By Christopher Gannatti, CFA, Global Head of Research

On January 25, 2024, I caught the following headline in The Wall Street Journal:

Taylor Swift’s Fans Swarm X to Combat AI Fakes of Singer1

If one looks at the picture of the world in January 2024, it’s absolutely true that few things are bigger than Taylor Swift—but AI might be one of them. As we go into the veritable political circus that could be the 2024 U.S. presidential election, this could only be the beginning of the headlines we might see about different AI fakes.

But, stepping back, as we seek to analyze where we are in the world’s journey of AI adoption, the use of generative AI to create videos of different celebrities is getting better and better. But this is merely one signal of the progress that has shaped the discipline in the last year. Remember—there were basically zero headlines about anything to do with generative AI prior to December 2022.

Look at some of these—maybe you imagine the implications here could be more constructive:

- AI Is Coming for Architecture2

- AI to Drastically Cut Time to Develop New Battery Materials, Say Executives3

- Can AI Solve Legacy Tech Problems? Companies Are Putting It to the Test4

- Could AI Transform Life in Developing Countries?5

- Is Artificial Intelligence the Solution to Cyber Security Threats?6

So in a short period of time, we have our example of AI being inserted near the peak of popular culture and we also have AI being touted as possibly contributing to solving some of the world’s toughest problems.

It’s becoming clearer and clearer that the momentum behind the AI topic could easily be used to make many believe we are in the midst of an AI revolution.

Technological Revolutions Have Been a Natural Part of Human History

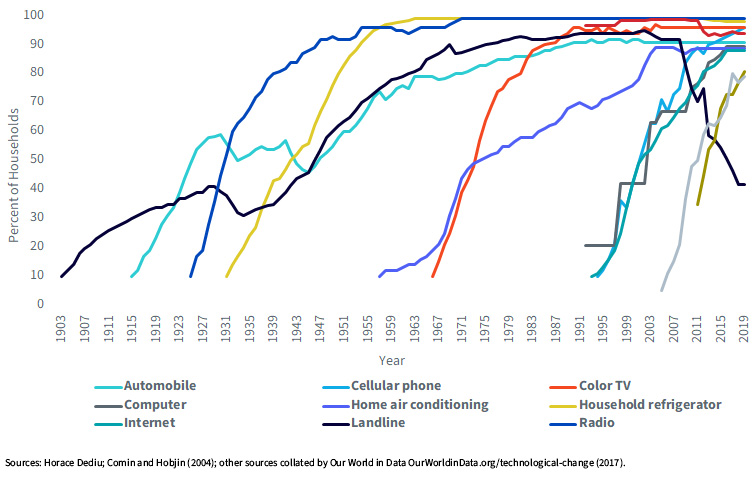

We have had many different waves of technological adoption over time. Figure 1 shows some examples:

- The vertical axis represents the percentage of U.S. households that have adopted a given technology. The horizontal axis represents the year, going back almost to 1900. One of the most important takeaways, in our opinion, is how no technology is instantly adopted. The slopes—in this case, the speeds of adoption—vary, but none of the lines, yet, is perfectly vertical. A perfectly vertical line would indicate no time between a technology existing and full adoption.

- One can look at smartphones as an example of something more recent and compare them to color TV, something that has existed going back to the 1960s. It’s interesting how the slopes, even though they’re occurring at very different points in U.S. history, are not that different. Both are electronic products that have an informational and entertainment value to them. They were exciting, they changed life as we know it, but neither was instantly adopted by all.

Figure 1: An Historical Look at the Adoption of Specific Technologies Amongst U.S. Households

The Need for Discipline

I keep mentioning this unattainable extreme, “instant adoption,” very purposefully. When we think of smartphones as an example, those of us around between 2000 and 2010 remember Blackberry. Blackberry was certain that people wanted a keyboard and to feel a “click” when sending text messages and emails.

Do any of your friends use a Blackberry device today?

Similarly, everyone is sure that the market for AI chips—what Nvidia is producing—will be much larger than it is today. I have seen forecasts that it could be in the region of $120 billion by 2027.7 Other forecasts suggest that it can be in the region of $400 billion by 2027.8

If any of you have watched the Blackberry movie,9 there was a moment when, in my opinion, they got distracted from the primary innovation—shifting from sending things as text messages to “using data.” Smartphones can seamlessly create and send data and we don’t even think about it anymore, whereas, the company became too focused on the exact device, along with details that proved less important over time.

I think it’s safe to say we know we need MANY more semiconductors, but we do not know with certainty what the market size will be or the exact type of semiconductors we will need in 2027 and beyond. AI is giving us a new toolkit—that much is clear—and the news headlines are telling us that we are still figuring out the best ways to use it, be it deep fakes of popular celebrities, accelerating scientific discoveries or facilitating other important trends.

The trick, as an investor, is to remember that we are on a spectrum—certain details are closer to being known and certain details are highly uncertain. If Nvidia’s share price is already representing a value coinciding with the assumption of a $400 billion market for AI accelerator chips by 2027, it is difficult to see much higher returns in 2024, as one example.

The Market Is Telling Us its Thoughts on AI All the Time

In 2024, we are faced with a barrage of information. Investors of all types are buying and selling the shares of different companies all the time. If there is a desire to monitor how the market is treating the AI topic, we have two distinct strategies at WisdomTree:

- The WisdomTree Artificial Intelligence and Innovation Fund (WTAI) is designed to track the returns, before fees, of the WisdomTree Artificial Intelligence and Innovation Index. The strategy is designed with a recognition that AI represents a broad ecosystem of activities and companies, and that in any given year, different parts of that ecosystem can outperform or underperform. Over the long term, however, AI will tend to be bigger and more in use than it is today.

- The WisdomTree U.S. Quality Growth Fund (QGRW) is designed to track the returns, before fees, of the WisdomTree U.S. Quality Growth Index. Exposure to AI is not a specific focus of the methodology, but if we simply stop there with our thinking, we do investors a disservice. Even though AI is not a focus of the stock selection or weighting, a major area of AI in February 2024 will be companies that are running and developing large language models, which include, so far, the likes of Microsoft, Meta Platforms, Amazon and Alphabet, to name a few. When the strategy is focusing on growth and quality, these companies tend to score very highly and end up with significant weights in the exposure. Of course, we’ll continue to monitor how this evolves and recognize it could change. But, for the time being, the AI topic could be an important driver of the return experience in QGRW.

Depending on whether QGRW or WTAI is leading or lagging, performance-wise, at any given time, can tell us important insights as to how investors are trading the AI topic.

Current performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For the most recent month-end and standardized performance, click the respective ticker: WTAI, QGRW.

1 Alexa Corse, “Taylor Swift’s Fans Swarm X to Combat AI Fakes of Singer,” The Wall Street Journal, 1/25/24.

2 Edwin Heathcote, “AI Is Coming for Architecture,” Financial Times, 1/20/24.

3 Harry Dempsey, “AI to Drastically Cut Time to Develop New Battery Materials, Say Executives,” Financial Times, 1/24/24.

4 Belle Lin, “Can AI Solve Legacy Tech Problems? Companies Are Putting It to the Test,” The Wall Street Journal, 1/26/24.

5 “Could AI transform Life in Developing Countries?” The Economist, 1/25/24.

6 Hannah Murphy, “Is Artificial Intelligence the Solution to Cyber Security Threats?” Financial Times, 1/16/24.

7 Source: “Gartner Forecasts Worldwide AI Chips Revenue to Reach $53 Billion in 2023,” Gartner, 8/22/23.

8 Source: Peter Cohan, “Don’t Bet AMD Stock Can Rise on $400 Billion AI Chip Market,” Forbes, 12/20/23.

9 Source: BlackBerry. https://www.blackberrymovie.com/

Originally published 6 February 2024.

For more news, information, and analysis, visit the Modern Alpha Channel.

Important Risks Related to this Article

For current Fund holdings, please click the respective ticker: WTAI, QGRW. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal.

WTAI: The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

QGRW: Growth stocks, as a group, may be out of favor with the market and underperform value stocks or the overall equity market. Growth stocks are generally more sensitive to market movements than other types of stocks. The Fund is non-diversified and, as a result, changes in the market value of a single security could cause greater fluctuations in the value of Fund shares than would occur in a diversified fund. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit. The Fund does not attempt to outperform its Index or take defensive positions in declining markets and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.