Investors seemed disappointed with Zoom on Monday despite the fact that the pandemic-era video-calling software company reported that it beat earnings expectations. While Zoom reported better-than-projected earnings, it faced difficulties with meeting year-over-year comparisons as the workers return to offices and a more pre-COVID way of life unfolds.

Zoom stock plunged almost 16% on Tuesday morning as investors assessed the possibility for future growth and the current pace of slowing customers.

“Bigger picture, a lot of people already bought the core video conferencing solution, so now the question is what else can Zoom sell to its customers?” said Pat Walravens, an analyst at JPM Securities.

“What we’re seeing … is headwinds in our mass markets, so these are individual consumers and small businesses. And, as you say, they are now moving around the world. People are taking vacations again, they’re going to happy hours in person,” Zoom CFO Kelly Steckelberg told CNBC’s “Squawk Box” on Tuesday morning.

“As we came through the back half of Q2, we started to see some additional churn there and that’s what’s evidenced in our guidance for the rest of the year and that’s what I think you’re seeing in the reaction to the stock,” she added.

Zoom has been one of the headlining coronavirus growth stocks, representing the pandemic era. The company’s video communication software has functioned as a pivotal resource for a wide variety of industries and applications, from students learning remotely to businesses attempting to connect with customers and staff amid a global pandemic.

Socially, it has become widespread as well, serving as the go-to for people around the world who want to connect with family and friends. The platform even earned the distinction as Yahoo Finance’s Company of the Year in 2020.

“Today we are a global brand counting over half a million customers with more than 10 employees, which we believe positions us extremely well to support organizations and individuals as they look to reimagine work, communications, and collaboration,” Zoom CEO Eric Yuan said in a press release.

Zoom’s guidance for the current quarter suggested that the company would see robust growth from its direct and channel businesses, with fragility due to online business as a result of headwinds among smaller customers and consumers.

Still, although the stock suffered a decline Tuesday, and the company’s share price is trading at roughly 77 times the company’s forward earnings, a number of analysts remained sanguine that the company will offer continued growth and development.

“Listen, we still believe Zoom is a very good franchise with a tremendous amount of growth in its future, but we expect the market will need to rationalize a different level of growth post-pandemic into their valuation expectations,” JPMorgan’s Sterling Auty said.

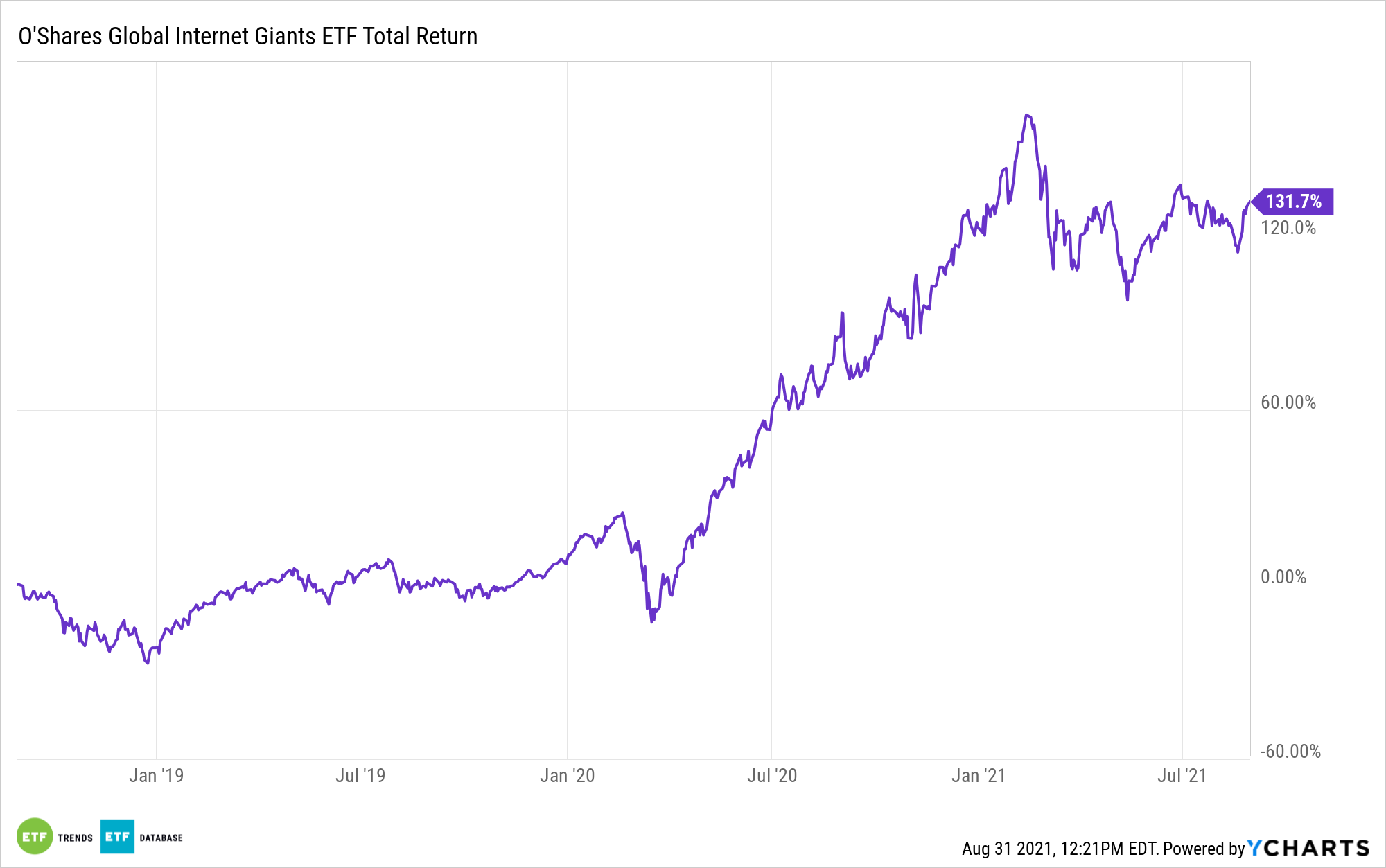

For investors looking at ETFs that have exposure to Zoom, they can start with a technology and e-commerce-focused fund like the Kevin O’Leary-sponsored Global Internet Giants ETF (OGIG) — OGIG debuted in the markets in June 2018 and has been offering investors access to a wide variety of both domestic and international stocks.

While Zoom tumbled on Tuesday, the Global Internet Giants is showing a modest profit.

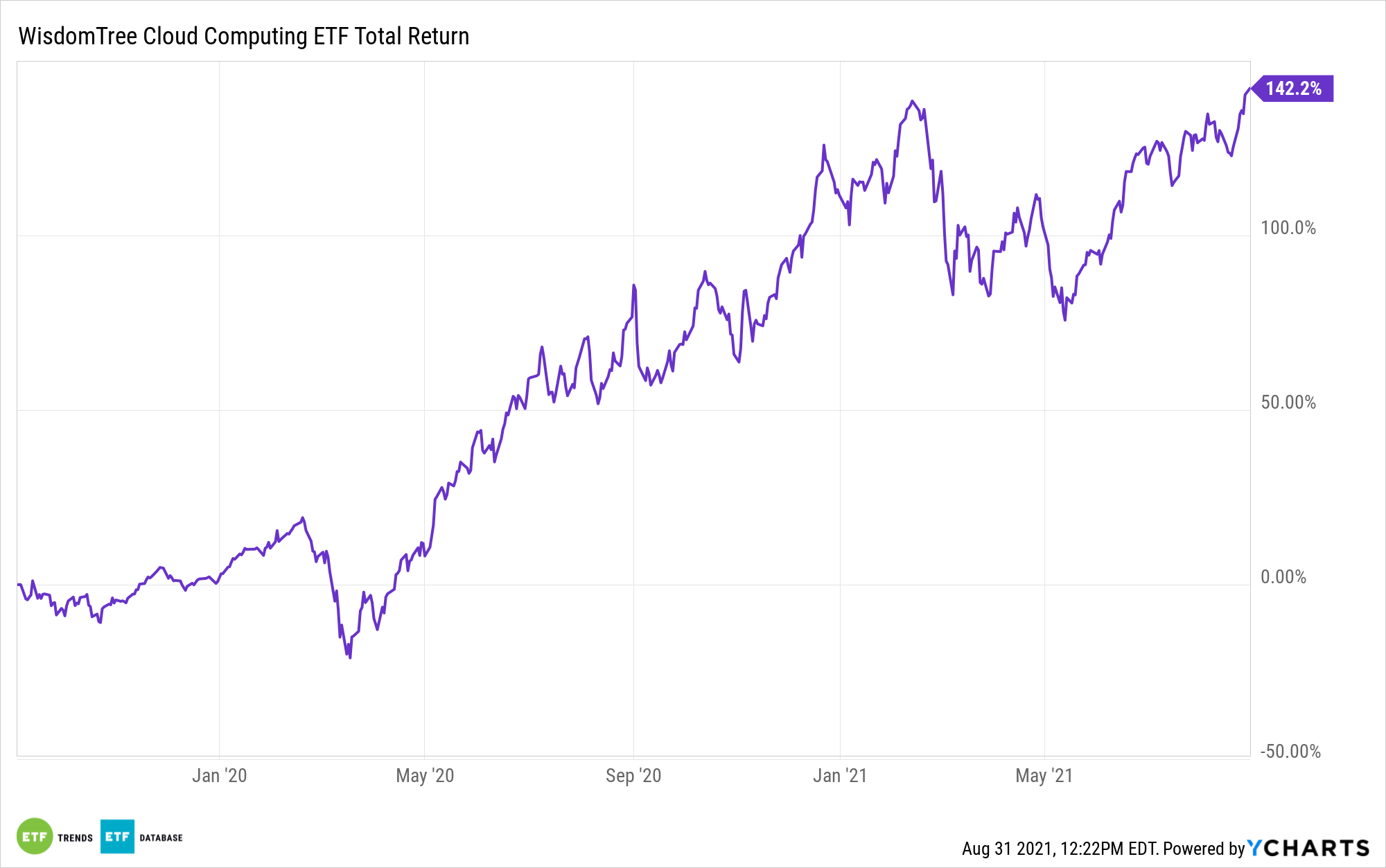

Another fund to check out is the WisdomTree Cloud Computing Fund (WCLD), which also has Zoom exposure. WCLD seeks to track the price and yield performance of the BVP Nasdaq Emerging Cloud Index, which is designed to track the performance of emerging public companies primarily involved in providing cloud computing software and services to their customers.

WCLD is off less than 1% on Tuesday.

For more news, information, and strategy, visit the Model Portfolio Channel.