By Kevin Flanagan, Head of Fixed Income Strategy

The last few years have presented interesting challenges for bond investors. In 2022 and 2023, fixed income portfolios were faced with how to position for what ended up being historic rate hikes. But now, the pendulum has shifted, and the investment profile has moved to how to position one’s bond allocation for rate cuts. Against this backdrop, I thought it would be useful to offer readers insights on how Treasury (UST) yields operate, especially in relation to the Fed Funds target.

Oftentimes, in conversations I have, there is a belief that whatever happens to the Fed Funds Rate will be passed along to the Treasury yield curve in a similar fashion. While, directionally, the idea of the Fed Funds Rate and UST yields moving up or down in tandem is somewhat accurate, the magnitude and timing of changes tend to be not so straightforward.

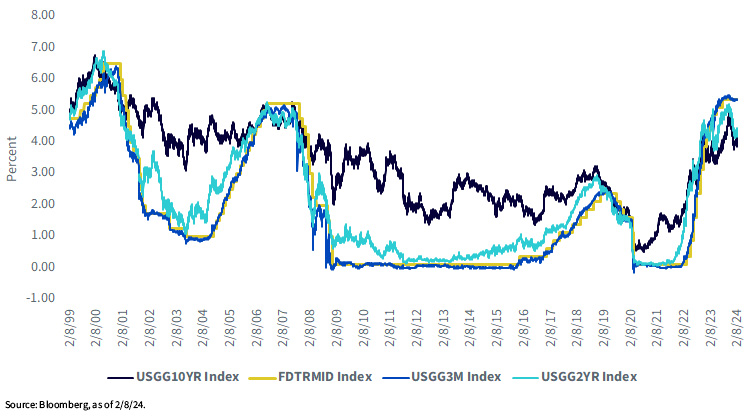

Fed Funds vs. UST 3-Mo, 2-Yr & 10-Yr Yields

Obviously, one begins with the Fed Funds target rate and/or range, which represents overnight money. As a result, the closer the maturity is to Fed Funds, the more positive the correlation is going to be. The above graph highlights the relationship over the past 25 years between the mid-point of the Fed Funds target range and the UST 3-month t-bill, as well as the UST 2-Year and 10-Year note yields. The UST floating rate note could also be considered in this analysis given the fact that it floats, or is referenced, to the weekly UST 3-month t-bill auction.

As you would expect given the above statement, the correlation between Fed Funds and the 3-month t-bill is extraordinarily tight, while the relationship with the 2-Year note is also very positively correlated. However, the positive correlation begins to lessen considerably the further one goes out on the yield curve, as illustrated by the spread between Fed Funds and the UST 10-Year note. While directionally these two rates tend to move in a similar way, the correlation in yields is noticeably lower when compared to maturities that are closer to Fed Funds.

Intuitively, this makes perfect sense. A maturity structure that is not too far removed from the Fed Funds Rate will be anchored and directly linked to trends in overnight money (Fed rate hikes/cuts). But, as you continue to move away from this anchor, other factors besides the Fed begin to come into play, and thus, investors demand a term premium, or an additional return or yield for the potential risk incurred by holding a security that is longer-term in maturity. In addition, inflation expectations also can play a visible role on this front.

Conclusion

In other words, just because the Fed may cut rates later this year, it doesn’t necessarily mean the UST 10-Year yield will move down in lockstep fashion. Indeed, history over the last 25 years is pretty clear on that front. So, when somebody says they expect rates to come down, it is important to be clear about which rate they are referring to exactly. Keep this in mind when, and or if, you are looking to position your bond portfolio for the potential Fed rate cuts that have been dominating the investment conversation.

Originally published 14 February 2024.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.