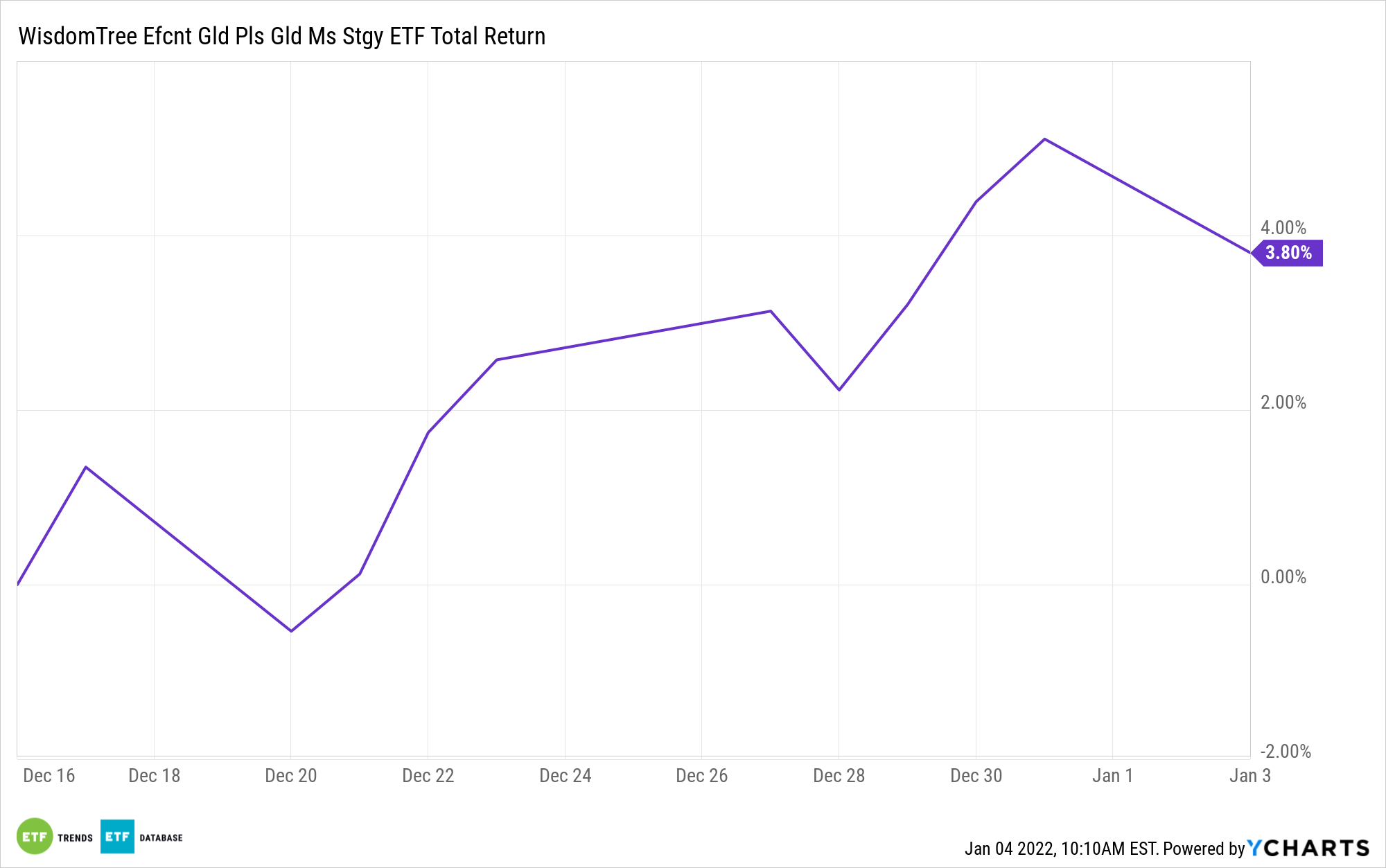

The WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN) debuted last month, meaning the latest addition to the fray of gold miners exchange traded funds missed nearly all of the 2021 weakness in mining equities and bullion itself.

However, GDMN could prove well-timed because there’s optimism that 2022 will bring better things for the yellow metal and gold miners, which remain under-owned by professional investors. Data from the World Gold Council indicates that there’s still strong investor appetite for the yellow metal.

“The World Gold Council believes there is a noticeable trend among investors to seek out assets that have previously helped their portfolios but are less liquid. The shift towards riskier alternatives would pave the way for gold, according to the Council, given that the metal provides capital and liquidity needed during a market sell-off,” reports Mining.com.

That could be a start for GDMN upside in 2022. However, the fund isn’t solely reliant on miners thriving. The new WisdomTree ETF does what new ETFs need to do: set itself apart from a pack of entrenched rivals.

GDMN does that by providing exposure to both miners and gold futures. Rival funds don’t do that. For each $100 allocated to GDMN, an investor receives $90 in gold miners exposure, and then the gold futures contracts will be positioned so that they represent an exposure of 90% of the net assets in the fund.

Over time, that could be a potentially winning trait for investors because there are frequently periods in which mining equities either inexplicably lag spot gold prices or dramatically outperform the yellow metal. The GDMN methodology could potentially even out some of that turbulence. Those benefits could soon be on display.

“The outlook for gold in the first quarter of 2022 is upbeat, with the main driver being inflation, which is keeping a floor under prices, said Jim Wyckoff, a senior analyst at Kitco Metals, in the latest Reuters report,” notes Mining.com.

Another case for the actively managed GDMN this year is inflation. “Transitory” is out the window, indicating that GDMN could shine through the first half of the new year.

“Still, with inflation pressures mounting and the possibility of multiple rate hikes, 2022 could manifest a year of recovery for the yellow-colored metal,” according to Mining.com. “Analysts, including those at TD Securities remain optimistic about a potential gold rally in H1 2022.”

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.