By Kevin Flanagan, Head of Fixed Income Strategy

Last week, I wrote about the money and bond markets apparently doubling down on their optimistic expectations for Fed rate cuts this year. However, an interesting development occurred over the last week: Fed pushback. Now, this doesn’t mean the Fed is not going to cut rates in 2024. It’s just that the markets had apparently gotten too far ahead in their expectations for the policy maker’s liking. Against this backdrop, investors should consider how to play this pivot in monetary policy.

Let’s first take a look at recent developments. The chart below highlights how the market’s narrative for the timing of the first rate cut has recently changed. Less than two weeks ago, the March 2024 FOMC meeting was widely viewed as the timeline for that first cut, with the probability coming in at just about 77%. Post-Fed comments over the last few trading sessions have pushed that probability down to 46%, with the May Fed meeting becoming the new frontrunner.

The implied probability for Fed Funds Futures has also scaled back rate cut expectations, albeit just slightly. As of this writing, five, rather than six, cuts worth a total of about 125 basis points (bps) appear to be priced in for this calendar year. In other words, the monetary policy pivot is still very much front and center for the money and bond markets. In fact, it will be interesting to see how rate cut expectations play out as 2024 progresses. If upcoming economic/labor market and inflation data continue to reveal resiliency and slow progress toward the Fed’s 2% threshold, it would seem reasonable for the market to dial back its current outlook to align more closely with the Fed’s dot plot, which called for three rate cuts this year.

Performance data for the most recent quarter-end and month-end is available here.

So, what is one way investors can position themselves in this rate setting?

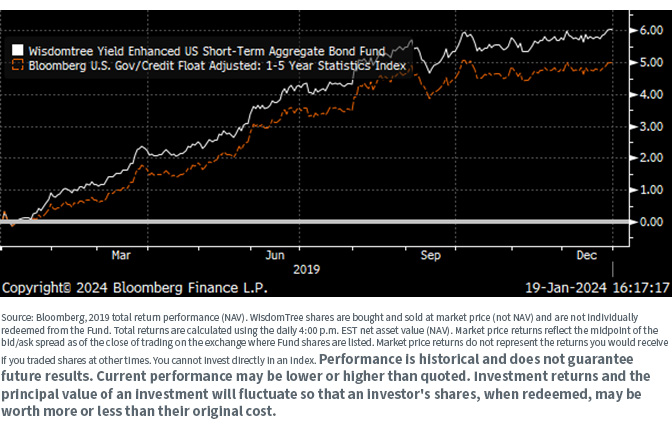

On Offense (Rate-Cut Strategy): WisdomTree Yield Enhanced U.S. Short-Term Aggregate Bond Fund (SHAG)

- SHAG is very correlated to the UST 2-Year yield, which is anchored to the Fed Funds Rate

- Thus, Fed rate cuts and/or rate cut expectations should show through here more directly than intermediate/long duration.

- During the last normal rate cut cycle pre-Covid (three cuts like the Fed’s current dot plot), SHAG outperformed the benchmark Bloomberg U.S. Govt/Credit 1-5 Year Index by more than 100 bps (see above).

Conclusion

Our primary 2024 theme for fixed income is that investors have entered into a New Rate Regime, reverting to the old or normal one, where zero interest rates are a thing of the past. It’s an environment that a generation of investors have not witnessed before. And unlike 2022 and 2023, the current calendar year brings with it the prospect of rate cuts, not rate hikes.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Originally published 24 January 2024.

For more news, information, and analysis, visit the Modern Alpha Channel.