Consumer spending beat expectations last month while consumer confidence fell slightly. The divergence is all part of a larger trend — a tale of two markets — that underscores the uncertainty investors face this year. In such a challenging environment, optimizing core exposures for tax-efficient income provides benefits to investors and portfolios.

The resilient economy gives hope that the U.S. may sidestep a recession, but also proves a direct challenge to inflationary easing. Retail sales rose 0.7% month-over-month in March, much higher than the 0.3% forecast. However, consumer sentiment remains cautious, falling slightly in April from the previous month according to the University of Michigan Survey of Consumers. Sentiment regarding the current economy fell three points month-over-month, to 79.3.

“Overall, consumers are reserving judgment about the economy in light of the upcoming election,” according to the survey. The November election “in the view of many consumers, could have a substantial impact on the trajectory of the economy.”

The economy is booming but consumers still don’t feel confident. Inflation remains persistent and rate cut expectations must change trajectory yet again. The jobs market remains resilient but threatens inflationary pressures.

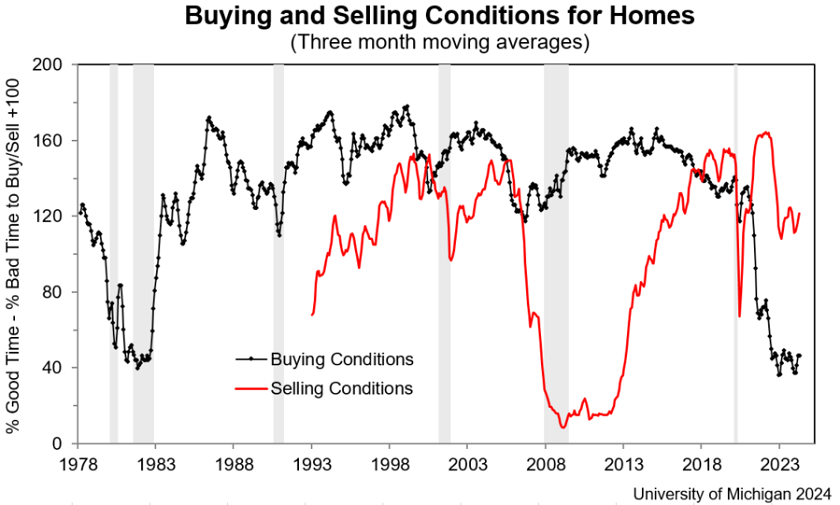

Equities closed out the first quarter with a record-setting rally, but new geopolitical risk now looms large over the global stage. The housing market recovery continues, albeit slowly, but only benefits sellers.

Image source: University of Michigan

Given the number of risk factors at play in 2024, uncertainty plagues investors and markets. Will the economy navigate a soft landing or will it crash into recession? Will the Fed hold off on rate cuts this year? If inflation continues to rise, how much higher will rates go? Will equities continue their bull run or does a market correction loom on the horizon?

“Right now, the market is thinking the Fed can still lower rates, but whether the central bank will hike is the real question,” Robert Daly, director of fixed income at Glenmede Investment Management told MarketWatch.

NEOS Tax-Efficient Income ETFs Enhance Core Exposures

Everywhere you look, it’s currently a tale of two markets with diverging performance and sentiment. Such an environment proves difficult even for seasoned investors to parse. In such uncertainty, making the most of core exposures matters. The tax-efficient income ETF suite from NEOS allows investors to harness high income potential across a number of asset classes. Multiple layers of tax efficiency also provide investors with optionality within their portfolios.

NEOS offers three different ETFs across core allocations for investors. The NEOS S&P 500 High Income ETF (SPYI) offers broad equity exposure through the S&P 500. The NEOS Enhanced Income Aggregate Bond ETF (BNDI) offers exposures across the broad bond market. Meanwhile, the NEOS Enhanced Income Cash Alternative ETF (CSHI) allows investors to capitalize on yields in ultra-short-duration Treasuries.

NEOS also offers targeted exposure to the Nasdaq via the NEOS Nasdaq 100 High Income ETF (QQQI). The fund seeks high monthly income by investing in the Nasdaq-100 Index. It also employs a call option strategy on the NDX and is actively managed. The fund has an expense ratio of 0.68%.

SPYI, BNDI, and CSHI utilize S&P 500 Index options to augment their income potential. The options used receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means that the options held at the end of the year are treated as if they had been sold on the last market day of the year at fair market value.

Similar to the other funds, QQQI utilizes options on the NDX that qualify as section 1256 contracts and receive the same favorable tax treatment.

Any capital gains or losses receive a tax treatment of 60% long-term and 40% short-term. This treatment occurs regardless of how long the strategy invested in the options. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

However you’re looking to make income this year, NEOS offers a tax-efficient solution for portfolios.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.