By Kevin Flanagan

Head of Fixed Income Strategy

Throughout the course of the current Federal Reserve rate hike cycle, and the attendant increase in the U.S. Treasury (UST) 10-Year yield, I periodically get asked whether it is time to go long on duration. My answer has been a very consistent one: I’d rather be late than early to the duration party. With the UST 10-Year yield once again passing the 4% threshold, I thought it would be a good idea to revisit this topic. And, alas, my answer still hasn’t changed.

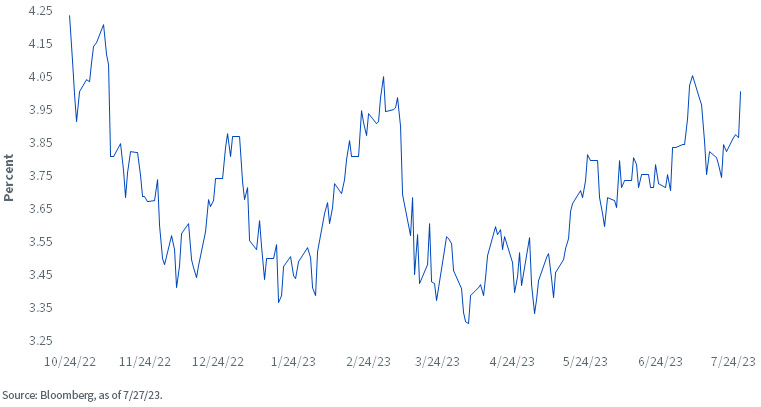

U.S. Treasury 10-Year Yield

In answering the duration question, I think it is useful to show the pattern of the UST 10-Year yield since it hit its most recent peak of roughly 4.25% (4.33% in intra-day trading) in October of last year. Yes, after reaching this high-water mark in the fall, the 10-Year yield did decline in a rather startling fashion, falling by 80 basis points (bps) to a little over 3.40% in December. However, just as quickly, this decline was reversed and another upward move occurred heading into the year-end. In fact, if you look closely at the enclosed graph, it becomes clear how this “up and down, then up again” trend has played out over the last nine months.

The most recent episode occurred beginning in early March. As the reader will recall, Fed Chairman Powell gave rather hawkish testimony to Congress in early March and yields all along the Treasury yield curve rose considerably as a result. In fact, the UST 2-Year yield rose above 5% and the 10-Year yield eclipsed the 4% mark yet again. Then the regional bank turmoil hit, and all bets were off as UST yields plummeted. In fact, the 10-Year ultimately fell to 3.31% in early April, another sizeable decline of 70 bps.

However, let’s fast-forward to the present, where that 70-bps plunge in yield has once again been completely reversed. Indeed, as of this writing, the UST 10-Year yield has retraced all the way back over 4% one more time, posting a 4.01% reading.

Conclusion

With the Fed in “higher for longer” mode, a reasonable outcome for the 10-Year could be to remain in a range-bound pattern, with the yield skewed toward the upper limit. In fact, another run at the aforementioned high point of 4.25% should not be ruled out either. This type of trading pattern would not be conducive to going long on duration in a bond portfolio.

In addition, the historical inversion of the Treasury yield curve offers no incentive, or urgency, to take on such positioning. Against this backdrop, investors should consider Treasury floating rate notes, which provide income without the volatility that has been witnessed in the 10-Year sector. The WisdomTree Floating Rate Treasury Fund (USFR) offers investors a means of tapping into this strategy.

Originally published by WisdomTree on August 2, 2023.

For more news, information, and analysis, visit the Modern Alpha Channel.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.