Markets look to end a multiple-week winning streak this week as recession fears and aggressive Fed talk weigh heavily on investors. For those looking to hedge in cash in the second-half, the NEOS Enhanced Income Cash Alternative ETF (CSHI) offers opportunity.

The fund is an actively managed ETF that generates high monthly income and is an options-based fund. CSHI is long on three-month Treasuries and also sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

“When the team developed this product, cash was yielding zero,” explained Troy Cates, co-founder and managing partner of NEOS, in a recent webcast hosted on the VettaFi platform. “Now here we are, many months later with… one- to three-month T-bills, you’re getting anywhere from five to five and a quarter on those rolls.”

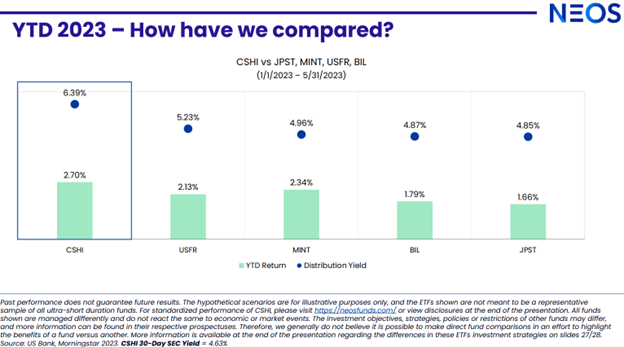

CSHI currently offers a distribution yield of 6.39% as of May 23, 2023 and a 30-day SEC yield of 4.63%. Distribution yield is calculated by annualizing the most recent distribution and dividing by the fund’s NAV. Thirty-day SEC yield excludes yield earned on options.

Options to Enhance Income Potential Within Cash Alternatives

“Being a cash portfolio, we’re not looking to take a lot of risk on the options portfolio,” said Cates. “We’re just looking to bring in one to one and a half percent a year over what the cash portfolio is doing.”

CSHI seeks to deliver 100–150 basis points above what 90-day Treasuries are yielding. CSHI also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options.

“On a weekly basis, we are selling deep out-of-the-money SPX Index put spreads,” Cates explained. “On average we’re [using] anywhere from three to four different laddered put spreads.”

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means that the options held at the end of the year are treated as if they had been sold on the last market day of the year at fair market value.

Any capital gains or losses are taxed as 60% long-term and 40% short-term, regardless how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

See also: “NEOS ETFs Boost Income Tax Efficiency Potential for Portfolios”

The Strategy Holds Even During Equity Downturns

The addition of SPX Index options introduces a long equity bias to the portfolio, Cates explained. Advisors and investors concerned about the impact of equity downturns on the fund’s income generation potential can look to the fund’s performance last September.

In September 2022, the S&P 500 dropped more than 9% while T-bills rose 0.20%. “CSHI at NAV was up 14 basis points, so we lost six basis points in the option portfolio when the S&P 500 went down over nine percent,” said Cates.

The fund has also continually outperformed peers since its inception last year.

CSHI has an expense ratio of 0.38%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.