By Matt Wagner, CFA, Associate Director, Research

It’s been just over a year since the launch of the WisdomTree U.S. Quality Growth Fund (QGRW) in December 2022.

This year’s performance provided compelling evidence that looking under the hood at the nuances of index construction matters.

2023 Performance

The WisdomTree U.S. Quality Growth Fund seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. Quality Growth Index (WTQGRW).

The Index was designed to identify stocks that have characteristics of both high profitability and high growth.

Our research into historical returns suggested that investing simply in high-growth stocks can be a losing game over the long run. We believe investors should instead consider investing in high-quality growth stocks.

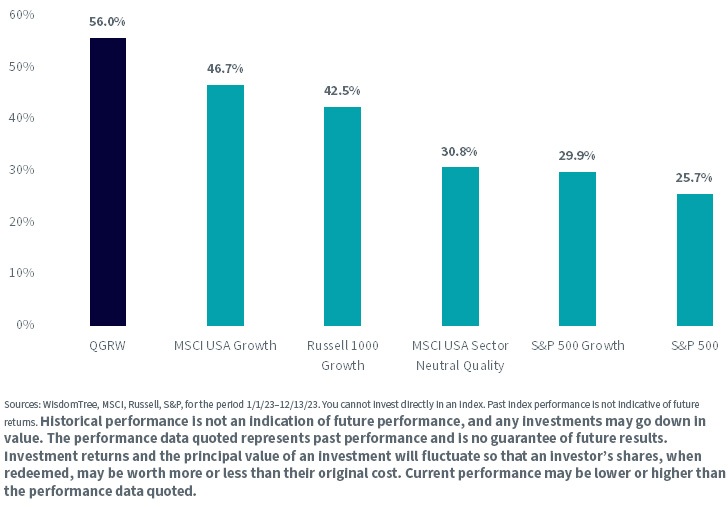

The U.S. equity market in 2023 was led by these high-quality growth stocks, as evidenced by the outperformance of QGRW relative to other measures of growth and quality.

2023 Total Returns

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click here.

For definitions of indices in the chart above, please visit the glossary.

The WisdomTree U.S. Quality Growth Index outperformed the Russell 1000 Growth Index by more than 1,000 basis points.

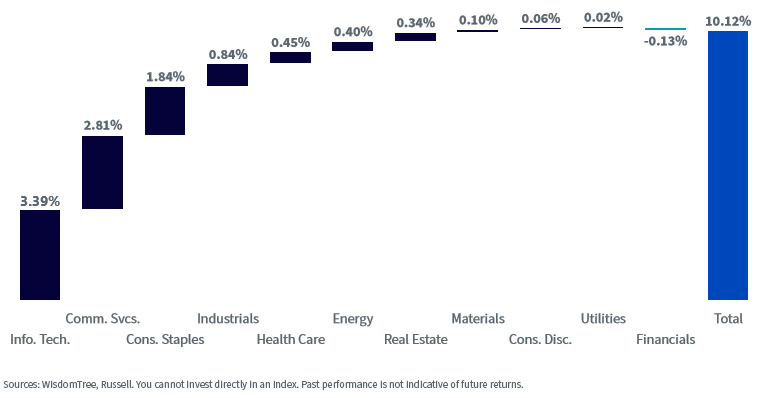

Though more than half of the outperformance was attributed to the tech-focused Information Technology and Communication Services sectors, the Index had positive attribution from 10 of 11 sectors.

2023 Index Attribution: WisdomTree U.S. Quality Growth vs. Russell 1000 Growth

Semi-Annual Index Rebalance

The Index rebalances each June and December. The universe of eligible securities is ranked on quality and growth factors separately, with the 100 highest-scoring securities selected.

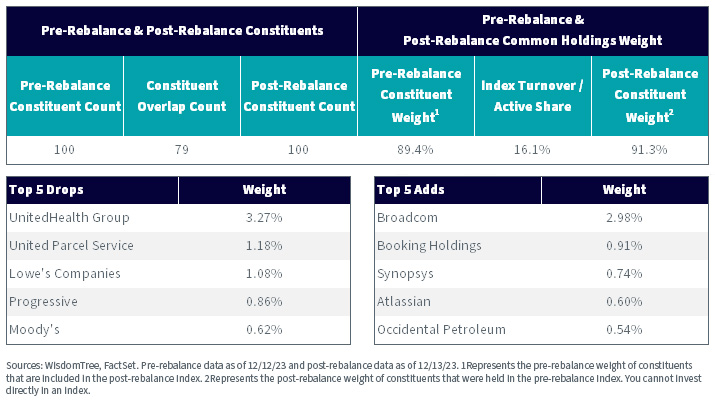

At this December’s rebalance, the only changes to the top 10 holdings were the addition of Broadcom at a roughly 3% weight, offset by the drop of UnitedHealth Group, which had held a 3.3% weight.

The remaining nine holdings were unchanged from the rebalance.

WisdomTree U.S. Quality Growth Index Top 10 Holdings

Of the 100 securities held in the pre-rebalance Index, 79 were maintained, and 21 were dropped/added. The cumulative impact on one-way Index turnover was 16%.

Holdings Overlap and Turnover for the WisdomTree U.S. Quality Growth Index

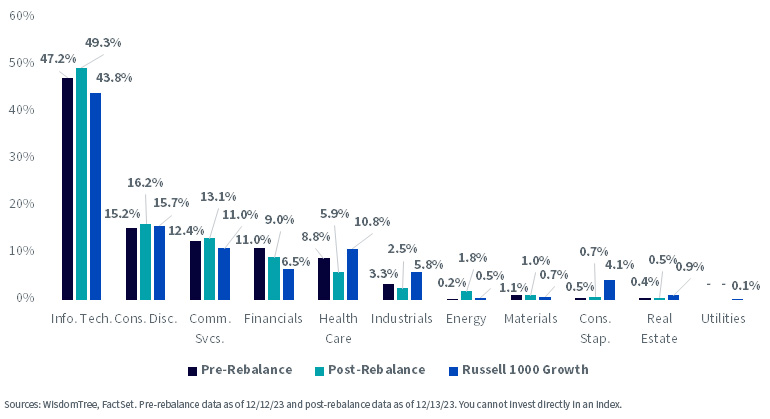

Sector changes were modest. The impact of the drop of UnitedHealth can be seen in a lower weight in Health Care, offset by an increase in Information Technology driven by the addition of Broadcom.

Sector Changes: WisdomTree U.S. Quality Growth Index

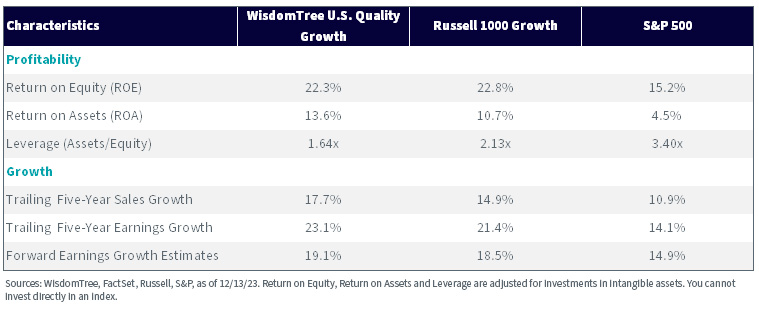

At each semi-annual rebalance, the Index systematically refreshes exposure to these high-quality and growth characteristics. This can be seen by the significant improvements in profitability and growth characteristics compared to the S&P 500.

For example, the return on assets (ROA) for the Index is more than twice that of the S&P 500 while also having a trailing five-year sales growth of almost 7 percentage points higher.

Index Characteristics

For definitions of terms in the table above, please visit the glossary.

Building a Quality Portfolio

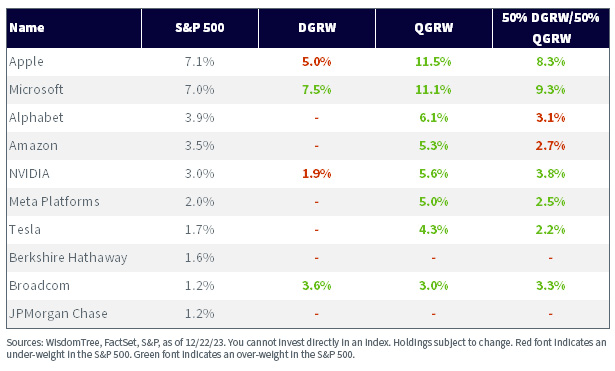

The WisdomTree U.S. Quality Dividend Growth Fund (DGRW) was WisdomTree’s first quality fund launched in 2013.

The Fund invests in high-quality dividend-paying companies, creating a more value-tilted core allocation. As a byproduct of its dividend requirement, the Fund is under-weight in many of the non-dividend-paying mega-cap companies that are top holdings in QGRW.

For investors utilizing an allocation to DGRW or a similar value-tilted core allocation under-weight in some of the non-dividend-paying mega-caps, a blend of DGRW with QGRW may mitigate some of the under-weights in the portfolio.

S&P 500 Top 10 Holdings

Important Risks Related to this Article

QGRW: There are risks associated with investing, including the possible loss of principal. Growth stocks, as a group, may be out of favor with the market and underperform value stocks or the overall equity market. Growth stocks are generally more sensitive to market movements than other types of stocks. The Fund is non-diversified; as a result, changes in the market value of a single security could cause greater fluctuations in the value of Fund shares than would occur in a diversified fund. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit. The Fund does not attempt to outperform its Index or take defensive positions in declining markets, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DGRW: There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Originally published 5 January 2024.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.