On Behind the Markets, a podcast brought to you by Jeremy Schwartz, WisdomTree Global Head of Research, we talk to market strategists, business executives and financial advisors about important trends underpinning the financial markets.

In this episode, Jeremy talks to Sailesh Radha, co-founder and chief investment strategist of Borealis Global Advisory, and Drew Edwards, head of GMO’s Usonian Japan Equity team.

In the first half of the podcast, we spoke with Sailesh Radha. We covered the following range of topics:

- Radha’s use of a “Smart CAPE” (cyclically adjusted price-to-earnings ratio) and real exchange rate model to rank and rotate equity investments among the most attractive countries.

- How his real adjusted exchange rate model can support valuations, with countries becoming more competitive via exports and stronger earnings growth.

- Why Radha’s model currently favors Japan, Singapore, Korea and a number of European and Scandinavian countries while avoiding the United Kingdom, Taiwan and New Zealand.

- Why Radha likes Japan for both elements in his model. He sees a strong decade ahead of increased productivity, higher earnings growth and valuations being really low relative to history.

In the second half of the show, we explore Japan in more detail with Edwards.

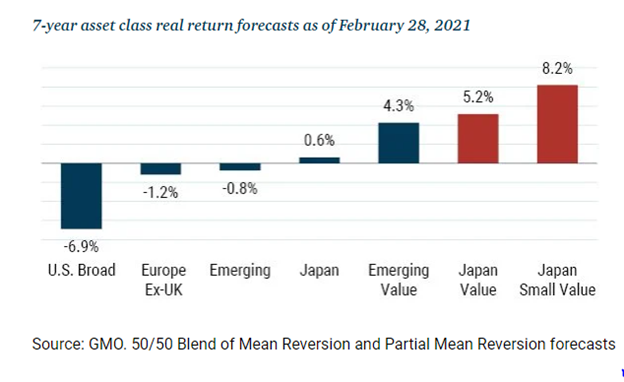

- GMO and Edwards’s team model global opportunities using a top-down and bottom-up process. GMO notably believes the U.S. market faces a tough seven-year stretch ahead, but Japanese assets, and in particular Japan value and small-cap value, represent an “island of potential in a sea of expensive assets.”[1]

- Edwards arrived in Japan as a college student and experienced the hangover from the bubble and party that occurred in 1980s. But now he sees the benefits of many years of hard work to restructure the economy. He recognizes many positive potential catalysts, from corporate governance reforms and improving returns on capital to broader cultural shifts.

- Historically, return on capital in the U.S. averaged 6% and Japan only averaged 3%. But these rates have converged, and the GMO team thinks we are now in a new regime of higher returns on capital in Japan.

- Edwards says the lowest-hanging fruit for Japanese companies is to deploy their excess cash, and there are a few places they are doing this: increasing buybacks, dividends and consolidation of industries. With high excess capital remaining, there are opportunities for better returns.

- Edwards’s team likes many of the Japanese small-cap industrial companies for leadership in niche parts of the value chain, but also because they are cyclically tied to an acceleration of global growth as the economy continues to reopen.

- We also talked about macro issues ranging from demographics and inflation to whether the Bank of Japan will ever end their policy of purchasing ETFs.

Please listen to the full conversation below.

Originally published by WisdomTree, 5/4/21

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.