Investors crowded into short-duration bonds for much of this year as rate risk remained elevated. With the Fed narrative potentially changing regarding rate hikes, many investors are now deploying a barbell strategy within bonds. The NEOS Enhanced Income Cash Alternative ETF (CSHI) is a strong addition to any short-duration bond barbell exposures for its notable yields.

Short and ultra-short-duration bonds proved both popular and profitable this year while the Fed continued its aggressive rate hiking regime. Falling inflation, reflected in both CPI and PPI in October, gave investors hope that rate hikes could be ending.

News of the lower-than-expected inflation prints sent longer duration yields falling last week. In a changing market environment, investors are increasingly employing a barbell approach to bonds. While they retain many of their shorter-duration exposures, investors also are moving back into longer-duration Treasuries. This is evidenced by the multibillion-dollar flows into 20-year and longer Treasury ETFs in the last month.

See also: “Income Opportunities in Bonds and Beyond“

Enhance Short-Duration Bond Barbell Exposures With CSHI

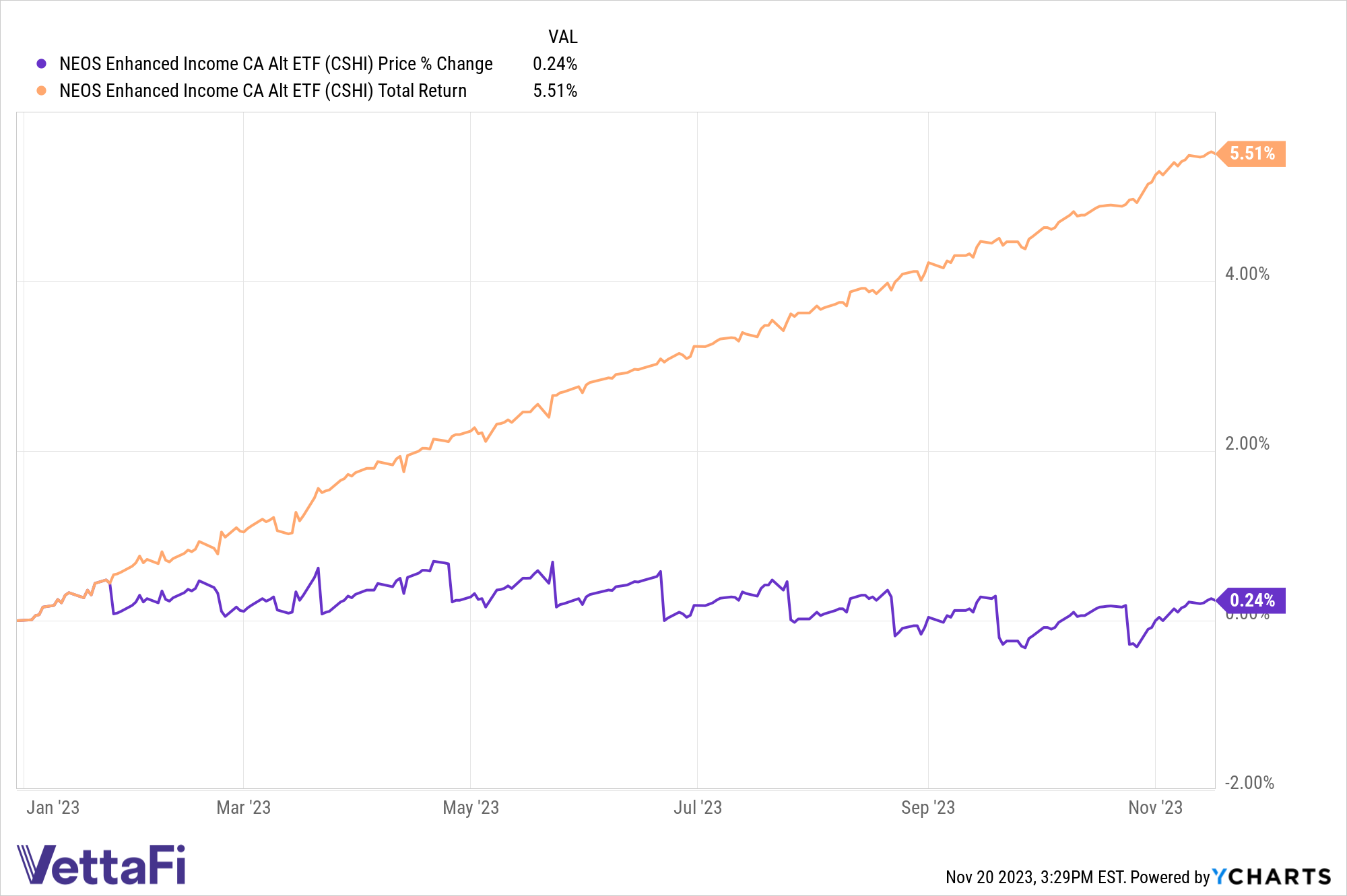

The NEOS Enhanced Income Cash Alternative ETF (CSHI) seeks to deliver 100-150 basis points above what 90-day Treasuries are yielding. It’s a strong addition to any strategy using short-duration bonds, including a barbell approach. CSHI is noteworthy for its tax efficiency and monthly income-oriented strategy.

CSHI is an actively managed ETF that generates high monthly income and is an options-based fund. It is long on three-month Treasuries and sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

The fund also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options. CSHI currently has a distribution yield of 6.15% and a 30-day SEC yield of 5.00% as of 10/31/2023.

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means the options held at the end of the year are treated as if sold on the last market day of the year at fair market value.

Any capital gains or losses are taxed as 60% long-term and 40% short-term. Notably, this tax treatment applies regardless of how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

CSHI has an expense ratio of 0.38%.

For more news, information, and analysis visit the Tax-Efficient Income Channel.