Once again, gold ETFs have earned a place of prominence among the top-performing ETFs. Gold strategies may be picking up interest and returns as a defensive play as uncertainty grows around a 2024 recession. The shiny metal tends to pick up interest as anxiety grows, and with the Fed’s campaign against inflation set for a “higher for longer” rate regime, the lagging impact of those rates may be making investors nervous.

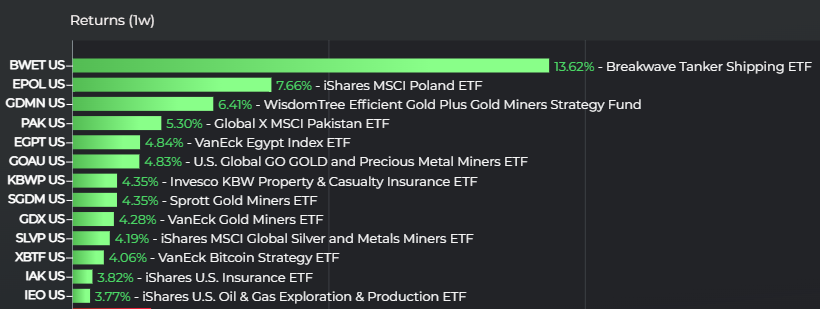

Which gold ETFs have performed over the last week, then? The WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN) took the top spot among gold strategies in the top-performing ETFs ranking, per Logicly.

Digging Into Gold ETFs

GDMN actively invests in gold as both a commodity and in firms’ equities. The fund looks to create a portfolio of global gold miners stocks, with those firms required to derive at least 50% of revenue from gold mining. GDMN charges a 45 basis point (bps) fee to do so. The gold strategy returned 6.4% over the last week to place it in the top three returning ETFs over the last week.

The WisdomTree strategy was not the only gold fund to take a top position. Five total ETFs in the top 12 focused on gold, including the Sprott Gold Miners ETF (SGDM) and the VanEck Gold Miners ETF (GDX). Those ETFs returned 4.4% and 4.3%, respectively, for the week, rounding out solid performance for gold funds.

Elsewhere, oil, shipping, and bitcoin ETFs also took top spots. Intriguingly, single-nation strategies took three of the top five positions, however. The Shares MSCI Poland ETF (EPOL), the Global X MSCI Pakistan ETF (PAK), and the VanEck Egypt Index ETF (EGPT) all did well over the last week. EPOL, specifically, likely owes its significant 7.7% return to election results in Poland. The nation appears to have elected a coalition more friendly to the E.U.’s trade and social liberalization, which could open the economy more.

Gold funds once again took top positions for the week, per Logicly.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.

For more news, information, and analysis, visit the Modern Alpha Channel.