Ongoing rate risk, geopolitical risk, and recession risk curated a perpetual sense of uncertainty for investors and markets in 2023. In such a troubled year, investors increasingly turned to alternative strategies to augment or enhance their existing core exposures. With more equity income funds coming online, how do the top ETFs in the category stack up?

The JPMorgan Equity Premium Income ETF (JEPI) seeks lower volatility than the S&P 500, as well as reliable monthly income. It’s an actively managed fund that invests in companies within the S&P 500 and utilizes several screens, including valuations. In addition, the fund invests in ELNs that combine call options on the S&P with the characteristics of the S&P 500 itself. The use of the covered call strategy generates a premium for the fund, alongside dividends earned.

In comparison, NEOS S&P 500 High Income ETF (SPYI) is actively managed and seeks to provide exposure to the S&P 500 and generate higher income through call options the fund writes and earns premiums on.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at year’s end are treated as if sold at fair market value on the last market day. Any capital gains or losses are taxed as 60% long-term and 40% short-term, no matter how long investors hold them. This can offer noteworthy tax advantages.

SPYI Outperforms Within Equity Income Category

JEPI brought in nearly $13 billion in net flows in 2023 in another monster year for options strategies. Since its launch in May 2020, the fund dominated the equity income category by AUM in 2022 and 2023. In comparison, SPYI launched in August 2022 and brought in approximately $550 million in net flows last year. Though the fund has less AUM, it has offered consistent outperformance within the class since its inception.

Comparing the two funds, JEPI generated total returns of 14.07% between 08/30/2022 (SPYI’s inception) and 1/31/2204 according to Morningstar data. The fund’s current distribution yield, measured by annualizing the most recent distribution and dividing by NAV at the time of distribution, was 6.42% as of 01/31/2024 as measured by Morningstar. Meanwhile, SPYI generated total returns of 15.92% between 08/30/22 and 1/31/24 with a current distribution yield of 12.09% as of 01/31/24 according to Morningstar data.

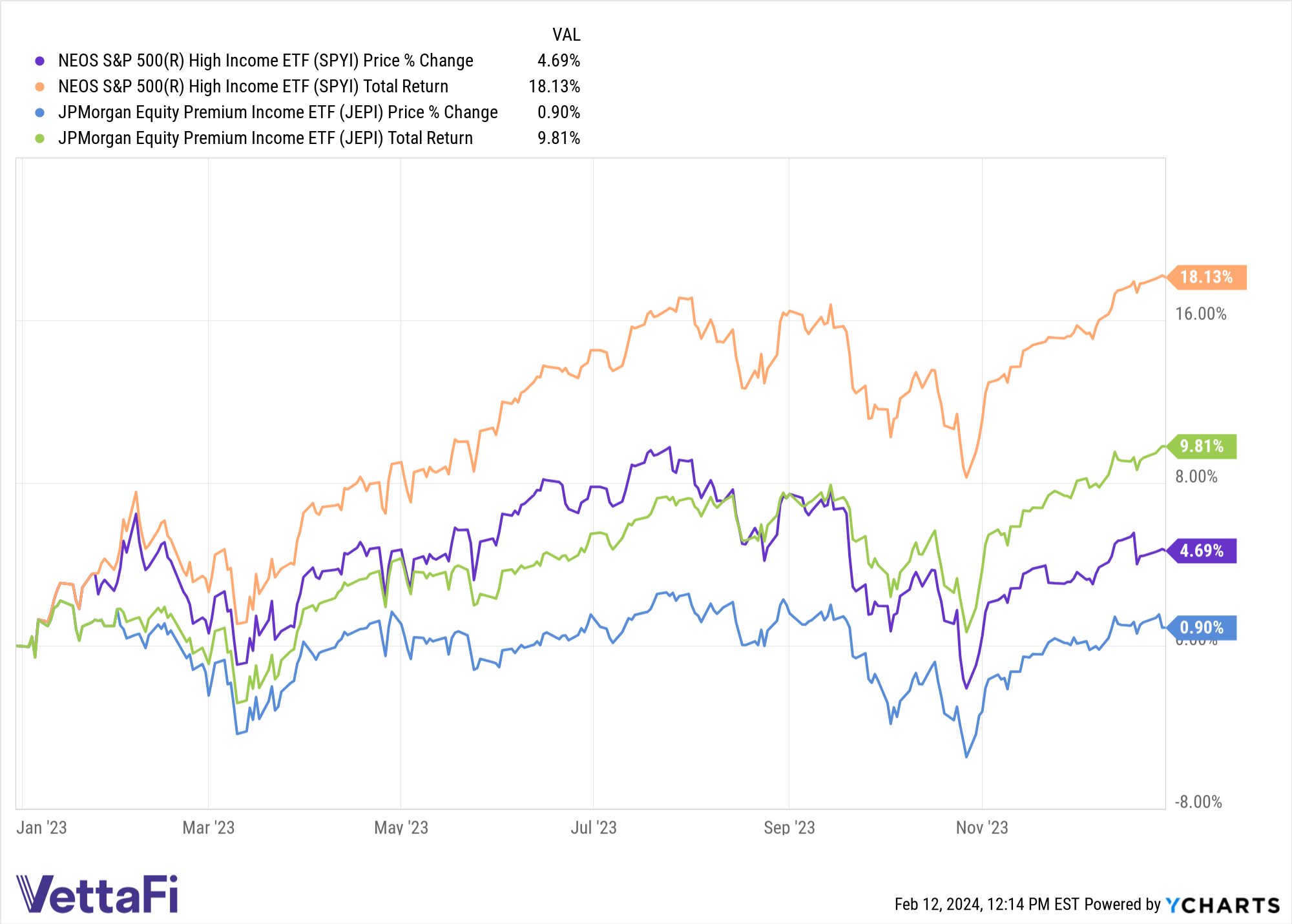

In 2023, SPYI generated total returns of 18.13% and price returns of 4.69%. JEPI’s total returns were 9.81% with price returns of 0.90% over the same period.

SPYI remains a consistent outperformer within the category and has a management fee of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.