Investor uncertainty regarding the path of Federal Reserve rate hikes in the last two years has been a contributing factor to ongoing market volatility. With much still uncertain about the path forward regarding higher rates for longer, market volatility remains a threat. Advisors and investors seeking refuge from volatility should consider the NEOS Enhanced Income Cash Alternative ETF (CSHI), given yields.

Guidance from Fed Chair Jerome Powell Thursday left investors with much uncertainty as to the long-term path of rate hikes. Powell maintained the previous stance and commitment of the Fed to fight inflation. Although the regulatory body sees signs of slowing prices, Powell underscored the high level of inflation currently.

“A few months of good data are only the beginning,” Powell said at the Economic Club of New York, reported CNBC. It will take more “to build confidence that inflation is moving down sustainably toward our goal.”

Futures markets priced the likelihood of holding rates at the next Fed meeting at 97% in the wake of Powell’s speech. Though the near-term looks more certain, the longer term is still murky. Despite the acknowledgment of positive data, Powell stressed the need for lower economic growth. The Fed Chair didn’t give any indication of the longer-term rate outlook.

The future path of interest rate hikes remains a narrative that investors and markets have consistently gotten wrong in the last 18 months. It’s a major contributing factor to ongoing market volatility. With the path ahead still appearing clouded, volatility remains a threat.

See also: “Investors Seek Refuge in Cash Alternatives as Inflation Persists”

Hedge for Market Volatility, Uncertainty With Cash Alternatives

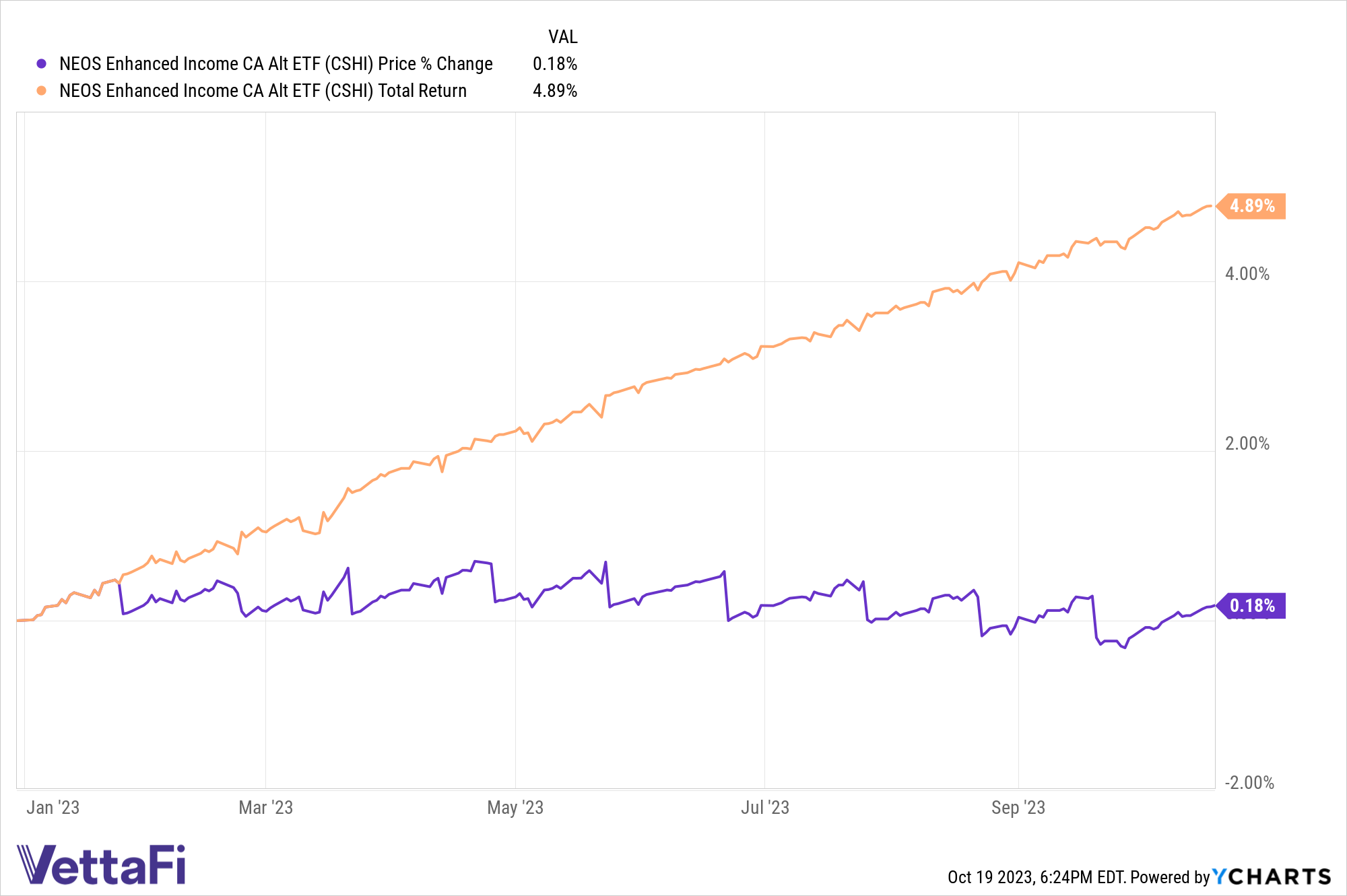

Investors seeking to make the most out of their cash allocations as they wait out uncertain markets should consider the NEOS Enhanced Income Cash Alternative ETF (CSHI).

CSHI is an actively managed ETF that generates high monthly income and is an options-based fund. CSHI is long on three-month Treasuries and also sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

CSHI seeks to deliver 100-150 basis points above what 90-day Treasuries are yielding. CSHI also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options. The fund currently has a distribution yield of 6.21% and a 30-day SEC yield of 4.99% as of 09/30/2023.

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means the options held at the end of the year are treated as if sold on the last market day of the year at FMV.

Any capital gains or losses are taxed as 60% long-term and 40% short-term. Notably, this tax treatment applies regardless of how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

CSHI has an expense ratio of 0.38%.

For more news, information, and analysis visit the Tax-Efficient Income Channel.