The outlook for equities appears decidedly less grim in the second half than previously predicted. For advisors and investors looking to make the most out of income and yield opportunities in equities, the NEOS S&P 500 High Income ETF (SPYI) offers notable distribution yields.

Hopes of a soft-landing lifted markets in July on the tails of favorable inflation data and signals of potential labor market weakening. Markets ended the first week of August lower on news of the U.S. credit downgrade by Fitch. They have since risen in trading as investor attention returned to earnings.

“Markets are back on to a risk-on mode,” Chris Zaccarelli, CIO of the Independent Advisor Alliance, told CNBC. “It’s been a better-than-expected earnings season, and so I think that’s why the market’s had such staying power.”

It’s been another strong earnings season for S&P 500 constituents thus far. Most companies have already reported earnings thus far (85% as of Monday, August 7). Of the companies with earnings announced, 80% beat forecasts according to FactSet data.

Bank of America economists and the Fed have both rescinded their estimates for a recession in the fourth quarter, reported Bloomberg. It’s the first Wall Street bank to make such a call as the narrative for this year changes.

Capitalize on Income and Yield in Equities With SPYI

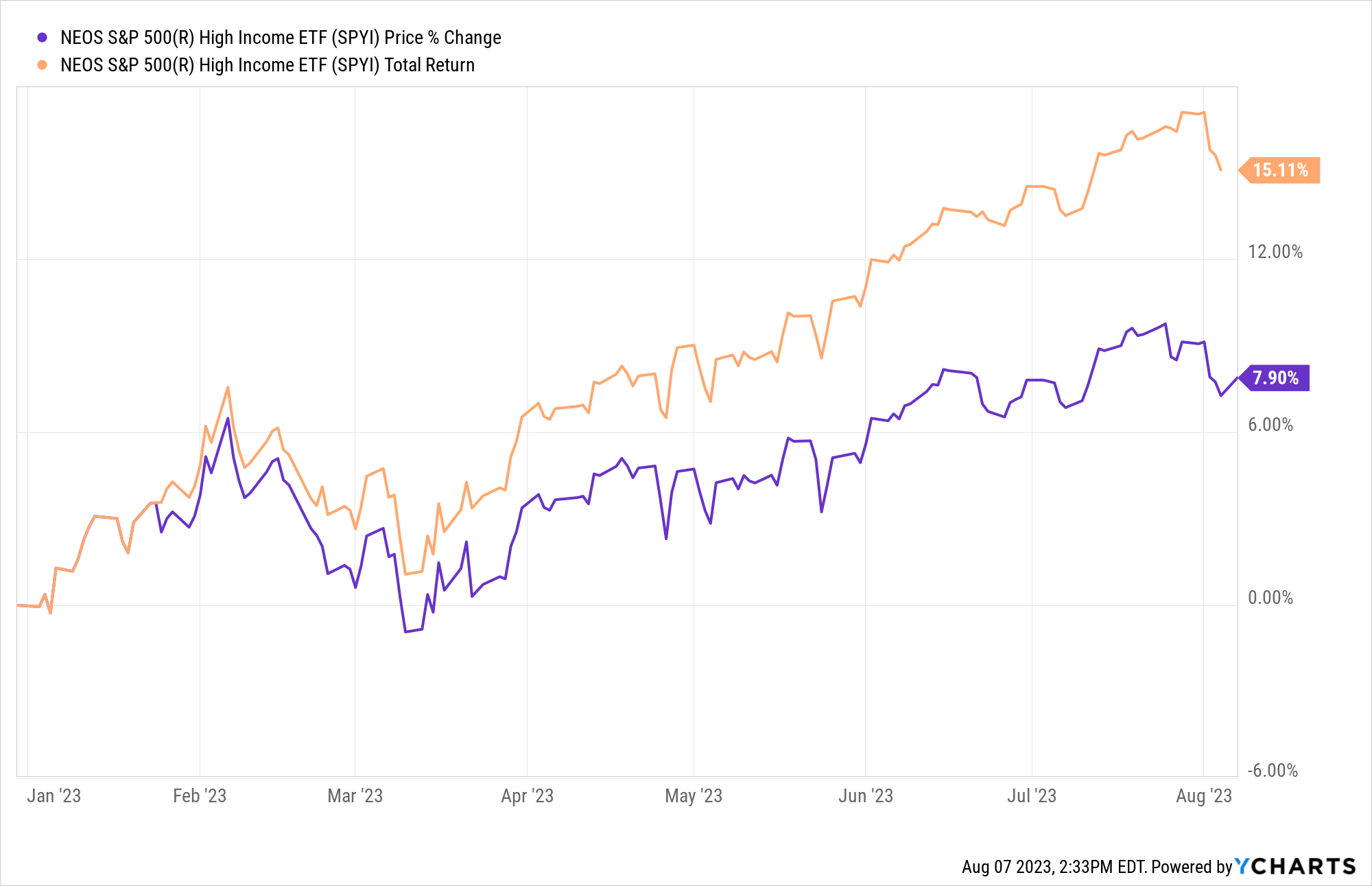

The NEOS S&P 500 High Income ETF (SPYI) is well positioned to capitalize on income opportunities in the S&P 500 as the index rises. It also offers tax-efficient income which can be a boon for portfolios during periods of economic weakening and an enhancement in times of gains.

See also: “Modern Portfolio Construction Should Include Covered Calls“

SPYI has a distribution yield of 12.10% as of 07/31/2023. The fund also has a 30-day SEC yield of 0.97% (doesn’t include options income).

SPYI seeks to provide higher income through call options the fund writes that it earns premiums on. It then can use the money earned from the written calls to buy long, out-of-the-money call options on the S&P 500 Index.

An out-of-the-money call option has no intrinsic value. That’s because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at the end of the year are treated like they were sold on the last market day of the year at fair value. Any capital gains or losses are taxed as 60% long-term and 40% short-term, no matter how long investors held them. This can offer noteworthy tax advantages.

The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.