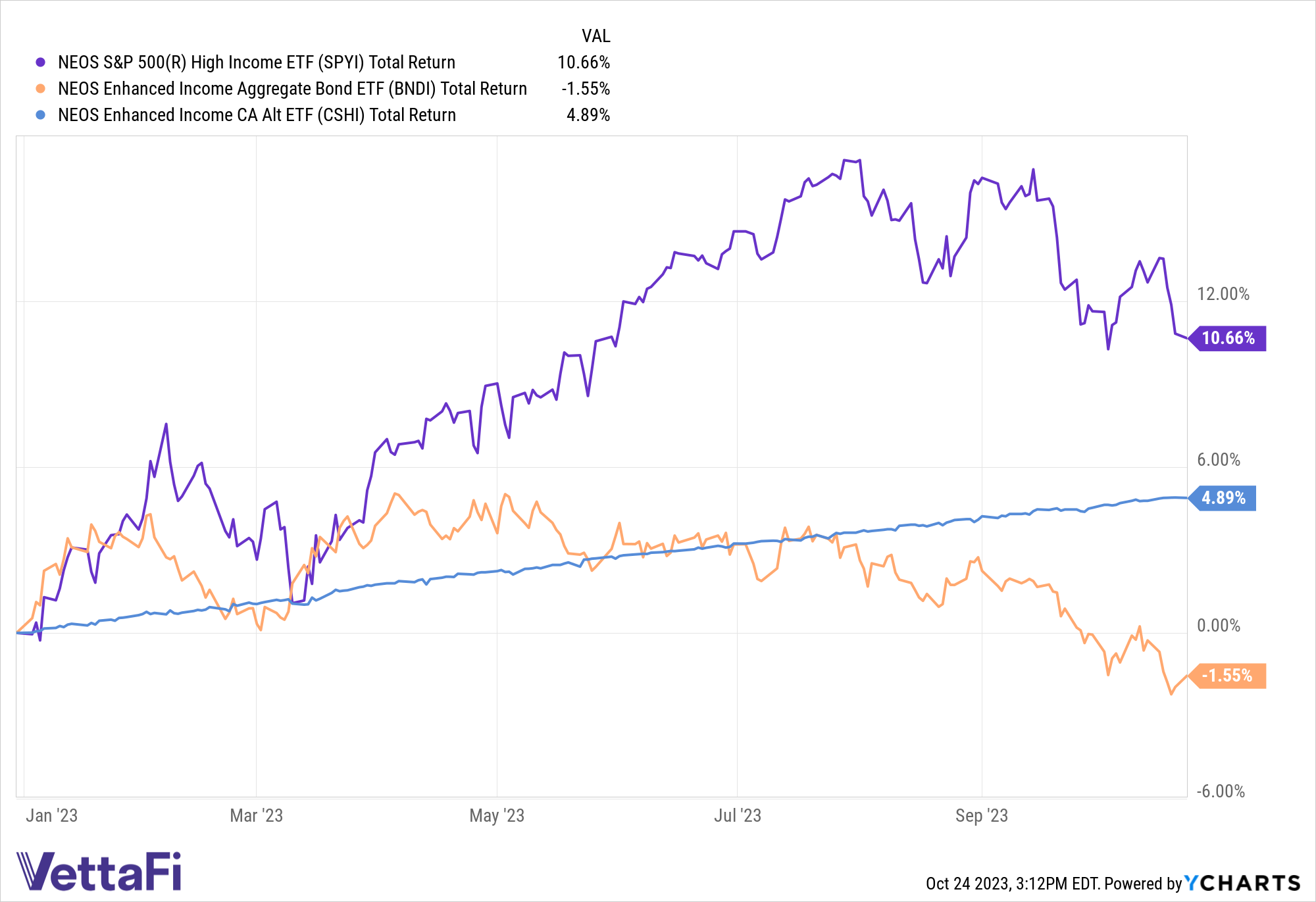

The strong equity performance of the first half continues to taper off in the last quarter of 2023. Rate risk, inflation, and broad risk factors loom large in the minds of investors. Though the Fed is no longer anticipating a recession, it does forecast U.S. economic growth to slow to 1.5% next year.

In such a challenging forward-looking environment, optimizing income earned from core exposures could prove highly beneficial. The NEOS suite of ETFs offers tax-efficient income across equities, bonds, and cash alternatives. The funds offer a good substitute or complement to existing core exposures, with income optimized for tax efficiency in multiple ways.

The NEOS S&P 500 High Income ETF (SPYI) offers broad equity exposure through the S&P 500, while the NEOS Enhanced Income Aggregate Bond ETF (BNDI) offers exposures across the broad bond market. Meanwhile, the NEOS Enhanced Income Cash Alternative ETF (CSHI) allows investors to capitalize on yields in ultra-short-duration Treasuries.

All three funds use S&P 500 Index options to augment their income potential. The options used receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means that the options held at the end of the year are treated as if they had been sold on the last market day of the year at fair market value.

Any capital gains or losses receive a tax treatment of 60% long-term and 40% short-term. This treatment occurs regardless of how long the strategy invested in the options. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

Enhance Your Core Income With Tax-Efficient Strategies

SPYI is actively managed and provides exposure to broad equities by investing in the S&P 500. It also employs an options strategy that entails writing short call options on the S&P 500 Index. The ETF uses the premium earned from written calls to buy long, out-of-the-money call options. SPYI has an expense ratio of 0.68%.

CSHI is an actively managed ETF that generates high monthly income and is options-based. The fund is long on three-month Treasuries and also sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility. CSHI seeks to deliver 100-150 b SHI has an expense ratio of 0.38%.

BNDI is actively managed and provides broad exposure to the bond market. It does so by investing in the iShares Core U.S. Aggregate Bond ETF (AGG) and the Vanguard Total Bond Market ETF (BND).

BNDI seeks to enhance the income and capital gains earned from its bond exposures by using a put-option strategy on the S&P 500. This strategy entails selling short puts and buying long puts to protect against volatility. The ETF has an expense ratio of 0.58%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.