“Another concept used to cope with uncontrollable events is known as amor fati which is Latin for ‘love of fate’. The exact term can be traced back to the nineteenth-century German philosopher Friedrich Nietzsche who describes it as, ‘My formula for greatness in a human being is amor fati: that one wants nothing to be different, not forward, not backward, not in all eternity. Not merely bear what is necessary, still less conceal it … but love it.’”

Ross Edgley

The Art of Resilience

The View from 30,000 feet

Last week was Super Bowl week for economists, with fresh guidance from the Fed, ECB, BoJ, as well as data releases on GDP and inflation. The economic data fireworks show was set against a busy week of earnings data, which acted as garnishes to the main course of economic data. The Fed was the first dish served, which could aptly be described as a nothing-burger, served with a side of data dependency. The ECB followed suit with a similar message, but against and wildly different economic backdrop for the Eurozone, which suffers from similar inflationary concerns, but a dramatically different growth landscape. As expected, the BoJ, provided hints that the days of yield curve control pinned at the zero-bound are numbered, setting the stage for the largest change in Japanese markets in three decades. Meanwhile, the news was filled with daily speculations that China would act more decisively to head off deflationary pressures threatening to push the country’s economy into a cold dark economic winter.

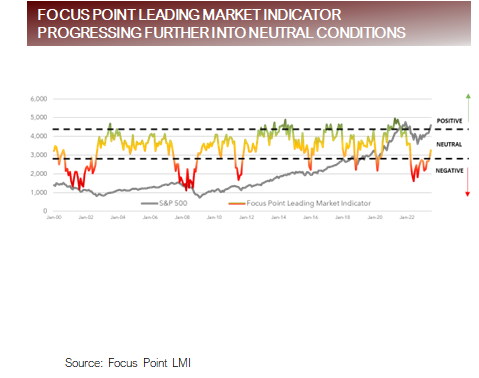

- The Focus Point Leading Market Indicator continues to trend higher, moving further into Neutral Conditions

- Better than expected inflation and growth data, and a Fed that is getting everything they want for the moment

- Earnings Season – Steady as she goes

- The most Frequently Asked Question from clients this week: What keeps you up at night?

The Focus Point Leading Market Indicator trends higher, moving further into Neutral Conditions

- The Focus Point Leading Market Indicator continue the recent trend higher, with positive changes in the following indicators within the model:

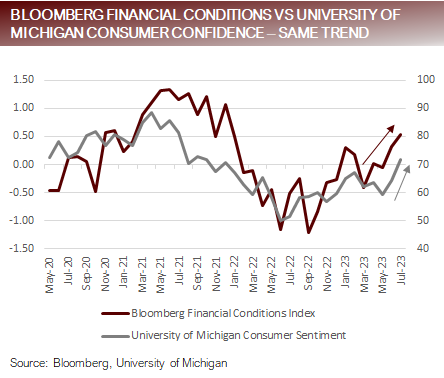

- Financial Conditions

- Margin Debt

- University of Michigan Consumer Sentiment

- However, not all the news was good. Indicators within the model that turned negative included:

• Earnings Momentum

• Housing

Bottom Line

• Consumers and business are feeling better about the economy and the prospects of vanquishing inflation. Better attitudes matched with falling volatility is a formula for institutional investors to leverage the portfolios and is adding to net flows into risk assets. Stronger than expected economy paired with disinflationary data and more accommodative Fed is creating a continued runway risk assets to rally. Investors should be careful not to become complacent, with the Fed fixated on data dependency, the markets are only one or two data prints away from a different environment.

The accumulation of economic strength signaling growing stability for the rally in risk assets

Better than expected inflation and growth data, and a Fed that is getting everything they want

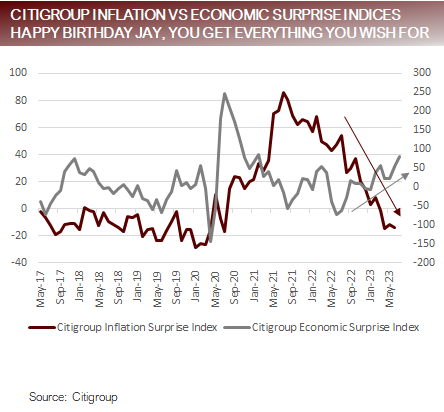

- Wouldn’t it be nice to get everything you want for your birthday? Jerome Powell’s birthday is February 4th and his birthday wish was for lower inflation and better economic growth. All his birthday wishes have come true.

- The drivers impacting the markets in 2023 include:

- Labor market strength and wage increases boosting spending

- Pandemic related cash balances fortifying consumers and company increased spending

- Consistent dissipation of headline inflationary pressures due to falling commodity costs and goods demand normalizing

- Less hawkish monetary policy as central banks around the world approached the terminal level of rates

- Corporate earnings holding up better than expected due to nominal spending and pricing power

- The housing markets showing signs of resiliency despite crippling affordability

- A frenzy around AI stocks reminiscent of the dotcom boom and FOMO as a driver of retail buying and institutional catch up

- Growth

The first reading on Q2 GDP supported the picture of better growth, with the GDP accelerating from 2.0% to 2.4% in Q2, surprising against an expectation for GDP to fall to 1.8%. Durable Goods Orders similarly surprised, jumping 4.7%, compared to an expectation of 1.3%. While Personal Spending, also came in above expectations, with revisions higher to prior numbers.

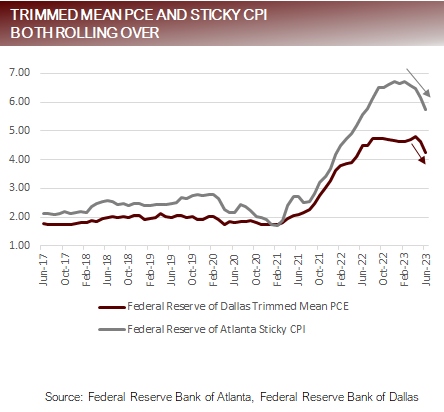

- Inflation

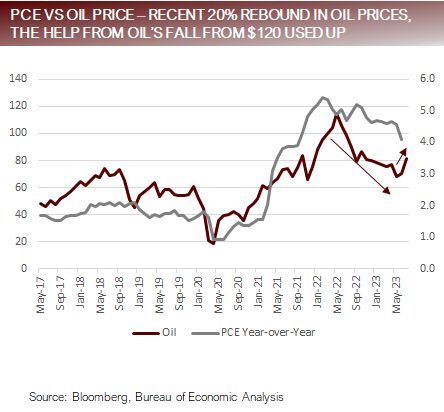

PCE printed 3.0%, the lowest level since March of 2021. Core PCI, which is less heavily impacted by the 30% fall in oil prices in the last year, came in at 4.1%, below expectations of 4.2%. The Fed’s highlighted Super Core (Services Less Housing), continued a trend lower to 4.1% as well.

Life is good for Jay until this trend is interrupted

Earnings Season – Steady as she goes

- With 51% of the S&P500 having reported earnings some key figures:

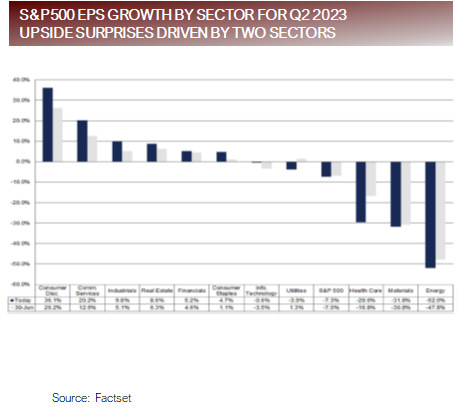

- 80% of the S&P500 have reported positive EPS surprises with earnings surprises are above the respective 5 and 10-year averages of 77% and 73%. At the sector level, Information Technology and Communication Services have been particularly strong with over 90% of the companies in each sector beating EPS projections.

- The Consumer Discretionary sector is reporting the highest year over year earnings growth, with an annual increase of 36.1%, and Energy reporting the lowest year over year earning growth with an annual decrease of -52.0%.

- Overall, companies have reported earnings that are 5.9% above estimates, which compares to respective 5 and 10-year averages of 8.4% and 6.4%.

- Companies that have beat earnings estimates are not being rewarded this quarter, with the average gain from two days before to two days after reporting earnings, of companies who beat earnings estimates to be -0.2%.

- Current blended year-over-year S&P500 earnings are expected to be -7.3%, which is slightly lower than the beginning of earnings season, June 30, when the expectation was -7.0%. Much of the lower revision has been driven by Merck having their earnings estimates lowered due to a charge related to their Prometheus acquisition.

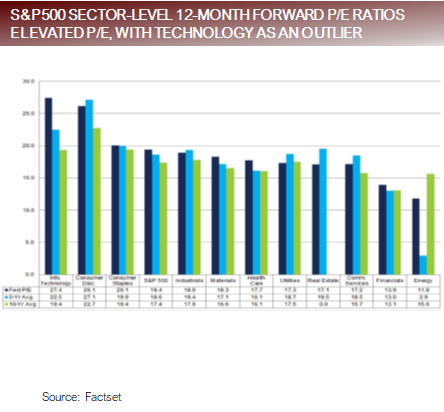

- The 12-month Forward Price-to-Earnings Ratio is 19.4x, which compares to respective 5 and 10-year averages of 18.6x and 17.4x. Source: Factset

- Bottom Line

- There is a broader range of companies beating earnings estimates by a lower-than-average amount. This is a good sign for a breadth, but a sign that expectations are coming more in line with company performance than in the recent past.

- The markets are expensive versus historical comparison, but investors should be careful to consider that high valuations have little relationship to near-term performance other than acting as a momentum indicator, meaning high valuations, tend to beget high valuations in the short-term.

- Analysts are projecting earnings to grow 12.6% in 2024, which is significantly above the long-term average of 6% to 8%.

- Investors should be wary of 2024 expectations, when paired with restrictive Fed policy targeting below potential growth.

Uneven sector surprises drive strength with valuations particularly elevated in Technology

FAQ: What keeps you up at night?

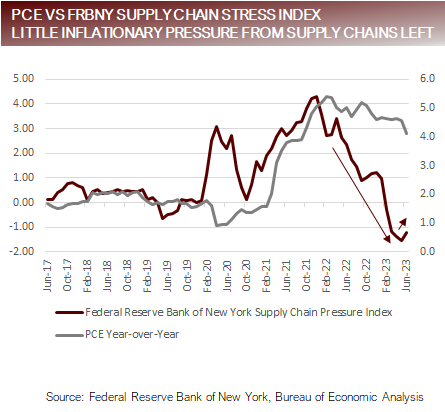

- As Powell alluded to in last week’s pressor, the disinflationary / growth story (immaculate disinflation) is largely tied to three drivers the Fed has little control over:

- Commodity Prices

- Supply Chains

- Government Sponsored Pandemic Savings

- Much of the juice has been squeezed out of these drivers.

- Commodity appear to have bottomed and have begun moving higher, with oil up over 20% from it’s lows in June.

- According to the Fed’s measure of supply chains (Federal Reserve Bank of New York Supply Chain Stress Indicator), friction in supplychannels is now lower than before the pandemic.

- According to the Federal Reserve Bank of San Francisco, of the $2.1t in pandemic savings created by government programs, as of Maythere was about $500b left. However, the two lowest groups in income distributions groups have had nearly all their savings return to normal.

- The facets of the economy that are supposed to be impacted by higher rates (housing and manufacturing) are showing signs of resilience, which means if the Fed is looking to impact the economy with their tools, they may need to be more aggressive.

- There is a disconnect between market expectations for higher growth and lower rates. If growth continues to surprise on the upside the logical conclusion would be higher rates, not lower rates. This creates a – good news is bad news – dynamic, that has yet to be reflected in risk asset prices.

Much of the Fed’s success in fighting inflation is tied to two drivers with little potential for more help

Putting it all together

- The recent resurgence in economic momentum and sentiment reduces the probability of a recession in the next two quarters.

- However, investors would be wise to not go all in on the “immaculate disinflationary” story (lower inflation and continued strong employment) and should consider assigning some of the probability of outcomes to a resurgence of inflation tied to factors out of the Fed’s control.

- Forced to confront the continual fall in inflation, paired with better-than-expected economic data and a strong equity market, the bears have shifted their narrative that the downturn is still coming but will now be postponed to 2024. This does not match earnings expectations for 2024, which are projected to grow at near 2x the historic average in 2024.

- Fear of the bearish proclamations of the past six months is keeping many investors sidelined. In fact, JPMorgan’s Institutional Survey found that 63% of institutional investors still have equity position expressed for a bearish outcome.

- The dynamic of underinvested institutions not fearful of a downturn in the near-term, playing catch up in a low volatility environment, creates a situation where pullbacks will likely be met with buying, putting a floor under selloffs.

For more news, information, and analysis, visit the Modern Alpha Channel.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2023, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied. FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.