Inflation is proving far more persistent than many market observers originally speculated. In fact, some might say that inflation expectations are now becoming embedded or entrenched.

A predictable response to extended upside for the Consumer Price Index (CPI), which isn’t the type of upside investors want, is to allocate to inflation-fighting assets. Some of those, including commodities, are doing their jobs this year.

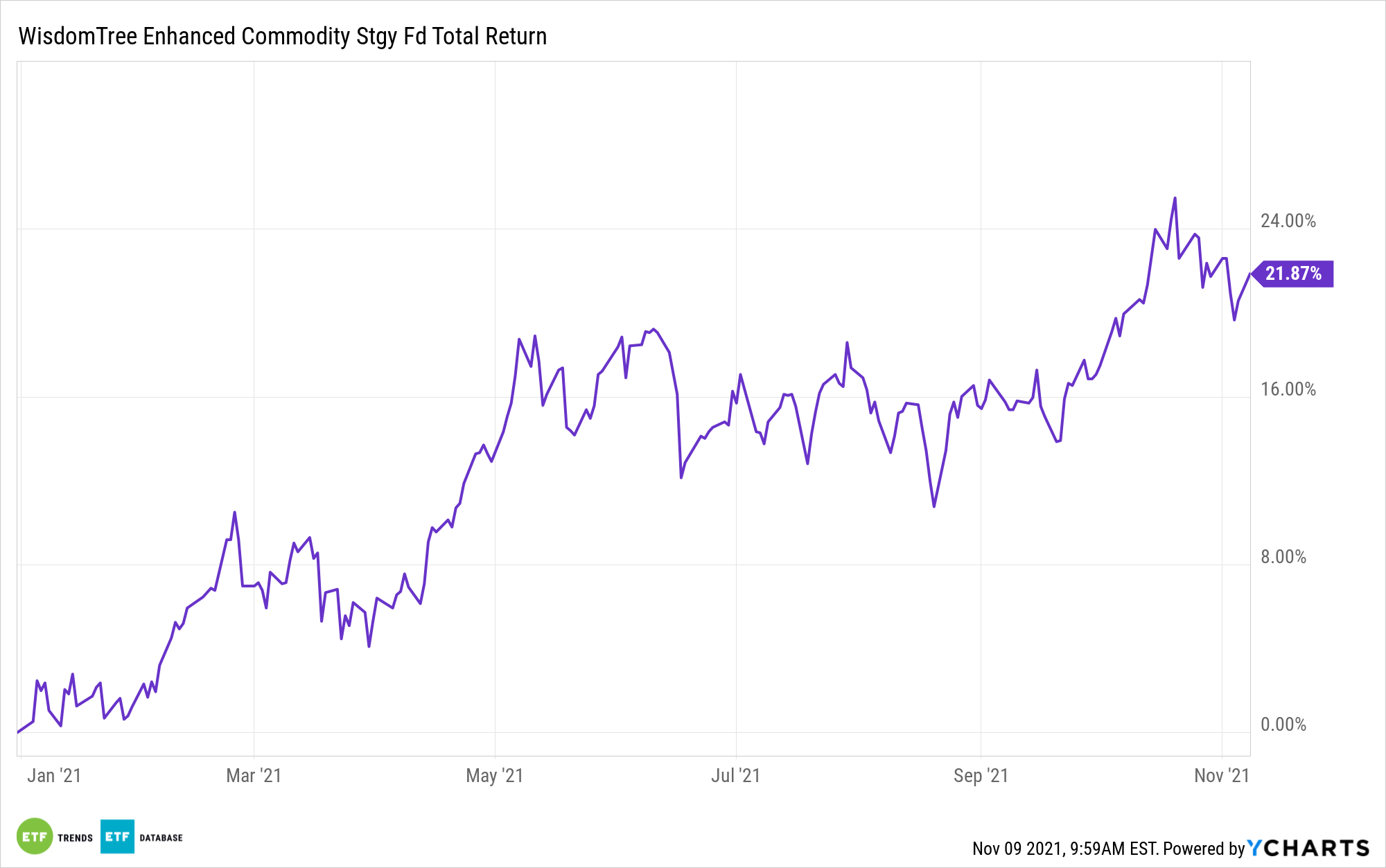

For example, the WisdomTree Enhanced Commodity Strategy Fund (GCC) is higher by 10% year-to-date.

GCC “is an actively managed exchange-traded fund and intends to provide broad-based exposure to the following four commodity sectors: Energy, Agriculture, Industrial Metals, and Precious Metals primarily through investments in futures contracts,” according to WisdomTree.

In the current environment, GCC’s energy and agriculture exposures are highly relevant because prices of those commodities are surging. While the inflation reading that most experts observe excludes food and energy, the fact is that consumers don’t have the luxury of ignoring those things, and they’re absorbing higher costs on both fronts.

Additionally, GCC could be relevant if stagflation — the combination of slowing economic growth and persistent inflation — comes to pass. Some market observers are betting it won’t, but for investors, it pays to be prepared, and GCC is a solid outlet for gaining that preparation.

“Though it is not our base case, stagflation is a prospect making the rounds and should at least be entertained. With the headline Consumer Price Index (CPI) showing annualized growth of more than 5% for several months running, it is unnerving that the Atlanta Fed GDPNow gauge has slipped to +0.5%. That moribund figure is corroborated by the recently released advance estimate of Q3 GDP, which showed the economy growing at an annualized pace of 2.0%,” said Jeff Weniger, WisdomTree head of equity strategy, in a recent note.

Weniger highlights a scenario that investors might want to consider heading into 2022, saying, “Here is a non-zero probability for, say, 2022’s first half: perhaps a situation where headline unemployment is working its way down to the mid-4% range and prices of goods and services are still running higher, while economic growth struggles to hold the zero-line.”

Another GCC benefit — one that some investors might not yet be aware of — is the fact that the fund has the flexibility to allocate up to 5% of its roster to bitcoin futures. The largest digital currency is flirting with record highs and is establishing credibility as an inflation-fighting asset.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.