It’s a big week in economic data for the U.S. economy. Conflicting data from a decline in job openings in February Job Openings and Labor Turnover (JOLTS) and a strong March employment report, and an upcoming CPI report, present a somewhat cloudy view. But the underlying data suggests that the slide towards recession may already be underway, despite up and down data points, which may call for dividend-focused ETFs to boost portfolios with current income.

Market watchers of all stripes are likely familiar with the current push and pull between positive economic data and negative market response, as the sooner the economy cools and the Fed can stop tightening the money supply, the better. But the day-to-day ups and downs of that tug of war belay the lagging nature of how the economy reacts to headlines – and we may now be seeing the jobs market start to slow down from months of rate hikes and ripples from disappointing earnings.

According to WisdomTree Investments’ senior investment strategy advisor, Professor Jeremy Siegel, the risk of recession is continuing to climb as seen in at least one key data point – hours worked each week. The jobs numbers that came out last Friday were in line with consensus estimates, Siegel explained but included yet another 1/10th drop in hours worked each week.

See more: “Siegel: Bank Crisis Equal to “One or Two Tightenings” by Fed”

That is equivalent to the market impact of about 300,000 workers leaving the market and nullified the jump in workers in that report, and while not a “complete falling apart,” Siegel noted, it does represent a softness also exemplified by seasonal factors cushioning jobless claims. With the banking crisis ripples yet to fully show up in economic data, the specter of a recession may be looming even larger.

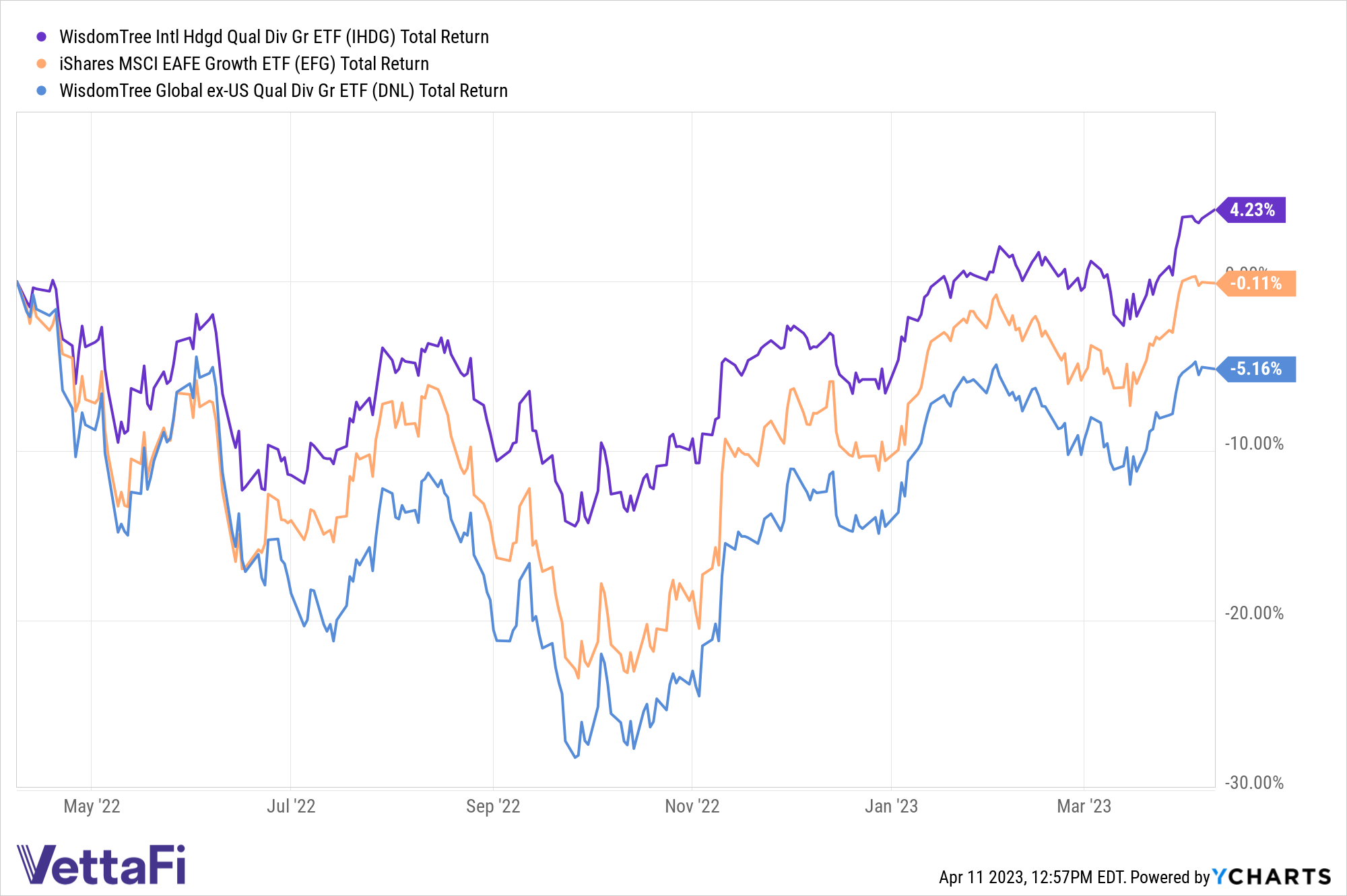

While some investors may have recently turned towards riskier offerings following the S&P 500’s strong start to the year, the underlying data suggests having a more cautious set of exposures on hand. Dividend-focused ETFs could be worth keeping on an ETF shortlist, with strategies like the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG).

IHDG tracks the WisdomTree International Hedged Quality Dividend Growth Index, which is a dividend-weighted index of developed market stocks outside of North America and screens for quality and growth in factors like earnings growth, return on equity, and return on assets. IHDG offers investors dividends without exposure to a threatened and expensive U.S. market, diversified with each country or sector limited to a 20% maximum weight.

IHDG has offered investors a 1.4% annual dividend yield for its charge, and with the prospect of a looming recession seemingly accelerating, it may be worth taking a look at IHDG and other dividend-focused strategies. Current income can boost an overall portfolio in tougher, volatile markets, and with the Fed’s fight against inflation set to continue, dividend-focused ETFs merit a place on ETF shortlists.

For more news, information, and analysis, visit the Modern Alpha Channel.