After months of predicted recession, the possibility of a “soft landing” appears to be back on the docket. Advisors and investors still unsure regarding both the short-term and longer-term economic outlook should look to opportunities in cash alternatives given current yields.

June’s inflation print saw the first substantial drop in core inflation this year. Core inflation, which subtracts energy and food, remains a closely watched metric by the Fed. Easing of this measurement could signal widespread inflationary easing within many sectors under scrutiny.

The news taken in tandem with softening labor numbers and a positive kick off to earnings season by JPMorgan gives hope for markets that the Fed could manage a soft landing. It remains to be seen, however, if the Fed will be content with one more rate hike and if inflation will continue trending downwards. There is also the matter of the long-term impact of commercial real estate loans concentration in small banks.

Make Cash Allocations Work While Waiting on Economic

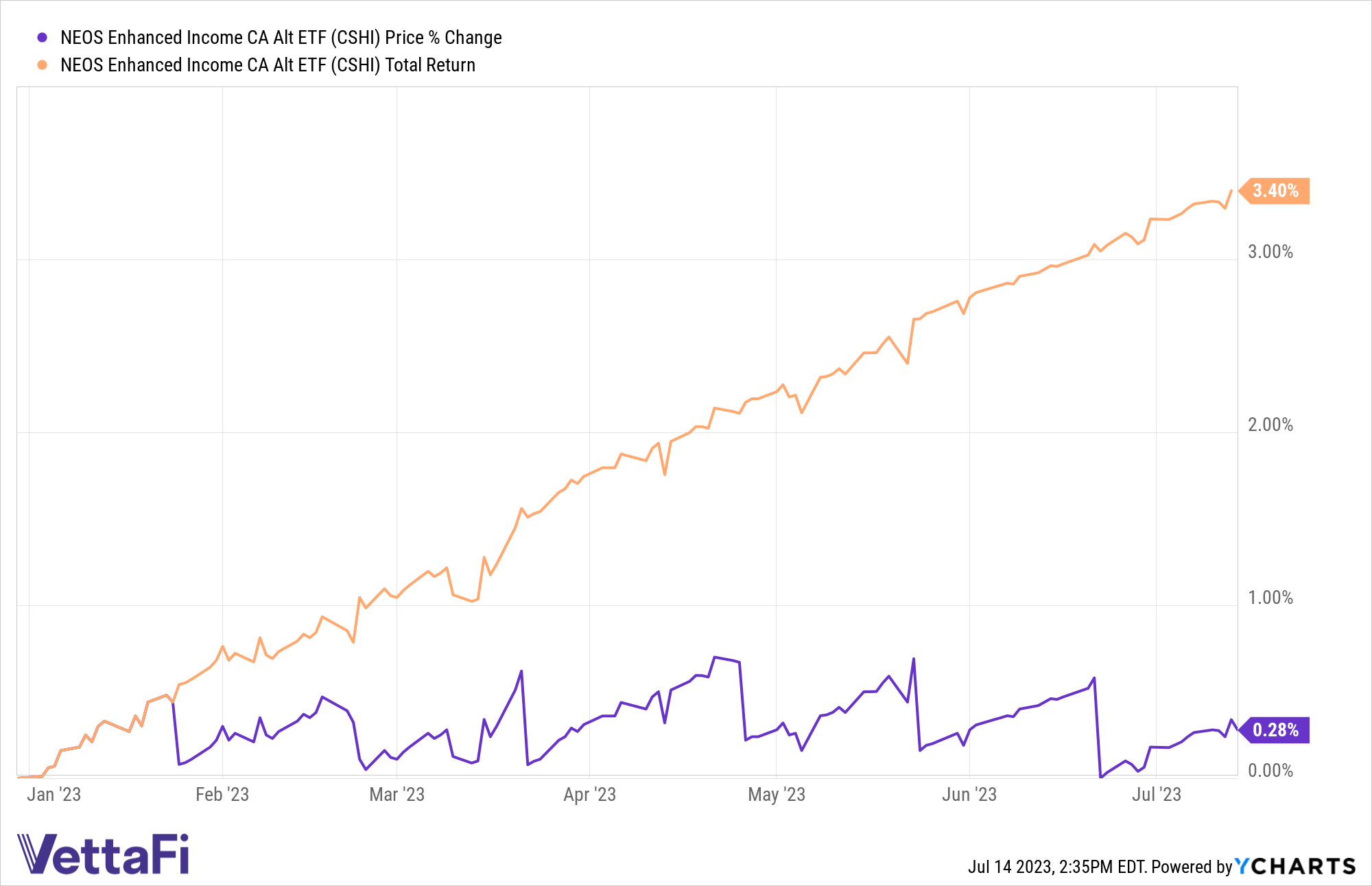

With much still uncertain, this earnings season remains closely watched. Given prolonged market volatility and continued uncertainty, advisors looking to wait for more definitive signals are likely to hold onto the larger cash allocations many portfolios have this year. The NEOS Enhanced Income Cash Alternative ETF (CSHI) is a fund worth consideration while waiting, given its distribution yield of 6.51% and 30-day SEC yield of 4.72% as of June 30, 2023.

The fund is an actively managed ETF that generates high monthly income and is an options-based fund. CSHI is long on three-month Treasuries and also sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

It seeks to deliver 100–150 basis points above what 90-day Treasuries are yielding. The yield on three-month Treasuries remains near two-decade highs at 5.396%.

CSHI also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options. The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable taxation rates as Section 1256 Contracts under IRS rules. This means options held at the end of the year are treated as if they had been sold on the last market day of the year at fair market value.

Any capital gains or losses are taxed as 60% long-term and 40% short-term. These rates hold no matter how long the options were held and can offer noteworthy tax advantages. The fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

See more: “Harness Noteworthy Yield in Core Allocations With NEOS”

CSHI has an expense ratio of 0.38%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.