Bonds are back this year after a dismal performance in 2022. With attractive yields continuing to draw investors in, the NEOS Enhanced Income Aggregate Bond ETF (BNDI) is worth consideration, given its high, tax-efficient income potential and first-half outperformance over the broad bonds market.

BNDI is an actively managed ETF that seeks to offer enhanced monthly income distributions for investors. The fund invests across the broad U.S. Aggregate Bond Market while also implementing a tax-efficient options strategy that generates additional income.

The fund invests in the Vanguard Total Bond Market ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG). The income and capital gains that BNDI receives from its bond allocations are enhanced by the addition of monthly income from the fund’s put-option strategy on the S&P 500. The strategy includes selling short puts and buying long puts to protect against volatility.

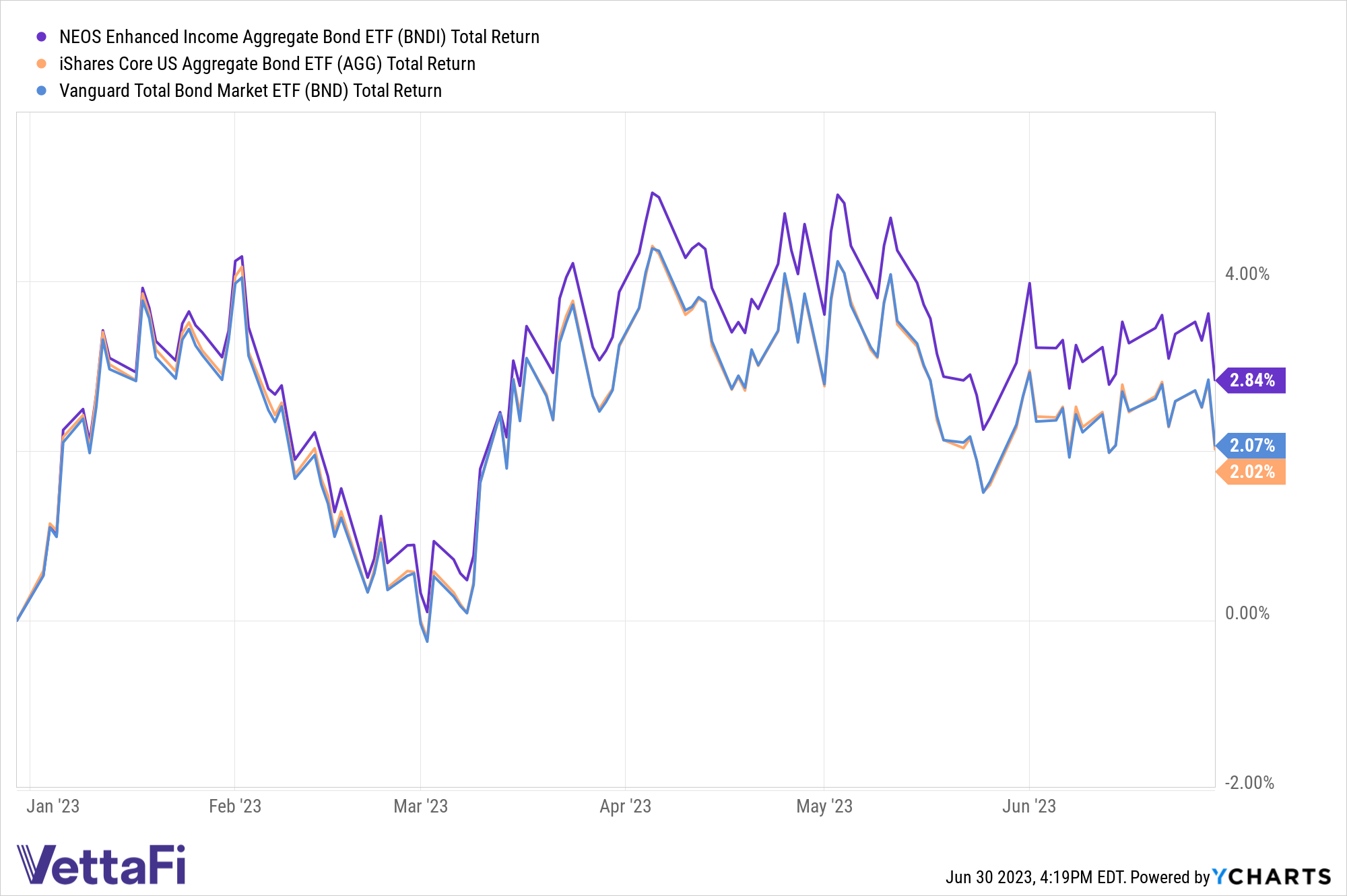

BNDI Generates Better Total Returns in Bonds in First Half

Advisors and investors looking to optimize income in bonds should consider BNDI. BNDI is up 2.84% YTD on a total return basis according to Y-Charts data. It outperformed the broad bond market as measured by the Vanguard Total Bond Market ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG). BND rose 2.07% in the first half of 2023 while AGG rose 2.02% on a total return basis over the same period.

As of the end of May, BNDI generated a distribution yield of 5.19%, and a 30-day SEC yield of 2.15% (excludes income from options).

The strategy may offer positive returns in both flat and rising equity markets. It may also generate positive returns in moderately-declining equity markets. This is possible if the premium from the puts bought and sold is greater than the cost to close out the positions. BNDI may also offer a lower correlation to certain risk factors such as duration, credit, and inflation risk.

BNDI’s put options aren’t ETF options but S&P 500 index options. These options are taxed favorably as Section 1256 Contracts under IRS rules. The IRS treats options held at the end of the year as if the investor had sold on the last market day of the year at fair market value. Most importantly, the IRS taxes any capital gains as 60% long-term and 40% short-term, no matter how long the fund held them.

This treatment can offer noteworthy tax advantages. In addition, the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

BNDI currently has an expense ratio of 0.58%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.