It seems that Democratic nominee Joe Biden will be the next president, the Democrats will lose seats in the House, and the fate of the Senate won’t be determined until January.

In other words, it’s likely we’re heading toward a divided government, a scenario markets appear to like for now, but may grow uncomfortable with as time goes on. In fact, some prior instances of divided governments lead to lethargic returns for equities.

Investors can prepare for that with model portfolios, such as the Volatility Management Model Portfolio, which is part of WisdomTree’s broader universe of Modern Alpha model portfolios.

The Volatility Management Model Portfolio is “designed for investors who seek to incorporate alternative investments into a traditional portfolio using ETFs. Volatility Management is a reference to including non-traditional assets in addition to stocks and bonds in order to reduce overall portfolio volatility as measured by annual standard deviation. This model portfolio was previously known as the Alternatives Model Portfolio,” according to WisdomTree.

Volatility Management for Volatile Times

The size of the next fiscal stimulus package in particular hinges on the final makeup of Congress,” notes Director and Senior Investment Strategist Paul Eitelman. “Given that Congress controls the power of the purse—the ability to alter tax or spending policies—the outcome of these races is highly significant for the macro-market outlook, perhaps even more so than the outcome of the presidential race,” Eitelman remarked

Underscoring the relevance of this model portfolio now were pre-election expectations of a blue wave, which would have led to increased Democratic control in nation’s capitol, likely unleashing massive spending and stimulus. Now, that scenario is likely off the table.

That could lead to some increased turbulence for investors, but the WisdomTree model portfolio offers ways for dealing with that situation.

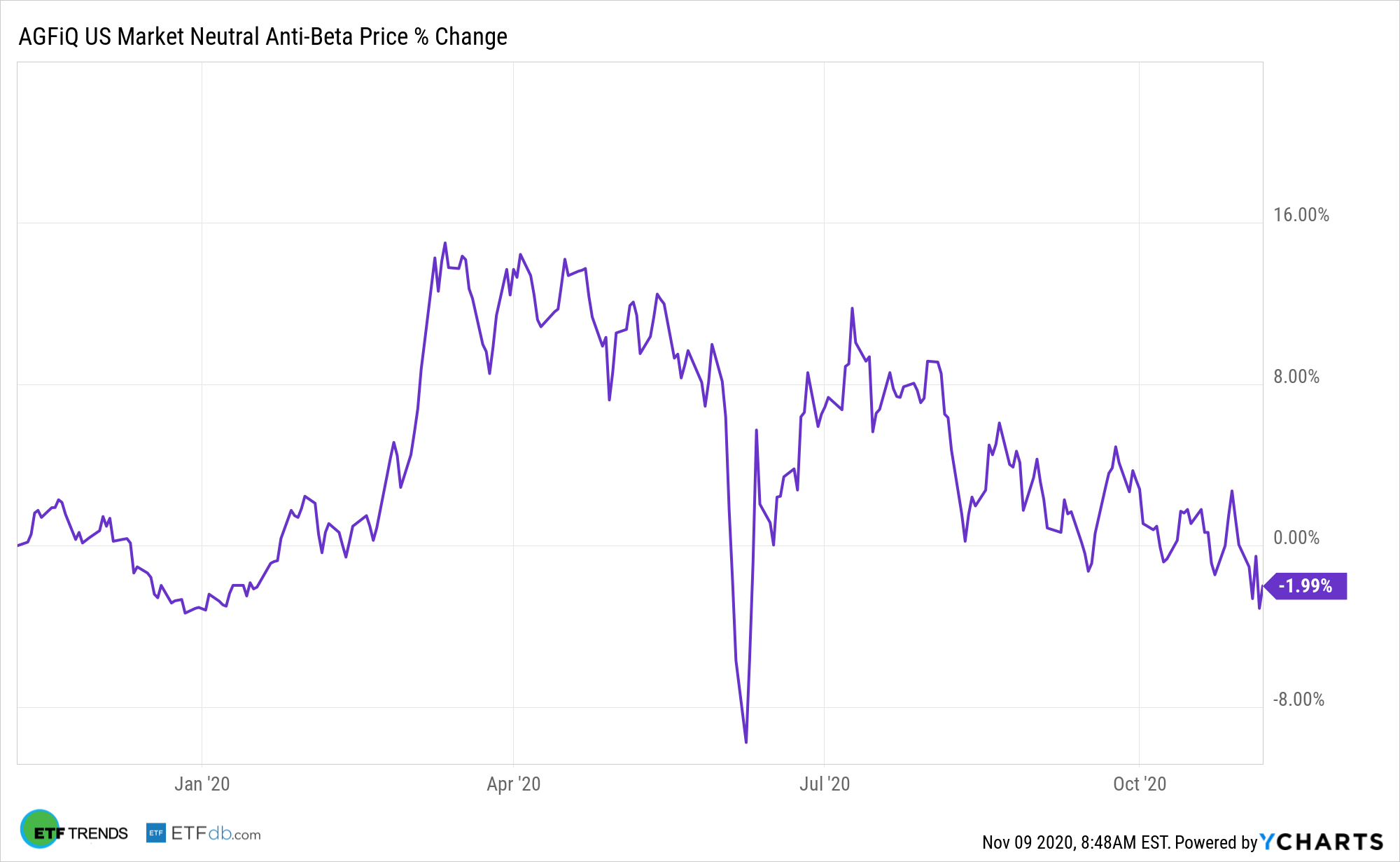

One of the components in WisdomTree’s Volatility Management Model Portfolio is the AGFiQ U.S. Market Neutral Anti-Beta Fund (BTAL).

BTAL tracks an equal-weighted index that takes long positions in low beta US stocks offset by short positions in high beta US stocks. It provides consistent exposure to the anti-beta factor by investing in the underlying index which reconstitutes and rebalances monthly in equal dollar amounts in equally weighted long low beta positions and equally weighted short high beta positions within each sector.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.