By Hyun Kang

Research Analyst

U.S. equities don’t have a monopoly on acronyms. Before there was the Magnificent 7, it was the FAANGS. Europe has been consistently ignored by U.S. investors over the lack of its own basket of tech-enabled, high-growth stocks.

Goldman Sachs recently highlighted a basket of 11 European companies it calls “internationally exposed quality growth compounders” with surprisingly similar returns to the Magnificent 7 over the last three years.

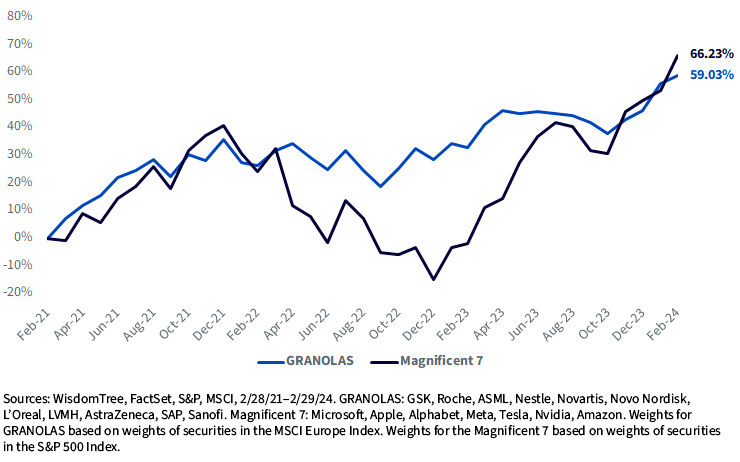

Despite Europe’s reputation for lagging the U.S. because it lacks the big tech stars of the U.S., the GRANOLAS (GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, SAP, Sanofi) rivaled the Magnificent 7 (Microsoft, Apple, Alphabet, Meta, Tesla, Nvidia, Amazon) over the last three years.

Trailing 3-Year Returns: A Dead Heat

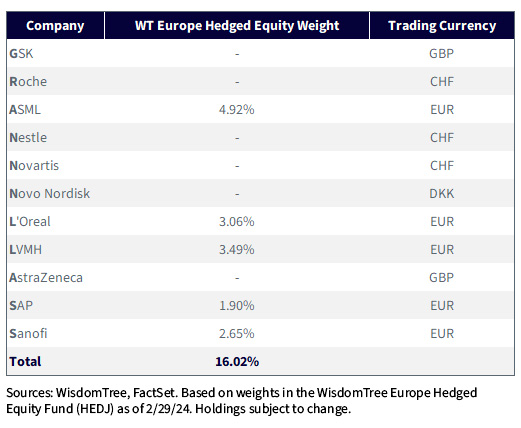

Of the 11 GRANOLAS, five are traded in euros, which makes them eligible to be held in the WisdomTree Europe Hedged Equity Fund (HEDJ). In total, these names make up 16% of the weight of the Fund.

HEDJ Fund Weight

It can be a fun exercise to cluster together securities into a catchy acronym. There is, however, some arbitrariness and hindsight bias involved. After all, if these securities hadn’t outperformed, the research wouldn’t be grabbing headlines, right?

But this basket isn’t the only collection of European equities with a return profile that would perhaps surprise some U.S.-centric asset allocators.

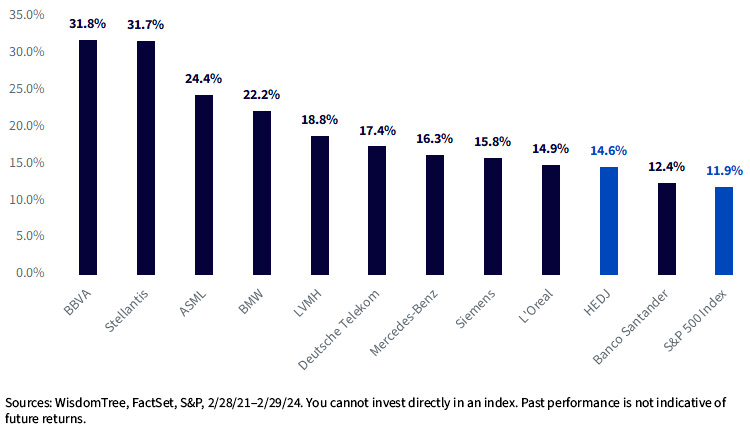

Take the current top 10 holdings of HEDJ. These securities comprise just over half of the Fund (55%).

Now guess what percentage of these securities have outperformed the S&P 500 over the last three years?

If you’re answer was 100%, you’d be right!

Outside of Banco Santander, which outperformed by 50 basis points, the returns weren’t even particularly close. The simple average return of this basket was 20.6%, well ahead of the 11.9% returns for the S&P 500 Index.

Every Fund is going to have its outliers—as a whole, HEDJ returned 14.6%. This return advantage of over 250 basis points would also surprise many.

Annualized Trailing 3-Year Returns: HEDJ Top 10 Holdings, as of 2/29/24

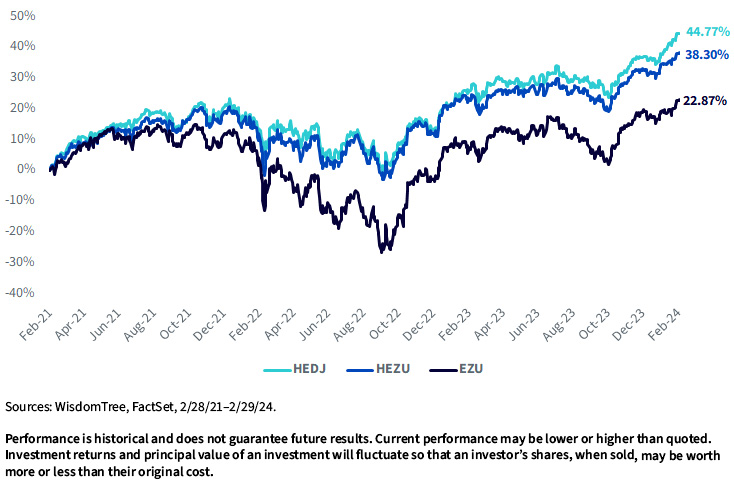

The iShares MSCI Eurozone ETF (EZU) returned 22.87% to investors over the last three years, representing U.S. dollar returns. The iShares Currency Hedged MSCI Eurozone ETF (HEZU), which tracks the MSCI EMU Index in local currency terms, fared better, returning 38.30%.

The difference between the two returns is caused by the weakening of the euro relative to the U.S. dollar; as the euro weakens, USD returns naturally decline and vice versa.

The WisdomTree Europe Hedged Equity Fund is also currency hedged and tracks the WisdomTree Europe Hedged Equity Index. HEDJ returned 44.77% over the same period.

Performance, HEDJ vs. HEZU vs. EZU

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: HEDJ, HEZU, EZU

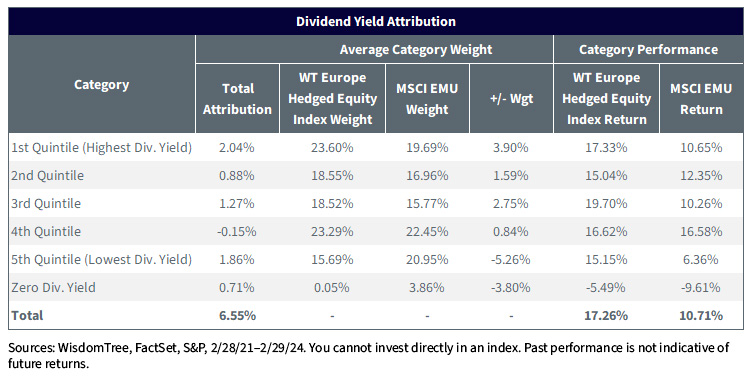

The performance difference between the two hedged ETFs can be attributed to the stock selection process driving HEDJ. The table below shows HEDJ’s Index’s allocations to the various dividend yield quintiles over the last year since January 2024—the Index is over-weight in the highest dividend payers in the eurozone compared to the MSCI EMU Index.

One-Year Returns: Dividend Yield Attribution

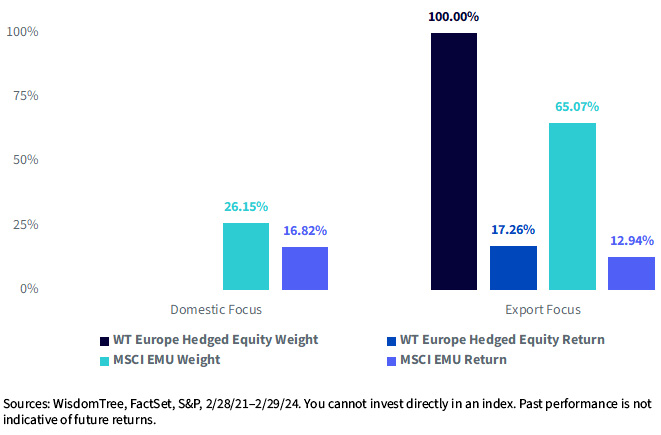

In addition to dividend payer weighting differentials, the impact of the WisdomTree Europe Hedged Equity Index’s exporter tilt cannot be understated in driving outperformance compared to the hedged benchmark index.

One-Year Index Returns: Export-Focused vs. Domestic

Outperformance with Lower Valuations

Whenever there is outperformance, investors wonder if they are late to the trade.

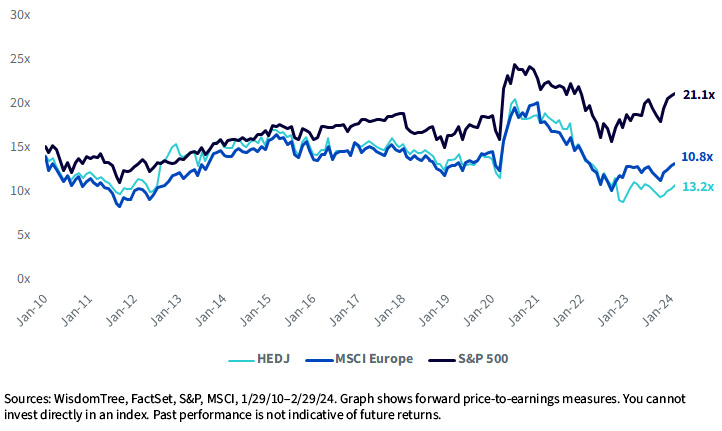

In terms of valuations, HEDJ has been trading at a discount to its broad Europe benchmark for over a year.

Compared to U.S. equities that are traded well above long-term average valuations, European equities are still cheap relative to history.

HEDJ vs. MSCI Europe vs. S&P 500 Historical Valuations

What about the Euro?

A number of investors believe the case to go international relies on currencies like the euro appreciating. We at WisdomTree believe investors have too much exposure to a weak dollar inherent in the S&P 500. When the dollar is strong, U.S. companies face earnings headwinds. Investors can add better diversification to their portfolios by adding hedged strategies in lieu of unhedged.

We also believe Warren Buffett’s take on currencies is the right one for most investors to adopt. Referring to his purchase of Japanese companies, Buffett wrote in his latest shareholder letter: “Neither Greg nor I believe we can forecast the market prices of major currencies. We also don’t believe we can hire anyone with that ability.”

If one of greatest investors of all time suggests it is tough to predict currencies and goes on to describe how he implemented an effective FX hedge, investors should stay humble in their views on adding in FX bets to their stock selection.

We’ve seen some analysts make the call that fair value of the euro to be at or below parity to the dollar (currently at $1.08). This type of currency move would be beneficial to exporters in HEDJ, but investors would want to hedge the euro. Going a step further, we think investors should hedge the euro over the long run as a strategic baseline rather than just as a tactical trade for a weak euro view. Hedging currency typically leads to a smoother ride in returns, as it mitigates a key source of added volatility of international investments.

Originally published by WisdomTree on March 18, 2024.

For more news, information, and analysis, visit the Modern Alpha Channel.

Important Risks Related to this Article

For current Fund holdings, please click here. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.