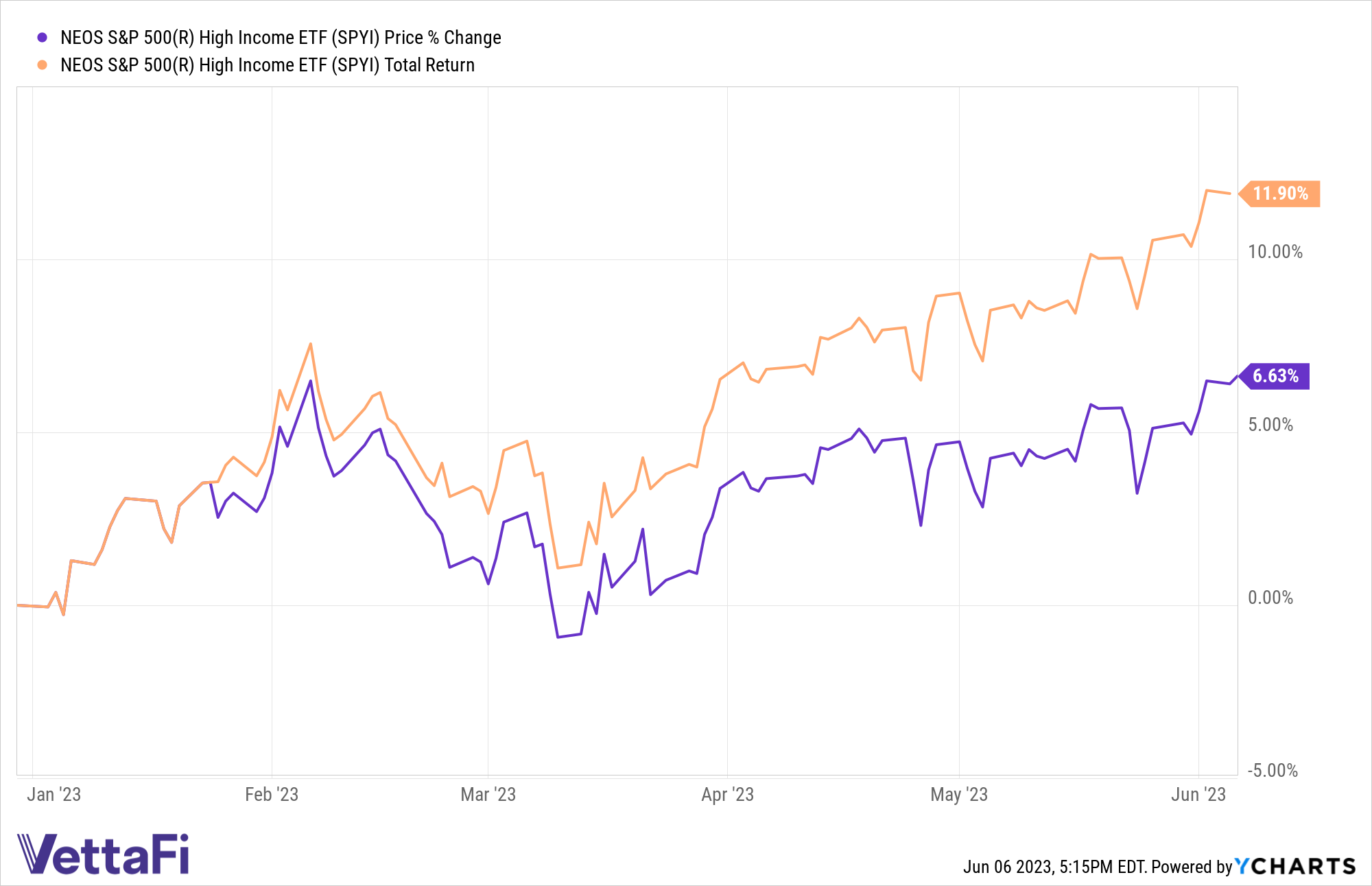

The S&P 500 edged into bull territory this week from October lows as markets continue to defy expectations. Investors seeking to capitalize on and optimize their income potential within the major index increasingly bought into the NEOS S&P 500 High Income ETF (SPYI) in the last month.

Despite economic slowing forecasts, markets remain buoyed by the information technology sector and mega-cap companies. The S&P 500’s returns are up nearly 21% compared to lows last October despite bank crisis, debt ceiling fears, and more.

Concerns of economic weakening this year continue to drive more advisors and investors towards perceived safe havens such as mega-caps. Stellar outperformance from companies such as Nvidia carried the index higher in May and investors took note.

Capitalize on Market Gains, Optimize Income During Drawdowns

In the last month, SPYI had net flows of nearly $17.5 million, more than doubling the fund’s AUM. SPYI launched at the end of August last year. The ETF is well positioned to capitalize on income opportunities in the S&P 500 as the index rises. It also offers tax-efficient income which can be a boon for portfolios during periods of economic weakening.

SPYI has a distribution yield of 12.29% as of 05/31/2023 and a 30-day SEC yield of 1.14% (it doesn’t include options income).

See also: “Don’t Miss Portfolio Yield Potential With NEOS Income ETFs”

SPYI seeks to provide higher income through call options the fund writes that it earns premiums on. It then can use the money earned from the written calls to buy long, out-of-the-money call options on the S&P 500 Index.

An out-of-the-money call option has no intrinsic value. That’s because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at the end of the year are treated like they were sold on the last market day of the year at fair value. Any capital gains or losses are taxed as 60% long-term and 40% short-term, no matter how long investors held them. This can offer noteworthy tax advantages.

The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.