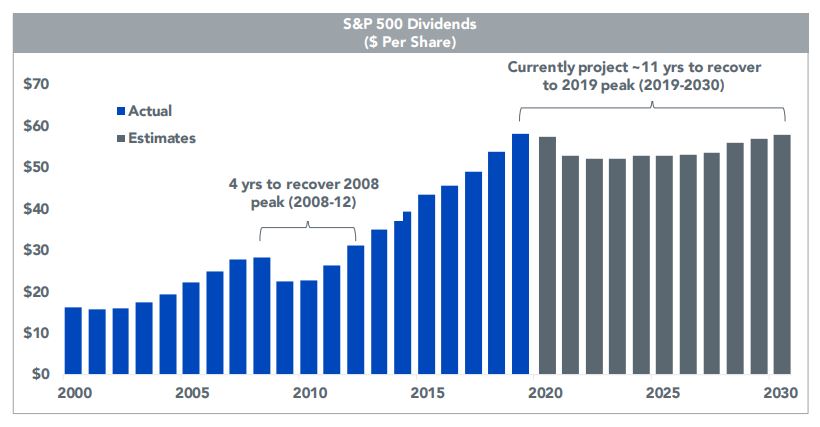

In addition to being an election year, where uncertainty was bound to play a role in the market, 2020 has faced challenges stemming from the Covid-19 pandemic leading to an economic shutdown for a short while before starting back up again. As a result, the S&P 500 dividends faced its own challenge in working back toward continued growth.

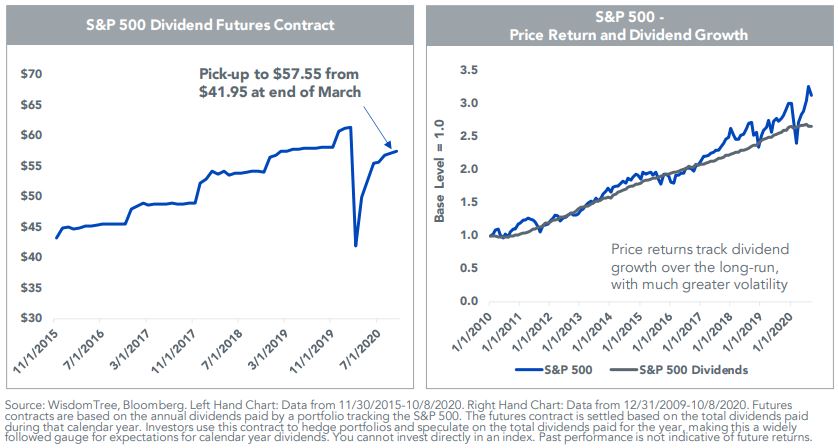

Looking at a presentation put together by WisdomTree investments, which has been monitoring dividends and compiling information from this year and comparing it to the last ten years, one can see some interesting results reflecting the current state of the market. As indicated in the chart below, a modest drop has been priced in for 2020.

As seen on the left, futures anticipate a 1% decline in S&P 500 Dividends Per Share for 2020 (relative to <25% drop during the Financial Crisis). On the right, since 2010, S&P 500 Dividends have more than doubled, matching the Index’s price gains. Looking ahead to next year and beyond, as seen in the next chart below, futures expect dividends to trough some point in 2021.

WisdomTree Dividend Indexes

It is important specifically for WisdomTree to be monitoring dividends, as the company has eight U.S. dividend indexes across market-caps and styles (Broad Dividends, Quality Dividends, and High Dividends). WisdomTree offers funds that seek to track the price and yield performance, before fees and expenses, of each of these indexes.

In looking at the WisdomTree Dividend Index characteristics, dividend yields indicate significant dividend cut expectations, particularly for Mid- and Small-Cap indexes and High-Yield indexes. Additionally, the severe declines in 2020 earnings results will diminish the usefulness of 12-month trailing valuations.

Looking at dividend yields by sector, energy yields indicate significant cuts due to low oil prices. Meanwhile, real estate – REITs are required to payout at least 90% of income to shareholders annually, but only 20% is required to be paid in cash. Cash-strapped REITs will likely pay significantly more dividends in stock.

Regarding dividend payout ratios and sector weights, payout ratios greater than 100% indicates the risk of cuts in specific sectors. The biggest sectors in WTLDI (Tech, Health Care, and Financials) have payout ratios ≤ 55%. Keep in mind, payout ratios for small-caps significantly higher than large-caps.

Also important to note – looking at the indexes, suspensions, and cuts have been concentrated in mid/small-caps thus far.

For more information, visit https://www.wisdomtree.com/.

For more market trends, visit ETF Trends.