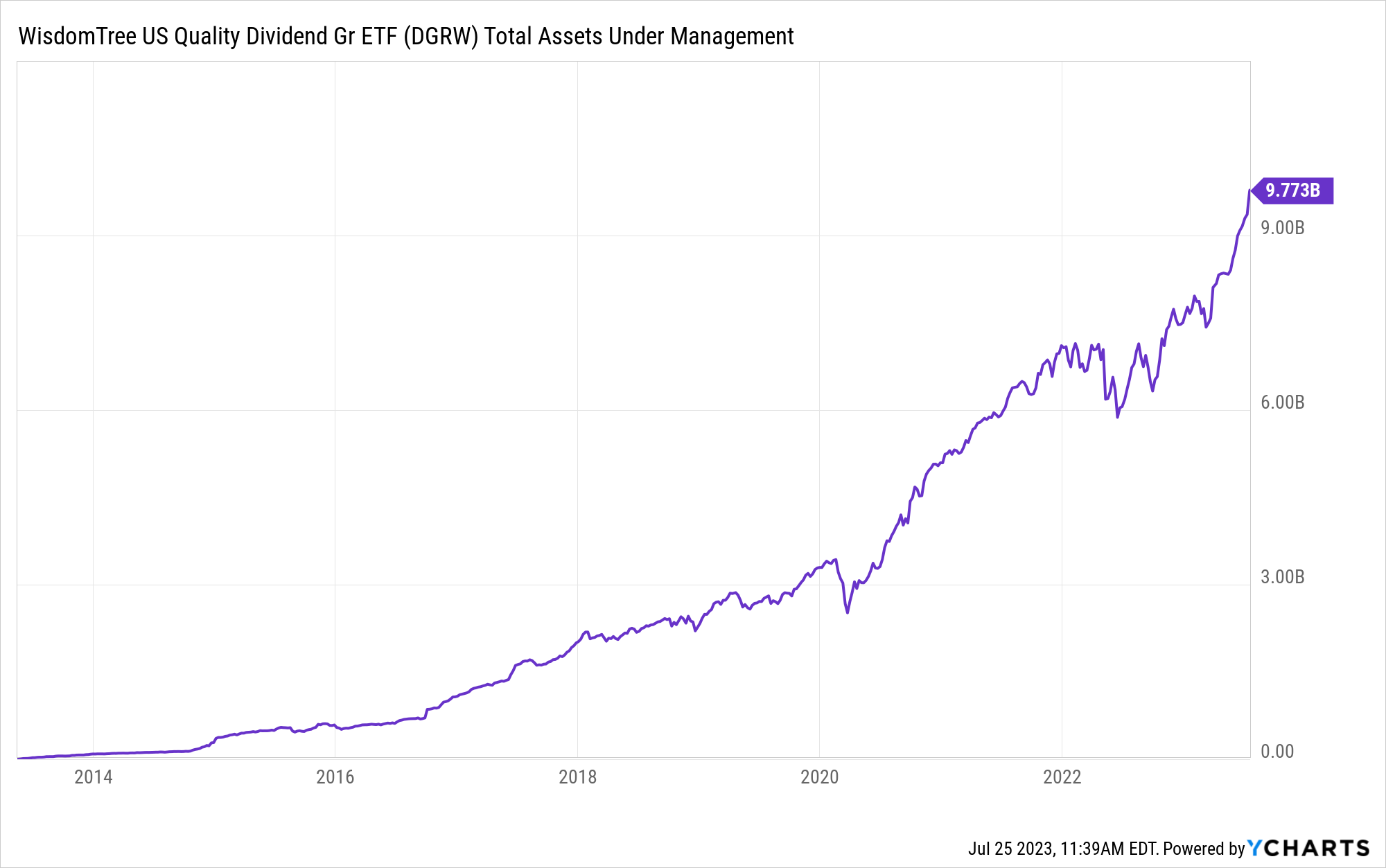

Following its tenth birthday, the WisdomTree US Quality Dividend Growth Fund (DGRW) is nearing another milestone. The quality dividend growth ETF is rapidly approaching $10 billion in AUM. Should it cross that threshold, it would be the first time DGRW has seen its AUM rise into the tens of billions. That may invite investors and advisors to take a closer look at why its AUM may be spiking.

DGRW is nearing $10 billion in AUM.

DGRW’s AUM has grown due to both price influence and inflows over the last month, up $603 million on net. More than half of that, however, owes to $322.6 million in net inflows in that same time frame. So why might investors be driving flows into the strategy? For just a 28 basis point (bps) fee, DGRW has returned 5.3% over the last month, outperforming both its ETF Database Category and Factset Segment averages.

A Quality Dividend Growth ETF Approach

The quality dividend growth ETF may emphasize dividends, but not in the way investors might think. Rather than mainly leaning on adding current income, DGRW uses dividends first and foremost as an indicator. Specifically, DGRW looks for firms with dividend growth that also pass its quality screen. That sets it apart from other strategies that also emphasize dividend growth but look at past dividend performance rather than growth potential.

DGRW pairs forward-looking earnings estimates with historical return on assets (ROA) and return on equity (ROE) growth. The strategy does tend to lean towards larger names but does weight individual firms and sectors at 5% and 20% respectively.

See more: “10 Years of DGRW“

Why consider a quality dividend growth ETF right now? With the Fed closer and closer to engineering a “soft landing,” investors may be eager to get in for an optimist’s rally. That may be true, but before diving into a disruptive innovation fund, consider how DGRW offers growth exposure with a quality, dividend view. The strategy still holds mega-cap tech leaders like Apple (AAPL) but fills out its roster with firms looking forward to future dividend growth.

For more news, information, and analysis, visit the Modern Alpha Channel.