The exuberant optimism that closed out 2023 already hit its first stumbling block in the opening days of 2024. 10-year Treasury yields climbed while tech stocks extended their retreat as 2024 markets kick off with a volatile start.

Yields on the 10-year Treasury touched above 4% Wednesday morning after falling precipitously for much of December. 10-year Treasury yields fell as low as 3.78% last month after touching above 5% in October. Bond yields and prices move inverse to each other.

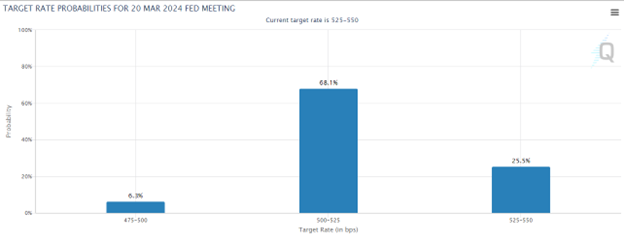

Markets enthusiastically absorbed the news in December of Fed forecasted rate cuts, three in total, in 2024. Many investors believed three rate cuts to be a low estimate and began pricing in more aggressive cuts — and sooner.

Image source: CME Group FedWatch Tool

Investors now find themselves reconsidering their optimistic timing of Fed rate hikes this year as they await December’s meeting minutes later today.

Meanwhile, the route in tech stocks continues as the Nasdaq falls further. Barclay’s downgrading of Apple on Tuesday prompted an almost 4% drop in the company’s stock prices yesterday. The selloff spread to many of the top tech performers in 2023 on Wednesday, including NVIDIA, Meta, and more.

“Long term, I’m still very bullish. But near term I just worry that everybody is coming into the year feeling too good,” Steve Eisman, senior PM at Neuberger Berman, said on CNBC’s “Fast Money”.

Two days does not a year make, but the ongoing investor uncertainty around rate hikes perpetuating market volatility is nothing new. Indeed, it’s been the trend of the last 18 months. Add into the near-term mix the impending primary season in the U.S., ongoing global geopolitical risk, and a host of other risk factors, and the near-term looks decidedly less sunny.

For Now, Cash Remains King in 2024 Markets

Many investors ended 2023 with an above average allocation to cash in the wake of ongoing market volatility. For advisors and investors looking to make that money work for them in the short-term, the NEOS Enhanced Income Cash Alternative ETF (CSHI) is a fund worth consideration. CSHI seeks to deliver 100-150 basis points above what 90-day Treasuries are yielding. It’s noteworthy for its tax efficiency and monthly income-oriented strategy.

CSHI is an actively managed ETF that generates high monthly income and is an options-based fund. It is long on three-month Treasuries and sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

The fund also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options. CSHI currently has a distribution yield of 6.03% and a 30-day SEC yield of 5.04% as of 12/31/2023.

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means the options held at the end of the year are treated as if sold on the last market day of the year at fair market value.

Any capital gains or losses are taxed as 60% long-term and 40% short-term. Notably, this tax treatment applies regardless of how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

CSHI has an expense ratio of 0.38%.

For more news, information, and analysis visit the Tax-Efficient Income Channel.