Small cap stocks started rallying late last year and are still doing so today. That doesn’t mean advisors and their clients should rush into the riskiest smaller equities.

Advisors looking for an array of quality-based approaches to small cap stocks can consider the WisdomTree Core Equity Model Portfolio.

“This model portfolio is designed for growth-oriented investors with a long-term horizon looking to maximize long-term potential for capital growth through a globally diversified set of equity ETFs,” according to WisdomTree.

The model portfolio features exposure to three small cap exchange traded funds spanning U.S. equities, as well as developed and emerging markets fare.

WisdomTree’s Broad Approach to Smaller Names

“Although forecasts are inherently limited, after a tumultuous 2020, this sanguine consensus is certainly encouraging. One sector on many investors’ minds is U.S. small caps. However, we think there’s a prevalent risk that is dangerously overlooked: historically high valuations and deteriorating fundamentals,” notes Brian Manby, WisdomTree senior research analyst.

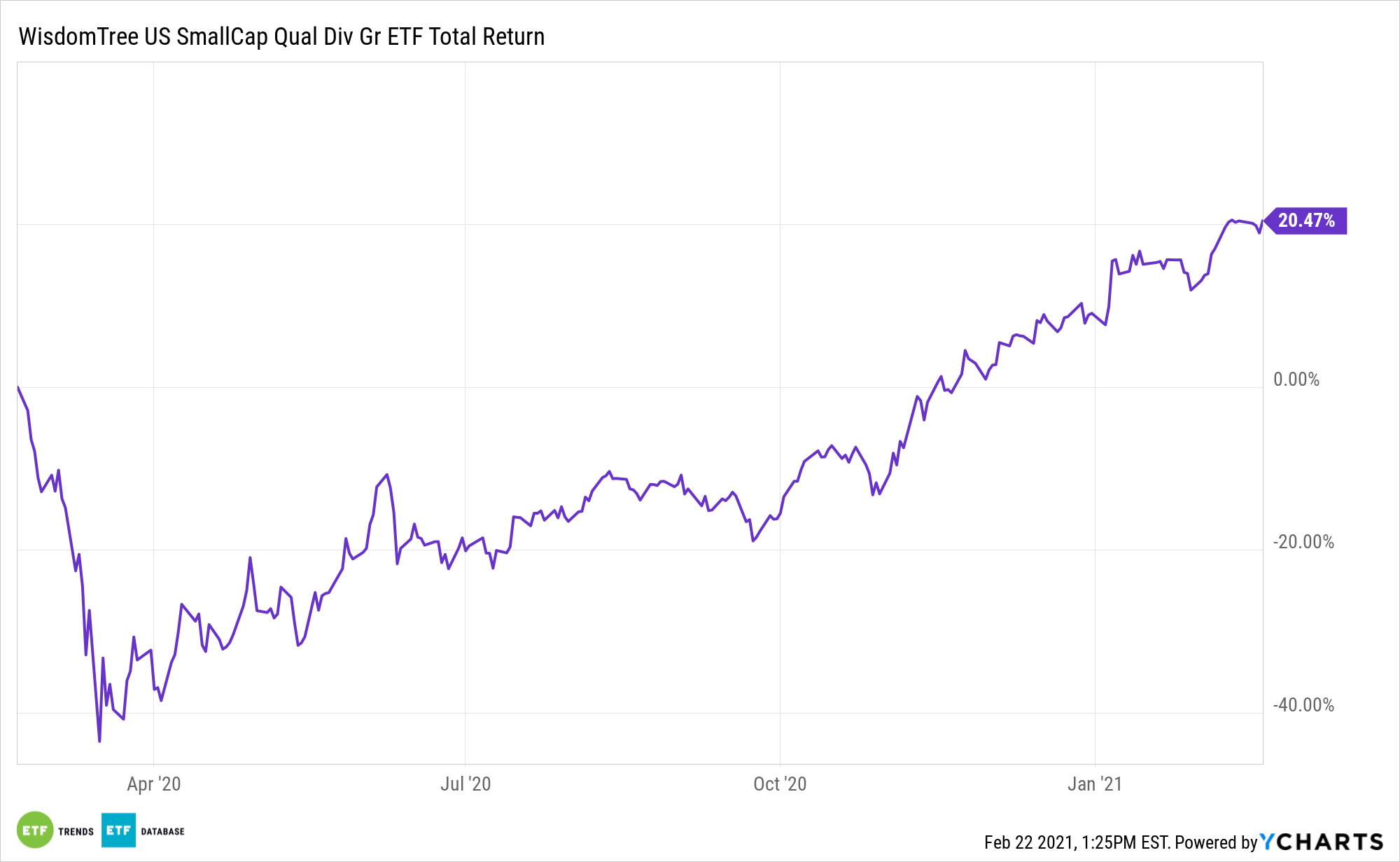

One of the ways this model portfolio ameliorates concerns surrounding lower quality small caps is with exposure to the WisdomTree U.S. SmallCap Dividend Growth Fund (NasdaqGM: DGRS).

DGRS tracks the WisdomTree U.S. SmallCap Dividend Growth Index, which is weighted by fundamental factors such as growth expectations, return on equity and return on assets, according to WisdomTree. The model portfolio’s weight to DGRS is compelling for multiple reasons.

“The Russell 2000 Index is currently trading at a P/E ratio of 496x earnings, a multiple so high it’s practically meaningless. Its forward P/E multiple is more mundane by its own standard (clocking in at 53x estimated earnings), but still nearly twice its historical average,” writes Manby. “Moreover, the health of the small-cap market, as measured by Russell 2000, has continued to deteriorate, all while investors have become comfortable throwing money at it with little regard for price.”

High quality value is particularly important as bull markets enter their waning stages, as some market observers believe the current bull market is doing. In the early stages of bull markets, lower quality companies see their shares soar.

“Small caps are in a precarious position. Market cap-weighted approaches are forcing investors to pay more than ever for lower quality and inefficient companies,” concludes Manby. “We believe in the benefits of a long-term allocation to small caps, but what you own is more important than just owning an allocation.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.