The Fed may have held rates at this month’s FOMC meeting but indicated the potential for one more hike before the year’s end. Advisors and investors looking to optimize their bond exposures in a higher-for-longer rate environment should consider the NEOS Enhanced Income Aggregate Bond ETF (BNDI).

The inflation fight remains a complex one, as reflected in the Fed’s most recent dot plot. The regulatory body now predicts higher rates for longer, with two fewer rate cuts less year than previously anticipated. These changes though are less to do with inflation and more about the resiliency of the economy.

“Broadly, stronger activity means we have to do more with rates, and that’s what that meeting is telling you,” Federal Reserve Chair Jerome Powell said in a press conference this week.

The Fed offered its first glimpse at projections for 2026 as well, with a fed funds rate of 2.9% forecast.

Higher interest rates for longer will likely weigh heavily on bonds, keeping yields sustained. (Bond prices and yields move inversely to each other).

BNDI offers enhanced income opportunities in bonds. The fund has consistently outperformed the iShares Core US Aggregate Bond ETF (AGG) all year. It’s performance that is consistent with how BNDI stacks up against the AGG since BNDI’s inception.

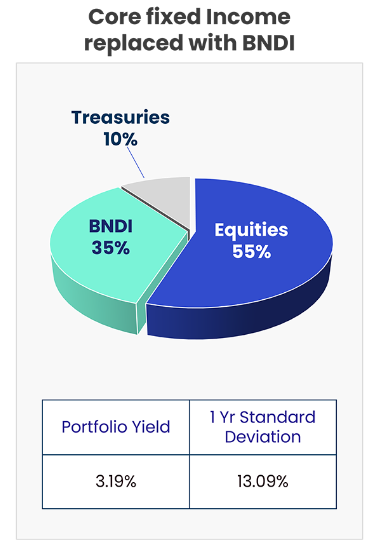

NEOS calculated the returns of a portfolio comprised of 55% equities represented by the SPDR S&P 500 ETF Trust (SPY), 35% fixed income represented by the AGG, and 10% treasuries represented by the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL). From 08/30/2022 to 08/31/2022, the portfolio yield was 2.49% and the 1-year standard deviation was 12.96%.

Image source: NEOS

In comparison, a portfolio where BNDI replaced the AGG allocation generated a portfolio yield of 3.19% and a 1-year standard deviation of 13.09% over the same period.

See Also: “Get Active Exposure as Corporate Confidence Returns in Bonds”

Enhance Your Bond Exposures With BNDI

The NEOS Enhanced Income Aggregate Bond ETF (BNDI) had a distribution yield of 5.25% as of 08/31/2023. The fund also generated a 30-day SEC yield of 2.40% (excludes income from options) over the same period.

The fund invests in BND and the AGG. However, the income and capital gains BNDI receives from its bond exposures are enhanced by adding monthly income from the fund’s put-option strategy on the S&P 500. The strategy includes selling short puts and buying long puts to protect against volatility.

The strategy may offer positive returns in both flat and rising equity markets. It may also generate positive returns in moderately declining equity markets. This is possible if the premium earned from the puts is greater than the cost to close out the positions. BNDI may also offer a lower correlation to certain risk factors such as duration, credit, and inflation risk.

BNDI’s put options aren’t ETF options but S&P 500 index options. These options are taxed favorably as Section 1256 Contracts under IRS rules. The IRS treats options held at the end of the year as if the investor had sold on the last market day of the year at fair market value. Most importantly, the IRS taxes any capital gains as 60% long-term and 40% short-term, no matter how long the fund held them.

This treatment can offer noteworthy tax advantages. In addition, the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

BNDI currently has an expense ratio of 0.58%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.