Asset allocators are pointing to a 2021 resurgence for ex-US equities, but few are saying it’s time to be bearish on domestic stocks. Investors can turn to exchange traded fund strategies to expand their portfolios into international markets. Advisors can turn to model portfolios for smart global allocations.

The Siegel-WisdomTree Global Equity Model Portfolio is a good place to start.

“WisdomTree’s collaboration with Professor Siegel brings a unique solution to investors with mid- to long-range time horizons who are trying to balance current income needs with longevity risk,” according to the issuer. “The Siegel-WisdomTree Global Equity Model Portfolio provides a diversified exposure to U.S and International stocks and tilts toward factors such as dividend yield and low P/E ratios to seek higher income generation and outperformance potential. This strategy may include both WisdomTree and non-WisdomTree ETFs.”

Making this model portfolio all the more relevant is the thesis that COVID-19 has accelerated geopolitical transformations like a bipolar U.S.–China world order and adaptation in the global supply chains, which has generated greater emphasis on resilience, even at the expense of efficiency.

The Right Model Portfolio for 2021

The global economy is slowly recovering despite a resurgence in coronavirus cases that threatens the fragile recovery process. In this type of environment, exchange traded fund investors should pick and choose their battles.

Some asset allocators are favoring emerging markets over developed markets due to favorable cyclical conditions, improving risk appetite, attractive local asset valuations, and an expensive U.S. dollar. The aforementioned WisdomTree model portfolio features exposure to three dedicated emerging markets ETFs.

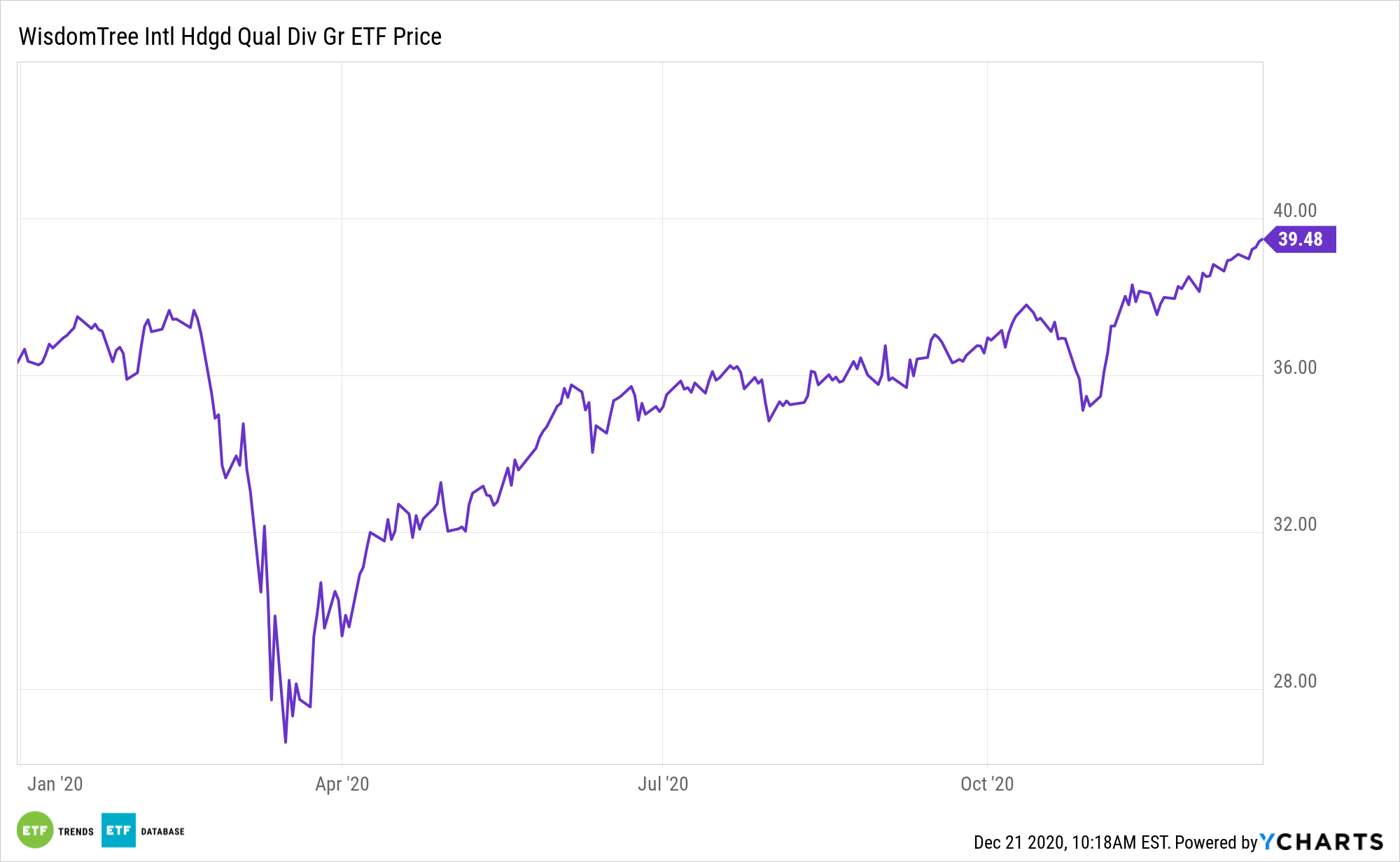

Some market participants believe the cyclical rebound will developed markets outside the U.S. One way to capitalize on that trend is with the WisdomTree International Hedged Quality Dividend Growth Fund (NYSEArca: IHDG). That ETF is featured in the Siegel-WisdomTree model portfolio.

IHDG targets dividend growers in developed markets, excluding the U.S. and Canada, and features a currency hedge that can protect investors in the event the dollar rebounds around developed market currencies. IHDG, which carries an annual expense ratio of 0.58%, tracks the WisdomTree International Hedged Dividend Growth Index (WTIDGH).

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.