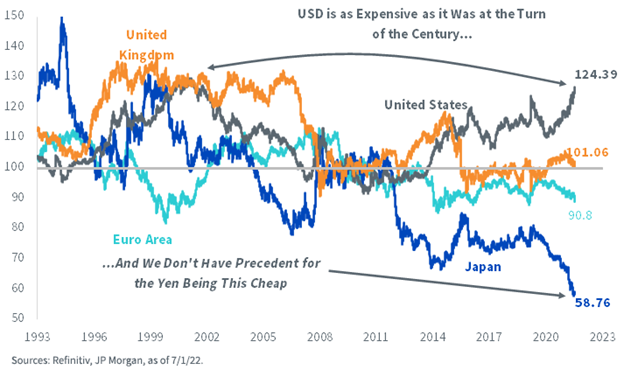

The U.S. dollar continuing to strengthen can be extremely problematic for other countries’ economies, impacting the U.S. trade deficit and adding persistent inflationary pressures abroad. It was such a problem in the 1980s that the Plaza Accord was struck in 1985 between the U.S., France, Germany, the U.K., and Japan to intentionally depreciate the U.S. dollar and improve the U.S. trade deficit.

Exchange rates now sit at levels close to pre-Plaza Accord for the British pound, while the Japanese yen is at levels that haven’t been experienced often in the last 25 years, and the euro has broken parity with the U.S. dollar in the last month, explained Jeff Weniger, CFA and head of equity strategy at WisdomTree, in a recent blog post.

“Coming out of the global financial crisis, these four majors—the dollar, sterling, euro and yen—each had CPI-based real effective exchange rates that were largely in balance. As the dollar strengthened over the years, that has changed, with EUR and JPY showing up on the cheap side on this metric,” Weniger wrote.

Image source: WisdomTree blog

The British pound is currently at a weakness level last seen after the Brexit vote in 2016, and if it continues its current trajectory, it could hit pre-Plaza Accord levels. The yen, while not anywhere near the weakness it saw in the 1970s, when it ran anywhere between ¥200–300 to the U.S. dollar, is still pushing levels last experienced in 2002’s devaluation, and it could conceivably reach the levels of the 1998 aftermath of Long Term Capital Management’s collapse.

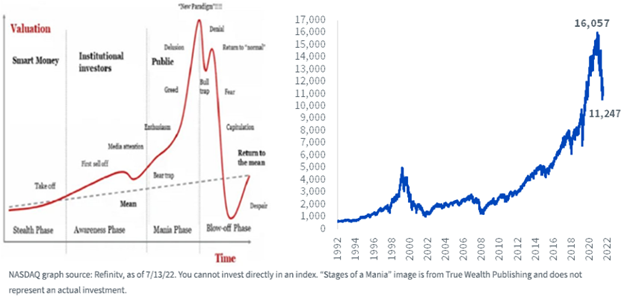

In the U.S., the plummeting valuations of the largest growth stocks, seen most easily through the performance of the Nasdaq Composite in 2022, follow a curve with a great deal of similarity to “Stages of a Mania,” as Weniger demonstrated through a side-by-side comparison.

Image source: WisdomTree blog

“If the coming years present a scenario in which U.S. stocks must unwind a bull market that got too far out of hand, maybe owning beleaguered overseas markets is the way to navigate it,” Weniger theorized.

WisdomTree has a bevy of funds for investing internationally, including currency-hedged options such as the WisdomTree Japan Hedged Equity Fund (DXJ) and the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG); rules-based hedging strategies through the WisdomTree Dynamic Currency-Hedged International Equity Fund (DDWM) and the WisdomTree International Multi-Factor Fund (DWMF); and non-hedged options such as the WisdomTree Japan Small Cap Dividend Fund (DFJ) and the WisdomTree Europe Quality Dividend Growth Fund (EUDG).

For more news, information, and strategy, visit the Modern Alpha Channel.