By Hyun Kang

Research Analyst

After a tumultuous 1Q earnings season amid numerous bank collapses, investors are continuing to closely monitor second-quarter earnings as the latest numbers pour in.

Blended Sales and Earnings Growth

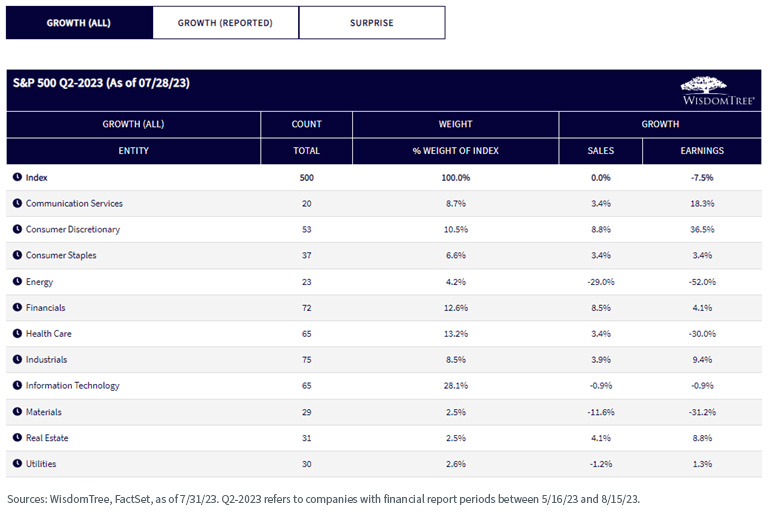

With earnings season fully underway, the screenshot below was taken from the Growth (All) tab of the Earnings Path on July 31, when 255 out of 500 companies in the S&P 500 had reported their 2Q earnings. The sales and earnings growth figures represent a combination of actual reported sales and earnings growth and analyst estimates.

Analysts expected the heavily weighted Information Technology sector to have a negative earnings growth of -3.5% against broader index-level estimates of -9.1%, partially driven by positive sentiment around artificial intelligence.

The Energy sector is expected to have a dramatically negative earnings growth of -52%—a stark difference in outlook compared to 1Q earnings of 14.4% as oil demand weakened.

Reported Figures

The below screenshot was taken from the Growth (Reported) tab of the tool, which shows actual sales and earnings growth figures from reporting companies. As of July 28, 2023, 56 out of 72 companies in the Financials sector had reported 2Q figures, while only 9 out of 30 Utilities companies had reported sales and earnings.

Surprises

The Surprise tab shows the difference between actual reported sales and earnings versus median analyst estimates. So far, 27 of the 65 companies in the Information Technology sector have reported Q2 earnings, with an earnings surprise of 9.2% and a sales surprise of 1.6%. As of July 28, all 11 sectors of the S&P 500 Index show positive earnings surprises, while 8 out of 11 sectors show positive sales surprises.

New Feature Highlight: Daily Earnings Snapshot

A new feature of the Earnings Path lets users download a PDF version of our Daily Earnings Snapshot by clicking on the “Download Daily Earnings Snapshot PDF” button, shown in the below screenshot.

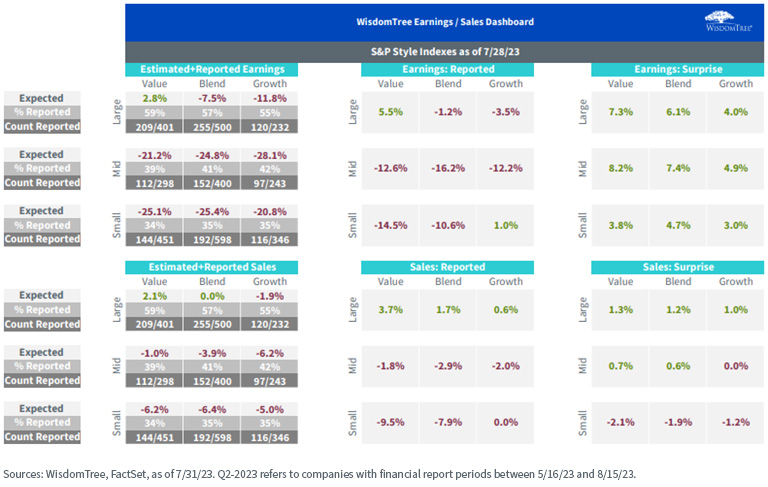

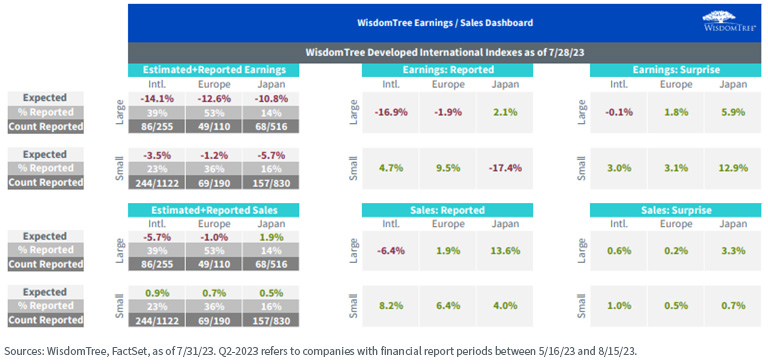

The Snapshot displays information from the Earnings Path tool in a concise format for benchmark indexes, including the S&P 500 and the Russell 1000, as well as their mid-cap and small-cap counterparts and style indexes (e.g., the S&P 400 Value Index).

The same information is also available for U.S., developed international and emerging markets indexes within the Snapshot.

The Earnings Snapshot also shows other useful information, including but not limited to valuation information for benchmarks and WisdomTree Indexes.

Conclusion

We hope the Earnings Path tool continues to help investors keep a close eye on earnings and that the Daily Earnings Snapshot will be another useful tool to track earnings trends in a concise, easily digestible format. Bookmark this link for easy access to daily data updates.

Originally published by WisdomTree on August 3, 2023.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.