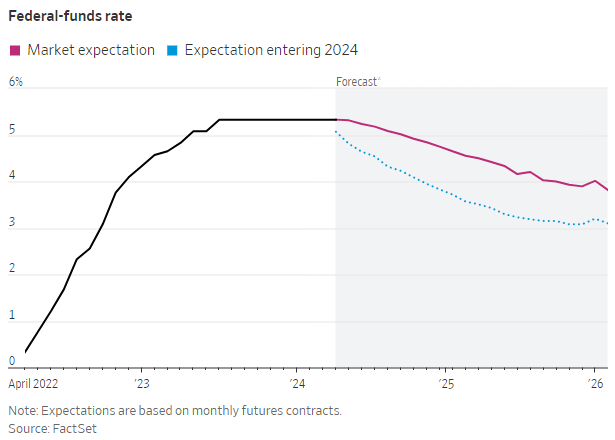

Market expectations regarding interest rates wavered in the aftermath of a strong jobs report last week. Short-duration investments continue to prove attractive as investors now mull over the potential for less interest rate cuts, or possibly none.

After expectations of upwards of six rate cuts this year, more investors now believe the Fed will cut rates just twice by the end of the year, according to the CME FedWatch Tool.

A resilient and robust economy challenges the rate cut narrative. With upward potential pressure on inflation driven by economic growth, investors now worry the Fed will maintain higher rates for longer.

Image source: WSJ

“The last of the economic bears are throwing in the towel,” Joe Brusuelas, chief economist at RSM US told the WSJ. “We have a sustained economic expansion, and investors who manage risk are now repricing it.”

Look to Cash Alternatives When Interest Rate Worries Rise

The shifting narrative is a familiar one in the last 18 months. Markets continue attempting to forecast — mostly incorrectly — the direction of inflation and rate cuts. When investor expectations misalign with Fed policy, volatility spikes. It’s left a lot of investors with cash on the sidelines until a more certain outlook surfaces. For those investors still sitting in substantial cash allocations, income options exist within a short duration.

The NEOS Enhanced Income 1-3 Month T-Bill ETF (CSHI) seeks to deliver 100-150 basis points above what 1-3 month Treasuries are yielding. It’s noteworthy for its tax efficiency and monthly income-oriented strategy.

CSHI actively managed and seeks to generate high monthly income and is options-based. It is long on three-month Treasuries and sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

The fund also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options. CSHI currently has a distribution yield of 6.03% and a 30-day SEC yield of 4.88% as of 03/31/2024.

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means the options held at the end of the year are treated as if sold on the last market day of the year at fair market value.

Any capital gains or losses are taxed as 60% long-term and 40% short-term. Notably, this tax treatment applies regardless of how long the options were held which can offer noteworthy tax advantages. The fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options. CSHI has an expense ratio of 0.38%.

For more news, information, and analysis visit the Tax-Efficient Income Channel.