Equities rallied Tuesday on news of October’s lower-than-expected inflation report. Investors are increasingly hopeful of an end to interest rate hikes and more predictable markets. When considering increasing allocations to equities, investors should look to the NEOS S&P 500 High Income ETF (SPYI) for income enhancement opportunities.

Hopes of a conclusion to the Fed rate hiking regime buoyed the S&P 500 to its highest close since April this year. October’s overall inflation print came in flat while core CPI, which excludes energy and food, gained at its slowest rate in two years. Month-to-date, the S&P 500 is up 7.2%.

“The sources of inflation are disappearing quickly,” Luke Tilley, chief economist at Wilmington Trust, told WSJ. Stocks gained while treasury yields tumbled (bond yields and prices move inversely).

The continued slowing in core inflation, a closely watched metric by the Fed, could be the signal needed to satisfy the regulatory body that further rate hikes are unnecessary.

SPYI Enhances Income in Equities

Although markets soared Tuesday, the economic outlook for the U.S. remains muted in the coming months. Advisors and investors looking to capture opportunities in equities while enhancing their exposures for income should consider the NEOS S&P 500 High Income ETF (SPYI).

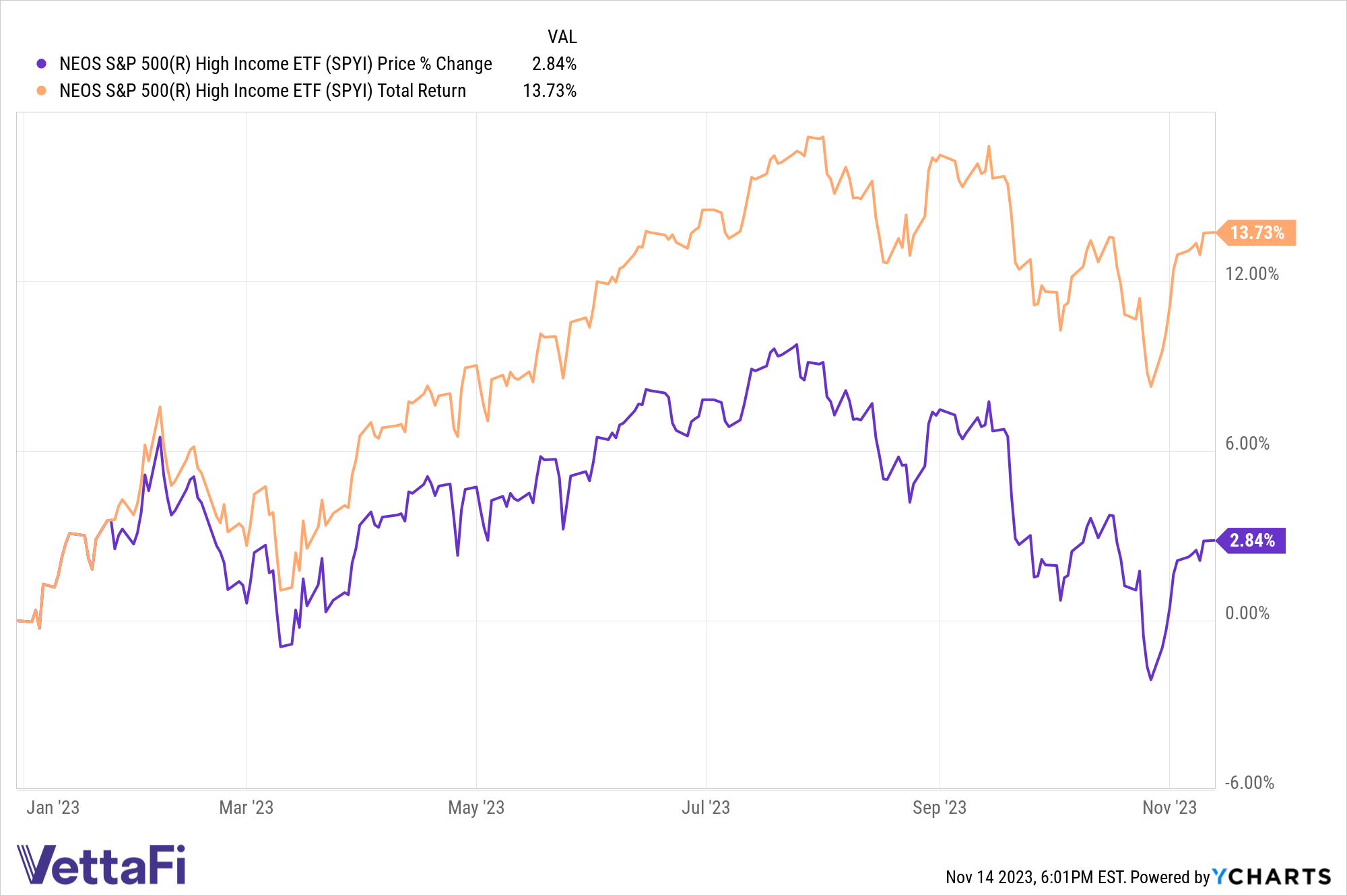

SPYI capitalizes on core equity allocations while also providing a tax-efficient income stream for portfolios. Investors continue to take note of the fund: year-to-date SPYI is up $425 million in net flows.

The fund seeks to provide higher income through call options the fund writes and earns premiums on. It then can use the money earned from the written calls to buy long, out-of-the-money call options on the S&P 500 Index.

An out-of-the-money call option has no intrinsic value. That’s because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at year’s end are treated as if sold at fair market value on the last market day. Any capital gains or losses are taxed as 60% long-term and 40% short-term, no matter how long investors hold them. This can offer noteworthy tax advantages.

The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.