Headline inflation in the U.S. declined in March, while underlying core inflation, a metric watched closely by the Fed, rose marginally, indicating that the Fed still has a complex path ahead in order to bring inflation back to its 2% target. As the U.S. faces down recession, income preservation becomes even more of a priority during economic slowing and downturn, and advisors looking for tax-efficient income across equities, bonds, and cash alternatives can consider the ETF suite from NEOS.

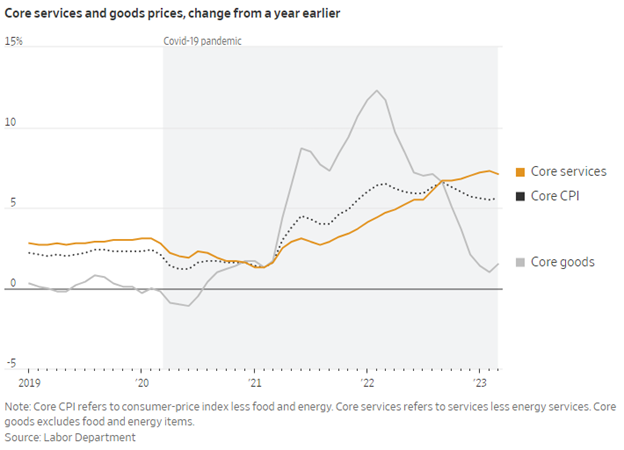

Headline inflation fell to 5% year-over-year in March, its lowest in two years, and crossed below core inflation, which rose incrementally from 5.5% in February to 5.6% in March, reported by the U.S. Bureau of Labor Statistics. It’s the first time that overall inflation and core inflation have crossed since December 2020.

Image Source: Wall Street Journal

Core inflation, which excludes volatile energy and food prices, is often seen as a better forward-looking indicator for future inflation and remains high due largely to the price of shelter, and is one of the major metrics the Fed looks at when making monetary policy decisions. The FOMC is set to meet again in May, when they will review inflation data alongside the jobs market and the health of the banking sector to determine if further interest rate increases are necessary.

Tax-Efficient, High Income Opportunities With NEOS

The addition of banking sector stress and tighter lending in the aftermath of the collapse of two regional banks in March has slowed the Fed’s rate hiking regime and could bring it to an end soon, though Fed officials have indicated that rates will remain at elevated levels through the remainder of the year. Tighter lending conditions alongside persistent core inflation and elevated interest rates could propel the U.S. into a moderate recession in the second half of the year.

In such a challenging environment, income preservation becomes a top priority for advisors and investors. The tax-efficient ETFs from NEOS offer exposure to familiar allocations through equities, bonds, and cash alternatives (via ultra-short Treasuries) while also utilizing options to seek to generate tax-efficient high monthly income. The funds could be a good supplement to an income sleeve and complement existing core allocations without having to take on additional risk.

Income for the funds is added through options utilizing two different approaches: the NEOS S&P 500 High Income ETF (SPYI) writes call spreads on equities, while the NEOS Enhanced Income Aggregate Bond ETF (BNDI) and the NEOS Enhanced Income Cash Alternative ETF (CSHI) utilize put spreads.

All three funds use S&P 500 index options classified as Section 1256 contracts that have favorable tax rates: 60% of capital gains from the premiums are taxed as long-term, and 40% are taxed as short-term, regardless of how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers may also engage in tax-loss harvesting opportunities throughout the year on the options.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.