By Pierre Debru

Head of Quantitative Research & Multi Asset Solutions at WisdomTree in Europe

With the end of each year comes long-awaited traditions such as the Thanksgiving turkey, Saint Nicholas, Christmas trees, Hanukkah’s menorah or the New Year’s fireworks. For investors, one of these traditions are equity forecasts for the following year. Recently, as I was reading predictions for 2024, I started to wonder how accurate last year’s predictions were.

Predicting Short-Term Moves in the Market Is a Fool’s Errand

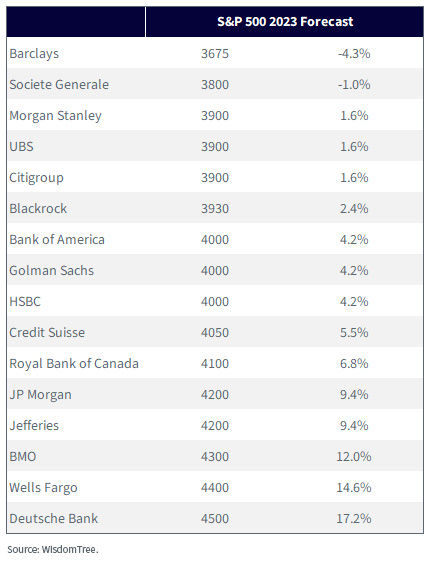

In figure 1, I compiled predictions from 16 forecasts published at the end of 2022 by different banks and asset managers across the spectrum. As a reminder, the S&P 500 gained 24.2% over the full year in 2023. The results are telling:

- The dispersion is massive, with a 21% spread between the most pessimistic and the most optimistic, with everything in-between.

- Even so, not one expert got it even close to right. Some predictions ended up 28% off.

Figure 1: What Experts Predicted for the S&P 500 in 2023

So, what should we conclude from this? I think we should acknowledge that when it comes to short-term moves in markets, “Nobody knows anything” and successful investors are long-term investors who aim to harness the equity risk premium over the long term through time-proven, consistent strategies. In the words of Kenneth Fisher, “Time in the market beats timing the market.”

Investing for the Long-Term: Core Strategies Anchored in Academically Proven Risk Premiums

Academics have demonstrated time and again that systematically investing in factor portfolios would have outperformed the market over the long term. Investing in high-dividend stocks, high-quality stocks or cheap stocks in a systematic manner gives investors one of the keys to potentially outperforming the market. It is worth noting that academic research has shown that the expected outperformance yielded by such approaches has not meaningfully decreased over time, despite markets becoming more efficient.

WisdomTree Quality Dividend Growth strategies are a good example of how using this decades-long research can help outperform the market and grow investors’ wealth over the long term. One of the reasons for these strategies’ success is that the investment process is rooted in academic literature and focuses on a systematic selection of a diversified basket of highly profitable companies with solid dividend-paying credentials, leaning heavily into the quality and high dividend factors.

WisdomTree Quality Dividend Growth: We Believe A Core Equity Strategy with a Track Record to Beat the Market over the Long Term and across Regions

Our portfolios are constructed around dividend-paying companies with the best-combined rank of earnings growth, return on equity and return on assets within a universe of companies with sustainable dividend policies. Stocks are also risk-tested using a proprietary risk screen (Composite Risk Score), which uses quality and momentum metrics to rank companies and screen out the riskiest companies and potential value traps. Each company is then weighted based on its cash dividend paid (market capitalization x dividend yield), which introduces valuation discipline in this high-quality portfolio.

Figure 2 illustrates the historical average relative performance of different global equity factors depending on volatility regimes. We observe that some factors, like min volatility, are fundamentally defensive. They historically outperform a lot when volatility is high (and usually markets are down) but they struggle and underperform significantly in bull markets when volatility is low. On the contrary, some factors, like small caps, are very cyclical. They do well in periods of low volatility but exhibit deeper drawdowns in high-volatility markets, which take a long time to recover from.

Figure 2: Average Relative Performance of Different Global Equity Factors Depending on Volatility Regimes

WisdomTree’s approach to quality, though, seeks to offer a very balanced mix with strong outperformance in high-volatility markets, helping to reduce drawdowns and time to recovery but also some outperformance in other volatility regimes. This combination is what we call “all-weather.” Such a strategy can be used as a strategic holding to put time in the market as it captures most of the upside while offering risk mitigation on the downside.

Key Takeaways

Looking forward to 2024, S&P 500 predictions remain incredibly diverse from 4,200 (-12%) by JP Morgan to 5,100 (+7%) from Deutsche Bank. Uncertainty in the markets also remains at a very high level. U.S. monetary policy remains extremely volatile and around half the world population will vote in 2024, including the U.S. in November. Overall, and as always, we believe like core, resilient equity investments that do not rely on knowing the future should be investors’ best friends. Investing in quality and high dividend could continue to be the best answer for long-term minded investors.

Pierre Debru is an employee of WisdomTree Ireland Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree, Inc.

Originally published by WisdomTree on January 18, 2014.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.