Markets are on the move ahead of the Fed decision later today as investors await potential guidance for interest rates looking forward. Despite — or perhaps because of — volatility and the traditional September slump for markets, advisors and investors continue steady allocations to the NEOS Enhanced Income Cash Alternative ETF (CSHI) this month.

Investors are almost entirely certain that the Fed will not raise rates after the FOMC meeting today. Instead, they are on the lookout for any indications of what the Fed’s position on rate hikes in November is.

This level of uncertainty as to even the near-term outlook for inflation and rates remains a hallmark of markets lately. With so much unknown, investors increasingly turned to money markets for their lucrative yields, and cash alternatives while they wait out uncertainty.

Cash Alternative ETF an Appealing Option Amidst Uncertainty

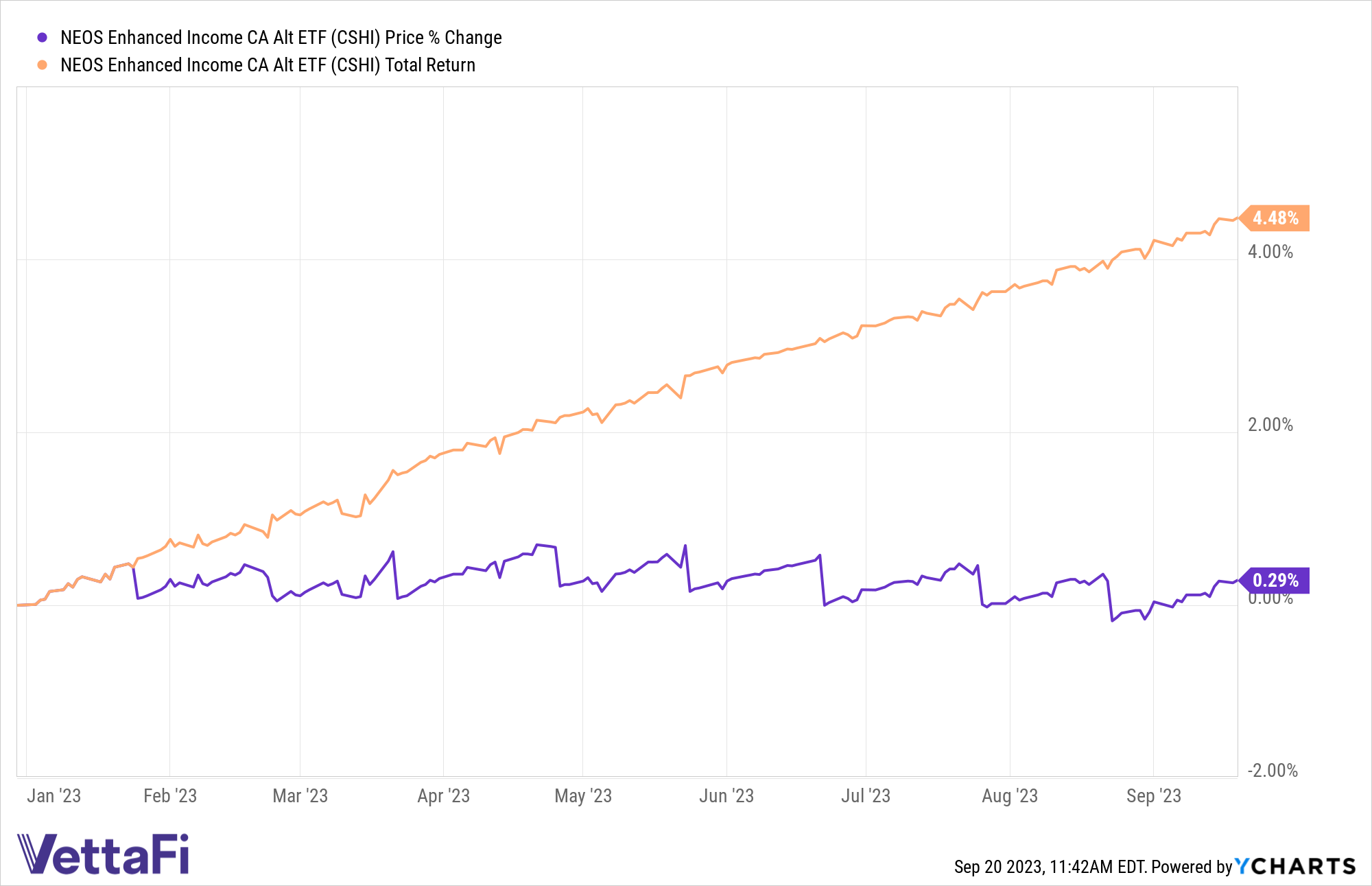

A major beneficiary of uncertainty this year is the NEOS Enhanced Income Cash Alternative ETF (CSHI). The fund offers advisors and investors the opportunity to put their cash allocations to work earning enhanced income while they ride out volatility.

At the mid-point of September, the fund had approximately $13 million in net flows as of 09/20/2023. For the year, the fund is up $144 million in net flows.

CSHI is an actively managed ETF that generates high monthly income and is an options-based fund. CSHI is long on three-month Treasuries and also sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

CSHI seeks to deliver 100–150 basis points above what 90-day Treasuries are yielding. CSHI also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options.

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means the options held at the end of the year are treated as if sold on the last market day of the year at FMV.

Any capital gains or losses are taxed as 60% long-term and 40% short-term. Notably, this tax treatment applies regardless of how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

CSHI has an expense ratio of 0.38%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.