Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Karrie Gordon and Nick Peters-Golden debate whether investors should include options-based ETFs in their portfolios to enhance income potential.

Karrie Gordon, staff writer, VettaFi: Nick, I’m glad I have the option to chat with you today about income opportunities for portfolios. It’s a good environment for risk-averse investors that capitalize on higher interest rates and elevated Treasury yields. For investors with a higher risk tolerance seeking elevated income potential, however, it’s been a great environment this year. That’s why I believe investors should include options-based ETFs to increase their income potential.

Nick Peters-Golden, staff writer, VettaFi: Hi Karrie – I too appreciate having the option to chat with you about this today. I, however, have my concerns about these ETFs. I think they’re a bit much and overcomplicated when ETFs trade like securities. In such a landscape, I think there are just better choices that provide the ability to dip in and out of sectors, styles, cap sizes, and more that present better “options” than “options-based” ETFs.

Following the Money Trail

Gordon: I’m going to limit my discussion to options-based equity strategies for the sake of brevity. There are, however, several appealing options-based ETFs in bonds as well as alternatives.

First off, let me talk about some basics. Options are a type of derivative that gives the holder the right — but not the obligation, and that’s important — to buy or sell an asset at an agreed-upon price (called the strike price). Options can be used in several ways but are mostly utilized to enhance income or hedge against risk. We’re focused on the former, but I’ll discuss later why options-based income ETFs can offer a bit of both income and risk hedging.

Within equities, most options-based income ETFs utilize covered calls to generate income. A covered call entails holding an underlying security while also writing a call on it.

Covered calls are popular because of the income generated from the premiums paid by the purchaser. The premiums can enhance income potential should the underlying stock gain but not rise above the strike price at expiration. They offer a supplement to any dividends or capital gains earned off the underlying assets.

You need look no further than the popularity of options-based income ETFs this year to see their strong appeal. The JPMorgan Equity Premium Income ETF (JEPI) dominates the field. The fund is up almost $12.5 billion in net flows as of October 6. Meanwhile, the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) has net flows of nearly $4.5 billion over the same period.

The Global X Nasdaq 100 Covered Call ETF (QYLD) has net flows of nearly $930 million YTD. On the broad equities side, the Global X S&P 500 Covered Call TF (XYLD) has net flows of roughly $710 million YTD.

The NEOS S&P 500 High Income ETF (SPYI) is a fund that focuses on tax-efficient, enhanced income within broad equities. SPYI uses S&P 500 index options which are taxed as Section 1256 Contracts under IRS rules. This can provide an enhanced level of tax efficiency for income generated. The fund recently celebrated its first anniversary and is up $341 million in net flows YTD.

All five funds use covered calls to enhance their various equity exposures. To put it all into a bit of perspective, the SPDR S&P 500 ETF Trust (SPY) is down nearly $1.8 billion YTD and the Invesco QQQ Trust Series I (QQQ) is up $4.3 billion YTD.

Try Explaining “That” to Clients

Peters-Golden: Let’s talk about these strategies. Look, I love ETFs. I think their ability to offer specialized strategies that had previously been only accessible to big institutions or hedge funds in a nimble, tax-efficient package is a great step forward for finance.

Just because the ETF wrapper has made investing in certain strategies easier and more transparent, however, does not make the strategies themselves transparent. I’m not talking about ETFs that purposefully limit transparency, either. I’m talking about certain strategies themselves – like options-based income strategies.

Complexity in finance isn’t inherently bad, of course. Many of the world’s most effective investing strategies rely on algorithms or schemes that most people would find complicated. As I mentioned above, however, retail investors, whether independent or advised by an RIA, have rarely been the audience for these strategies. The former group, specifically, just may not be suited to investing in them.

Investors who move in and out of ETFs like SPY understand that they’re getting straightforward exposure to the S&P 500. Part of SPY’s success stems from that elegant simplicity. All kinds of ETFs are out there providing thematic exposure to a simple list of securities.

Options-based income ETFs require significantly more education and due diligence. They do a lot more than just track an index. They’re relying on puts, calls, and going long or short depending on circumstances and more to meet their goals.

Advisors, of course, pride themselves on their ability to explain complicated strategies to their clients but imagine explaining how a “call spread” approach works, or how puts and calls interact differently with a stock being at the money (ATM). With simpler strategies out there offering income via dividends or just doing well via tracking a very straightforward index, adding that complexity doesn’t inherently pay off.

Investors have to do much more due diligence with these, and advisors need to do a lot more education. I just don’t know if they’re worth that at the end of the day.

Do You Yield?

Gordon: Covered-call ETFs are some of the most straightforward of options strategies. While they require a level of education and due diligence, these strategies aren’t overly complex and they bring real benefits. In an environment of prolonged volatility and uncertainty, investors increasingly are looking to the income generation portions of their portfolio. Options-based ETFs offer a number of potential benefits in uncertain times, chief amongst them better yields.

Let’s look at S&P 500 exposure first. JEPI has a 30-day SEC yield of 7.90% as of the end of September. The fund also has a dividend yield of 7.69% over the same period. For comparison, SPY has a 30-day SEC yield of 1.47% with an index dividend yield of 1.62% as of October 6, 2023.

SPYI also offers noteworthy yields. The fund has a 12-month trailing yield of 11.99% as of September 30. In comparison, SPY has a trailing 12-month yield of 1.52%, calculated using the 12 most recent distributions in the last year divided by the fund’s NAV. SPYI also has a distribution yield of 12.22% as of September 30. Distribution yield annualizes the most recent distribution and then divides by the fund’s NAV. It’s a more forward-looking measure of performance potential.

Given the performance of the Nasdaq-100 this year, I’d be remiss not to talk about the yields on options-based ETFs targeting the index. QYLD has a 12-month trailing yield of 12.63% and a distribution yield of 11.88% as of Oct. 6. For comparison, QQQ has a 12-month trailing yield of 0.59% and a distribution yield of 0.58% as of October 9.

There are real yield opportunities within options-based ETFs for investors looking to optimize their income potential in a challenging market environment.

Don’t Forget About Fees

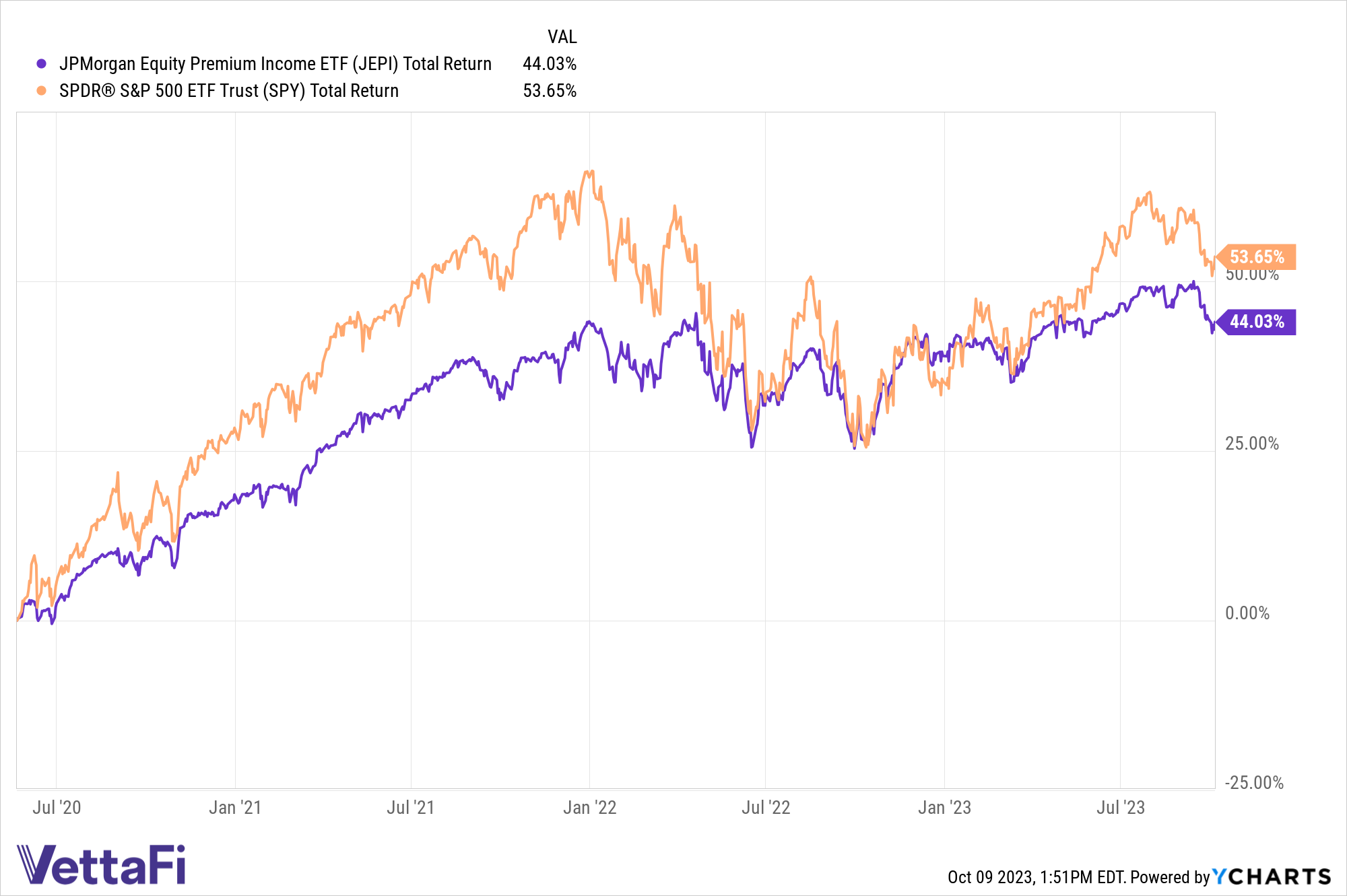

Peters-Golden: Here’s another bear point regarding income options ETFs. Above, I talked a lot about how much more complicated these strategies are than your standard passive thematic or beta ETFs. I failed to mention that that means they’re much more expensive, too. SPY, of course, charges just nine basis points (bps). As a reminder, that’s the cost to get an ETF that has returned 54% over the last five years and 31% in the last three.

The very popular JEPI meanwhile, has trailed SPY over both those windows. JEPI looks to add call options to the S&P 500, yes, so you wouldn’t see too much of a difference. Investors are still seeing nearly 10% less in returns than SPY for JEPI, an ETF that also charges 35 bps compared to SPY’s nine. That 35 bps charge also stands out as much “cheaper” than other ETFs in the options-based income ETF space.

SPYI which also actively invests in call options combined with holding S&P 500 stocks, charges even more. SPYI asks for 68 bps from its holders to invest in such a complicated way. While it is still a relatively new strategy and has time to justify that fee, it reminds investors again of the availability of low-fee strategies.

Consider, for example, the onset of “zero-fee” ETFs. The BNY Mellon US Large Cap Core Equity ETF (BKLC) charges zero bps to track its index of large-cap U.S. equities. It has returned nearly 30% over the last three years for that zero fee charge. Yes, it doesn’t have that current income component – but for a strategy that, again, charges “zero” bps, that’s a pretty solid overall win despite missing that income.

Options-Based ETFs Offer Better Income With a Smoother Ride

Gordon: Not only do options-based ETFs offer the potential for better yields and income opportunities in equities, but they also generate less volatility. The premium generated from writing covered calls can offer a measure of downside protection when markets slide. Premiums can help to make up for stock declines should the underlying security fall before the option expires. It’s a trade-off for the full upside capture these strategies sacrifice to varying degrees.

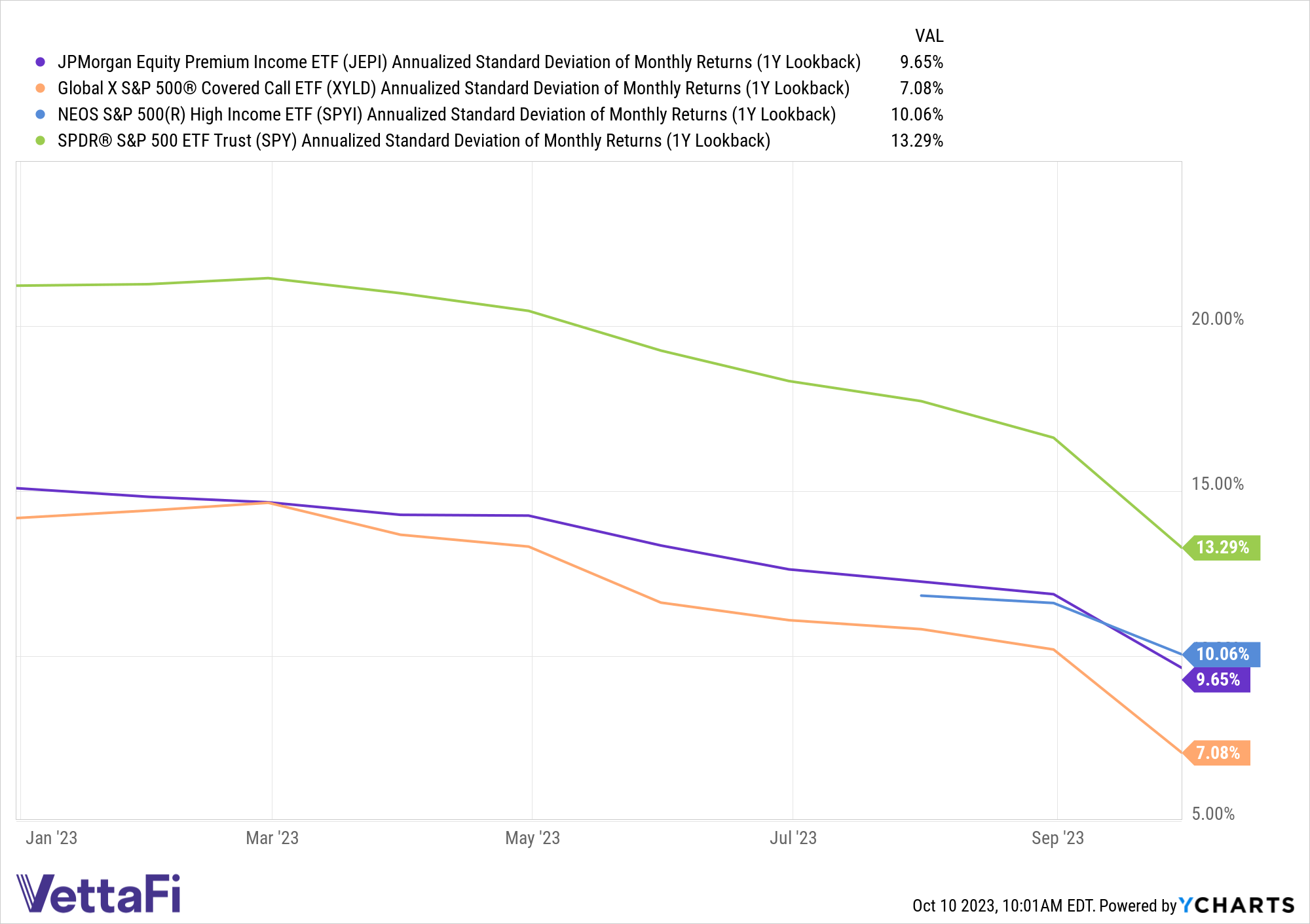

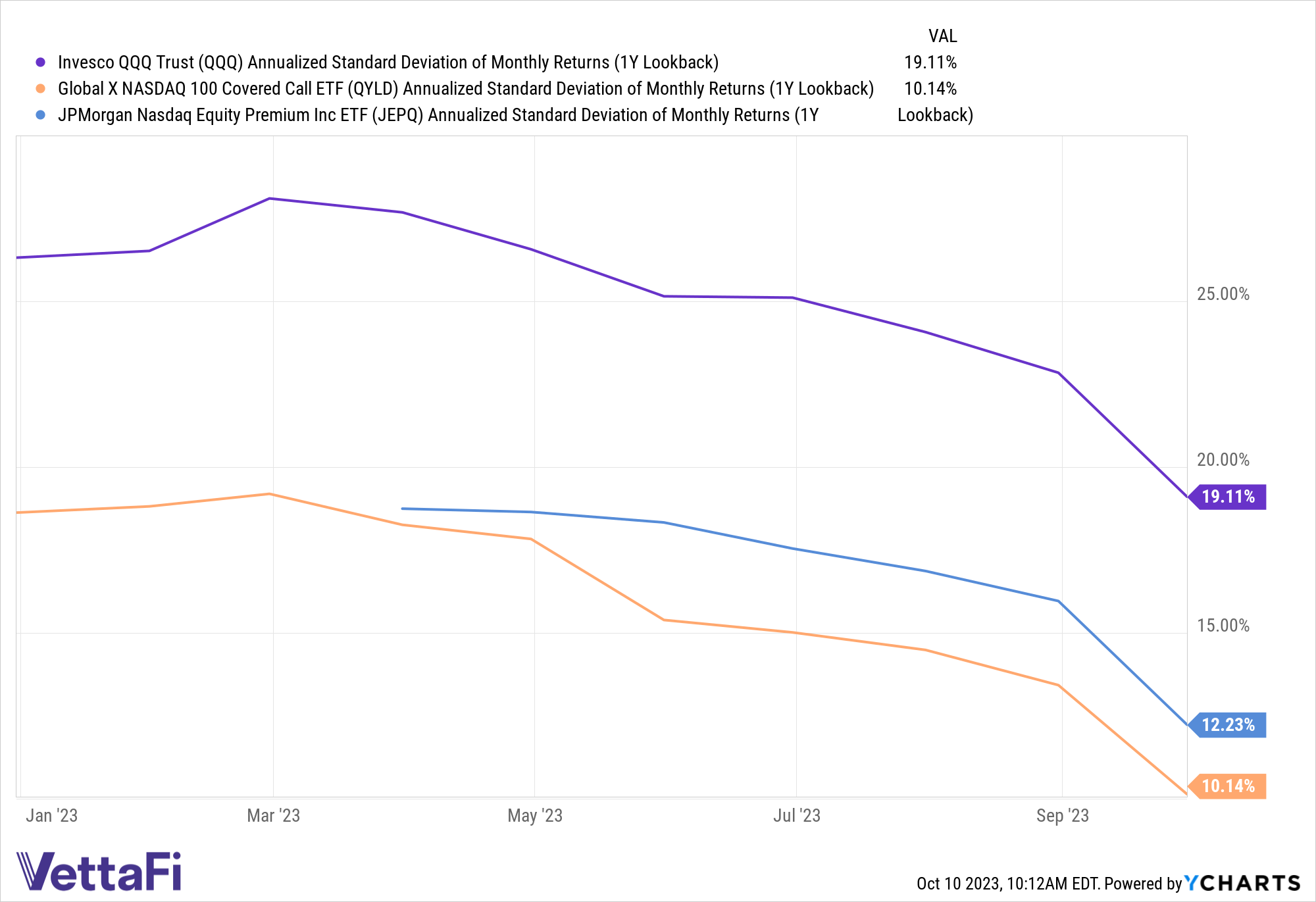

Standard deviation is arguably the most straightforward way to measure volatility and risk. It’s a measurement of the variation between returns over a given period compared to the averaged returns. Higher variability of returns over a period creates higher standard deviation. It’s a measurement that is most useful when comparing a fund to its peers.

In broad U.S. equities, the annualized standard deviation of monthly returns looking back one year for SPY was 13.29% as of the end of September. SPYI, which hit one year in August, currently has an annualized standard deviation of 10.06%. JEPI generated a standard deviation of 9.65%. XYLD offered the lowest standard deviation in the last year of just 7.08%.

It’s a trend that’s mirrored in covered-call ETFs within the Nasdaq-100 as well. QQQ generated an annualized standard deviation of monthly returns over the last year of 19.11%. Comparatively, JEPQ had a standard deviation of 12.23% over the same period. QYLD offered the lowest standard deviation at 10.14% YTD.

Not only do you have better yield opportunities with options-based ETFs, but you often obtain them with a smoother ride. Though options can carry higher risk potential, enhanced income with less volatility is clearly a worthy trade-off for less upside capture. These strategies may have higher fees but the income is worth it. You don’t have to take my word for it though — just ask the investors pouring billions into these strategies.

Not Enough Bank for the Buck

Peters-Golden: Finally, I want to bring up a concerning aspect of these ETFs’ actual investing strategies – they tend to cap upside potential. One would expect that such complicated strategies would, maybe, swing for the fences in terms of the positives they bring. But that’s not the case.

Yes, in some cases, that capped upside is a tradeoff investors can accept. There’s a case that, if a strategy can consistently provide stable, but modest returns, that could play a role in a portfolio. Again, however, for the cost that they charge, and the complexity they add to a portfolio, is it really worth it?

Let’s look at why the strategies see their upside capped. It comes from the use of options from which they ostensibly benefit so strongly. Say a covered call ETF tracks an index, but adds those calls on top of it. When the index drops, the ETF sees its equity portion drop. When it rises, the call option loses money past the strike price. That cap is the price paid for the premiums found in the options themselves.

There is a market environment in which that could pay off. Should the market drop overall in the coming year, say via rising rates or a recession owing to those hikes, one could see the value of such an approach. However, again, there are alternatives. These aren’t the only strategies on the block that can do well in such a down environment.

The market has relied heavily on the tech sector, for example. Should the market decline next year, one would imagine that area would take a big hit. That doesn’t mean every other equity area has to do poorly.

I think there are cheaper, simpler ETF options to rotate into that could do as well or thereabouts as these options-focused strategies. If one thinks such passive strategies are too simple or boring, however, active ETFs with wider remits to look at fundamentals don’t just have the ability to swerve in bad times. They can look for upside, like the active ETFs over at T. Rowe Price. I just think there are strong alternatives to these complicated strategies.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.