Though the outlook remains muddled for markets in the first half, big AI earnings wins continue to boost equities. For investors looking to enhance their equity holdings and gains with a tax-efficient income stream, the NEOS S&P 500 High Income ETF (SPYI) is worth consideration.

Another strong quarterly earnings report from chipmaker Nvidia catalyzed markets on Thursday. The S&P 500 rose above 5,100 for the first time in early trading Friday, buoyed by ongoing AI optimism. Although Nvidia proved the spark for equity gains this week, surging 16% on Thursday, earnings beats resounded across sectors. Other winners include Carvana, Block, Live Nation Entertainment, and more.

“Blockbuster earnings from tech giant Nvidia sparked the rally, but many sectors contributed,” Larry Tentarelli, chief technical strategist for the Blue Chip Daily Trend Report, told CNBC. “This is a very constructive breakout.”

Investors looking to enhance their equity allocations would do well to consider the NEOS S&P 500 High Income ETF (SPYI). The fund seeks to provide exposure to the S&P 500 and generate high monthly income through its covered call strategy. It also uses multiple layers of tax efficiency, a boon in any kind of market.

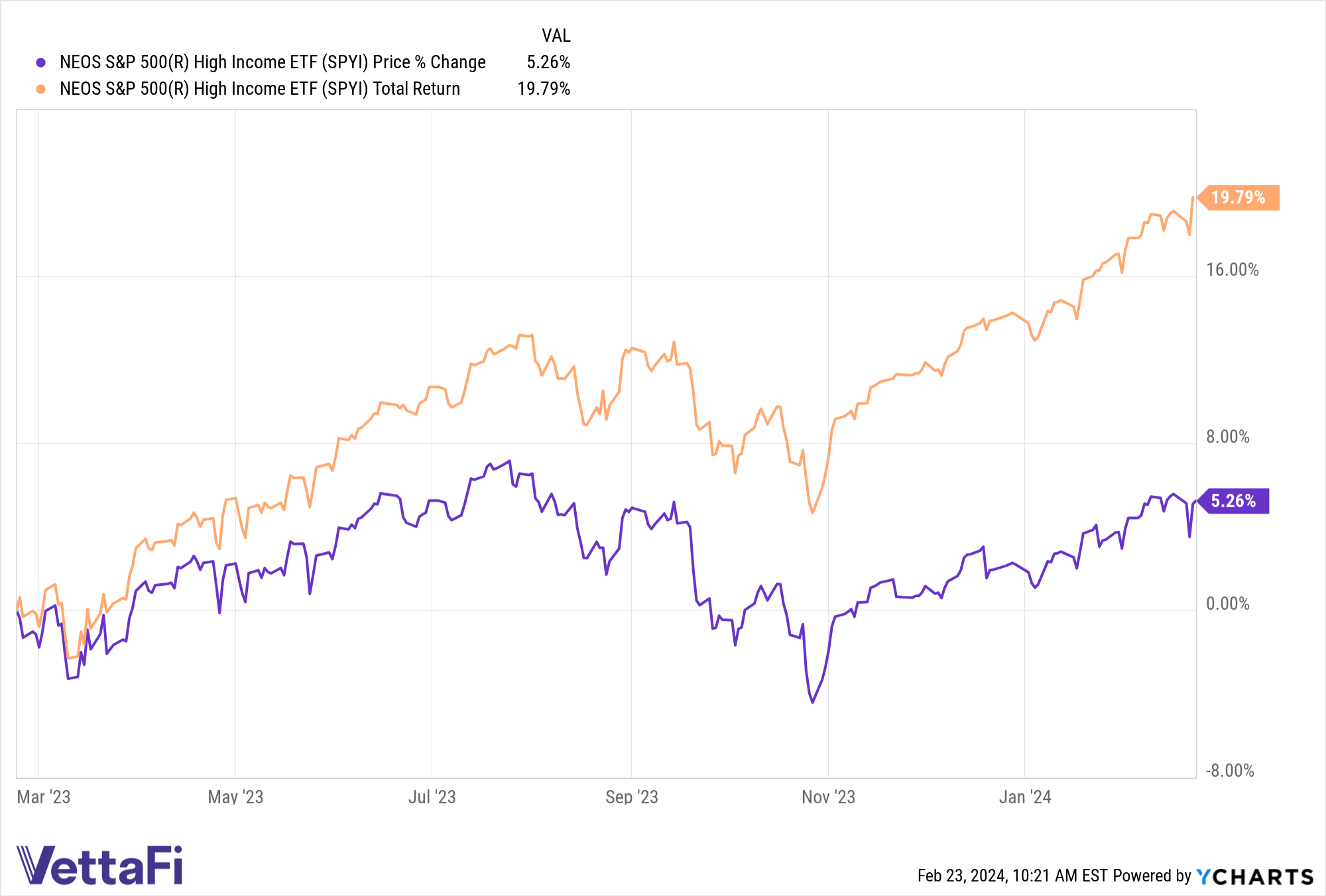

SPYI generated a current distribution yield of 12.09% and a 30-day SEC yield 0.88% as of 01/31/24. Over the last 12 months, the fund is up 19.79% on a total return basis and is up 4.91% in total returns YTD as of 02/23/24. SPYI currently has net flows of $240 million YTD as of 02/21/24.

The fund uses money earned from written calls to buy long, out-of-the-money call options on the S&P 500 Index. An out-of-the-money call option has no intrinsic value. That’s because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at year’s end are treated as if sold at fair market value on the last market day. Any capital gains or losses are taxed as 60% long term and 40% short term, no matter how long investors hold them. This can offer noteworthy tax advantages.

The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.