By Samuel Rines, Managing Director, Corbu LLC; and Jeremy Schwartz, CFA, Global Chief Investment Officer

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Signposts & Frameworks > Outlooks

Bottom Line: I see no usefulness in making point estimate guesses about the outcome of the various risk markets for the upcoming year. This note puts together signposts for the transition of the major themes dominating markets.

Companies have pushed price increases onto consumers and shown a willingness to sacrifice lower volumes (theme: price over volume or POV). Now, I see companies pushing prices and focusing on cutting costs to increase margins (a theme I call PAM). We call the resulting monetary policy volatility that comes from various uncertainties on this transition MonPolVol.

Can the transition from price over volume to price AND margin overpower the FOMC’s institutionalization of MonPolVol? Building a framework to be able to consistently question and iterate is worthwhile for the coming 3, 6 and 12 months.

After the December FOMC announcement and Powell’s press conference, the doves are flying. Markets began pricing a straight-line series of cuts to the perceived level of neutral.

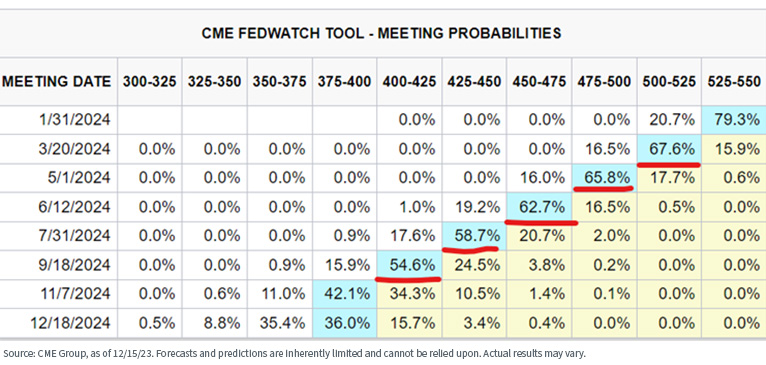

And—while it is both enjoyable and tempting to judge the FOMC on its level of incorrectness over the years—market pricing has not exactly been accurate, either. But it sets the initial condition. Post-December FOMC, a cut is currently priced for every meeting between March and November. And it is a perfect setup for a year of MonPolVol.

The relevant signposts –

- Do the incoming inflation readings sufficiently corroborate the current market expectations?

- Does the labor market matter?

- Is the FOMC comfortable with cutting in the face of 2.5% to 3% inflation prints?

And this is where it becomes difficult to disentangle the themes from one another. After all, price over volume contributed to the inflation readings. As the transition to price AND margin gathers steam, there is a disinflationary impulse—to an extent.

That plays into the framework through a few channels –

- POV held margins steady during the 2022–2023 timeframe.

- Supply chain/input cost normalization is beginning to contribute to margins.

- Some of the increase in gross margin dollars will be used to claw back some of the lost volumes.

- That requires “brand investment” and “advertising.”

- But much of it will flow to the bottom line.

There is disinflation being guided through the system (at least by the major brands) as the price elasticities have been tested and found. That is positive for the disinflation narrative and positive for corporate earnings.

And—to be clear—none of that is reliant on rate cuts or deterred by hikes. The “return to the algo” of 2% pricing and moderate volume gains from the consumer packaged goods group is not going to be dramatically altered by 25 basis points or 50 bps or 100 bps of cuts by the FOMC. It is what it is.

This is partly why the transition to PAM is an attractive theme for 2024. It is not reliant on a less restrictive policy to work. But it would be enhanced by it. Less restrictive policy = less gross margin spent on brand investment to regain volumes. Restrictive policy = status quo.

[Which—counterintuitively—indicates tighter policy being potentially better for the large tech advertising platforms like Meta/Alphabet.]

But that does not diminish the problem of MonPolVol. Initially, it was an issue of every new data point in 2022 and 1H 23 moving the terminal rate higher or lower by 25bps. MonPolVol may be even more sinister in 2024 since it has more victims to claim. Given current pricing, the risk is asymmetric (unlike the FOMC’s supposed framework).

- Hotter-than-expected CPI report? Push out the cut cycle and take out a 2024 cut.

- Softer-than-expected CPI report? No change to market pricing.

- And a similar dynamic could be applied to employment data (but with less influence on pricing).

- Repeat after every new data point.

MonPolVol is not to be trifled with in 2024. But it should not be feared either. There will be plenty of opportunities to exploit it as the data pushes the pricing around. But do not ignore PAM. PAM will happily ignore MonPolVol.

And this is directly related to the CORBU x WisdomTree Model Portfolio positioning. As PAM and MonPolVol come to dominate the equity investment narrative, consistency and quality of earnings and capital returns to shareholders will become increasingly valuable. This applies to U.S. businesses as well as their international counterparts. With the elevated volatility of yields and FOMC policy, maintaining a modest duration portfolio should help reduce the exposure to policy and market whipsaws.

Important Risks Related to this Article

Model rebalancing and trading will be provided by Adhesion Wealth, a provider of outsourced investment management solutions, giving their advisor clients direct access to a platform that will deliver a more customizable approach with advisor input. WisdomTree’s Portfolio and Growth Solutions enable advisors to prioritize customizable brand practices and fact sheets, investment design of models, and efficiencies across implementation, trading and tax transitions, which can serve as a springboard toward their growth.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

Originally published 22 December 2023.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.